Question: Please help out with the part b. The part b is the one that has an incorrect answers. part A part B Crane Productions Led

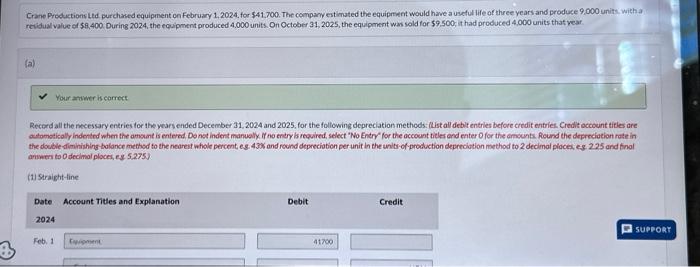

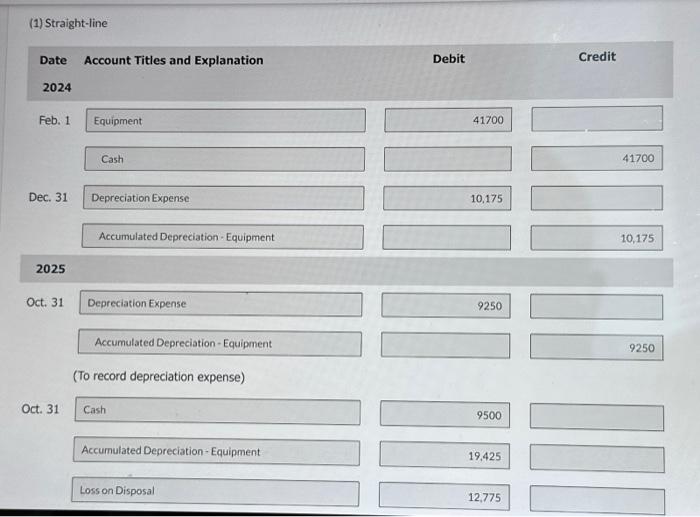

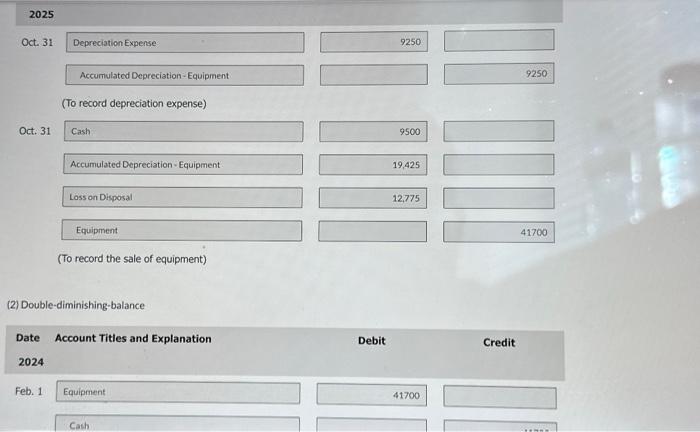

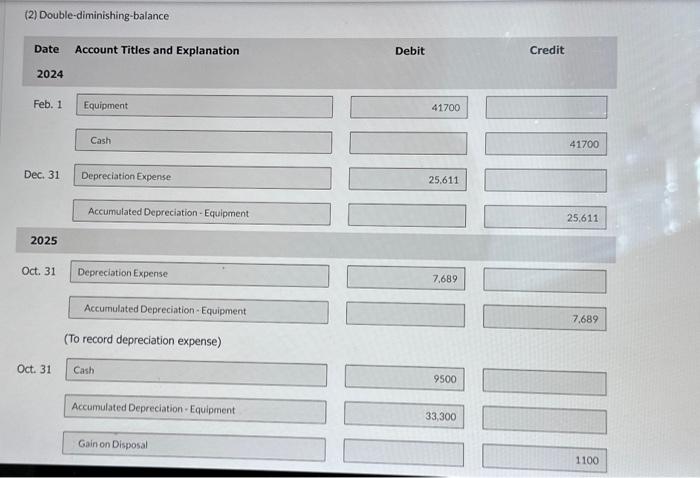

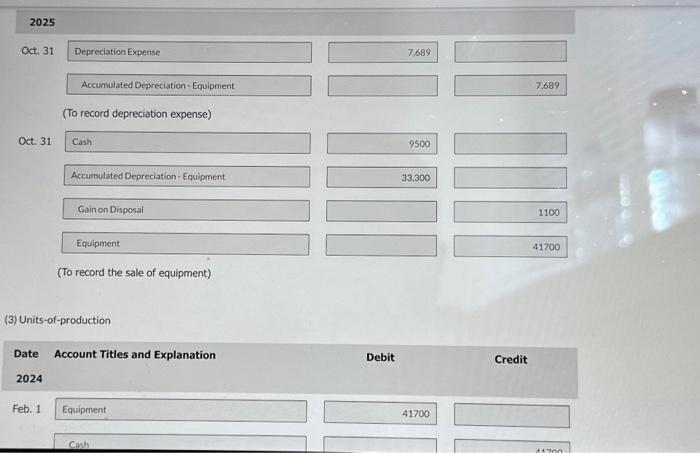

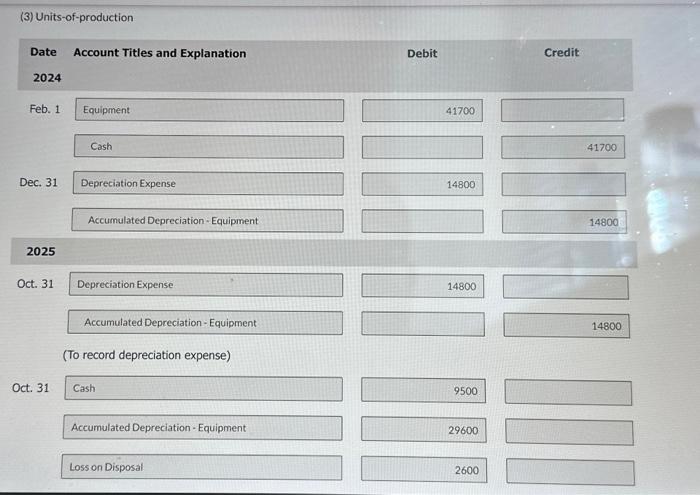

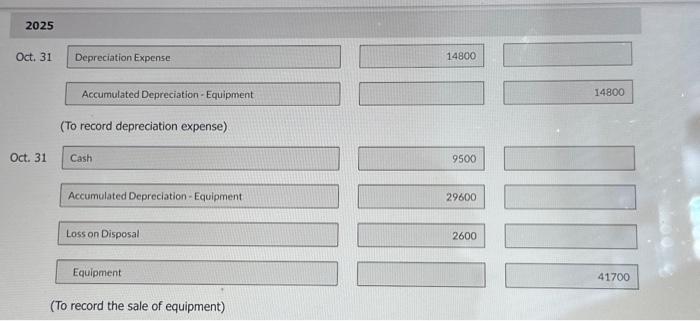

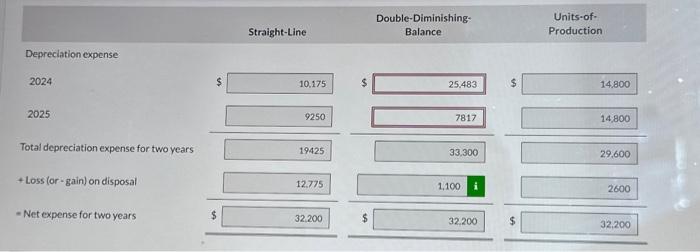

Crane Productions Led purchared equiphent on February 1,2024, for $41,700. The compary estimated the equiprent would have a useful life of three years and produce 9,000 units, with a relidual value of 58,400 . During 2024, the equipment produced 4.000 units. On October 31,2025 , the equipment was sold for $9,500, it had produced 4,000 units that vear. (a) Your aniver is correct Record all the necessary entries for the years ended December 31,2024 and 2025, for the following depreciation methods: (List all debit entries before credit entries, Credit occount tities are aninen to 0 decimal ploces, es 5.275 j. (1) Straight-line Date Account Titles and Explanation Debit Credit 2024 Feb. 1 Equipment 41700 Cash Dec. 31 Depreciation Expense 10,175 41700 Accumulated Depreciation - Equipment 10,175 2025 Oct. 31 Depreciation Expense 9250 Accumulated Depreciation - Equipment 9250 (To record depreciation expense) Oct. 31 Cash 9500 Accumulated Depreciation - Equipment 19,425 Loss on Disposal 12,775 (2) Double-diminishing-balance (2) Double-diminishing-balance Date Account Titles and Explanation Debit Credit 2024 Feb. 1 Equipment 41700 Cash Dec. 31 Depreciation Expense 25.611 Accumulated Depreciation - Equipment 41700 \begin{array}{l} Dec. 31 Depreciation Expense \\ Accumulated Depreciation - Equipment \end{array} 25.611 \begin{tabular}{|r|} \hline \\ \hline \\ \hline \\ \hline \end{tabular} 2025 Oct. 31 Depreciation Expense 7.689 Accumulated Depreciation - Equipment 7.689 (To record depreciation expense) Oct. 31 Cash 9500 Accumulated Depreciation - Equipment 33,300 Gain on Disposal 1100 (3) Units-of-production (3) Units-of-production Date Account Titles and Explanation Debit Credit 2024 Feb. 1 Equipment 41700 Cash 41700 Dec. 31 Depreciation Expense 14800 Accumulated Depreciation - Equipment 14800 2025 Oct. 31 Depreciation Expense 14800 Accumulated Depreciation - Equipment 14800 (To record depreciation expense) Oct. 31 Cash 9500 Accumulated Depreciation - Equipment 29600 Loss on Disposal 2600 2025 Oct. 31 Depreciation Expense 14800 Accumulated Depreciation - Equipment \begin{tabular}{r} \\ \\ \hline \end{tabular} 14800 (To record depreciation expense) Oct. 31 Cash 9500 Accumulated Depreciation - Equipment 29600 Loss on Disposal 2600 Equipment 41700 (To record the sale of equipment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts