Question: Please help please help I don't know what to do On January 1, 2022 John Doe Enterprises (JDE) bought an 80% interest in Bubba Manufacturing,

Please help

please help I don't know what to do

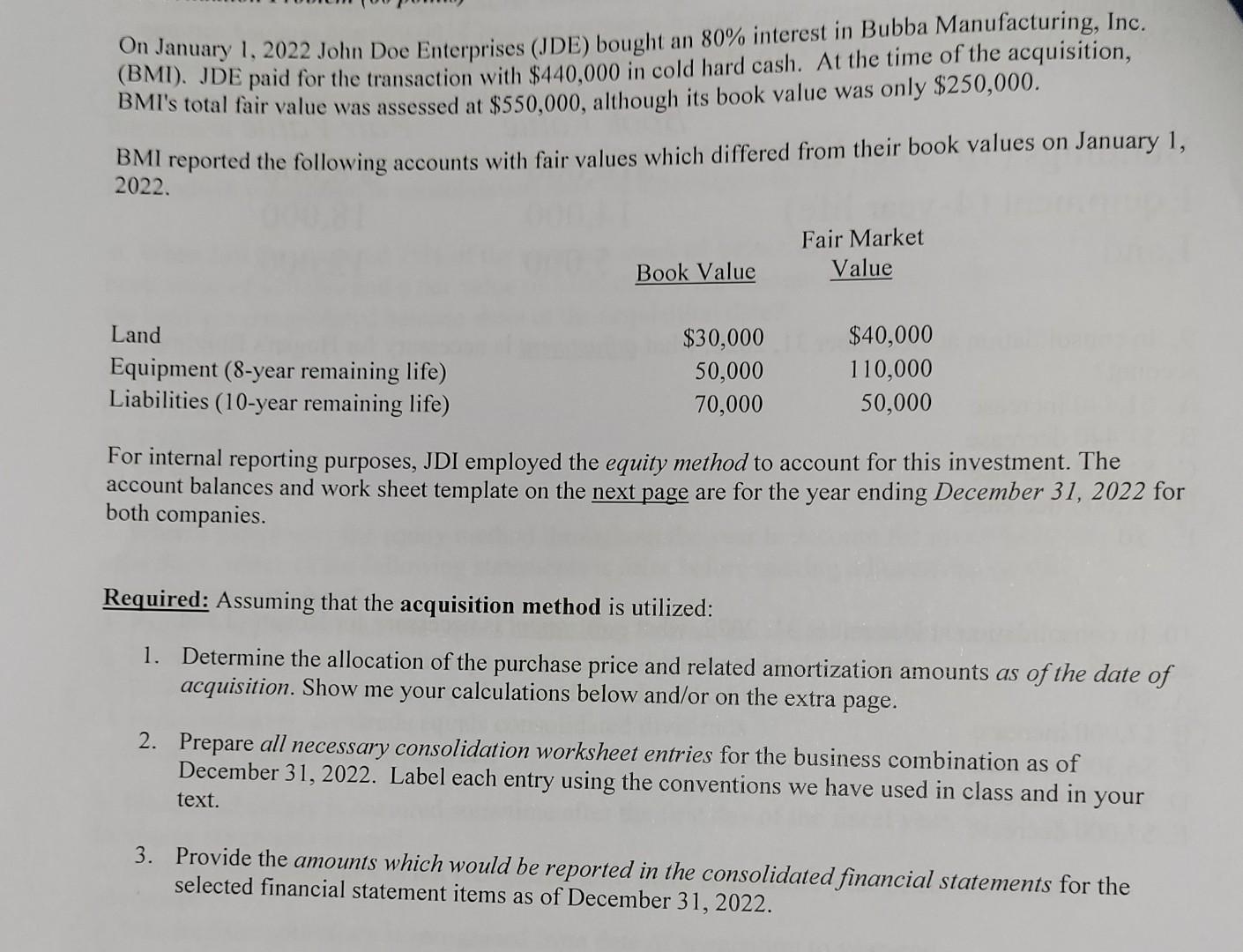

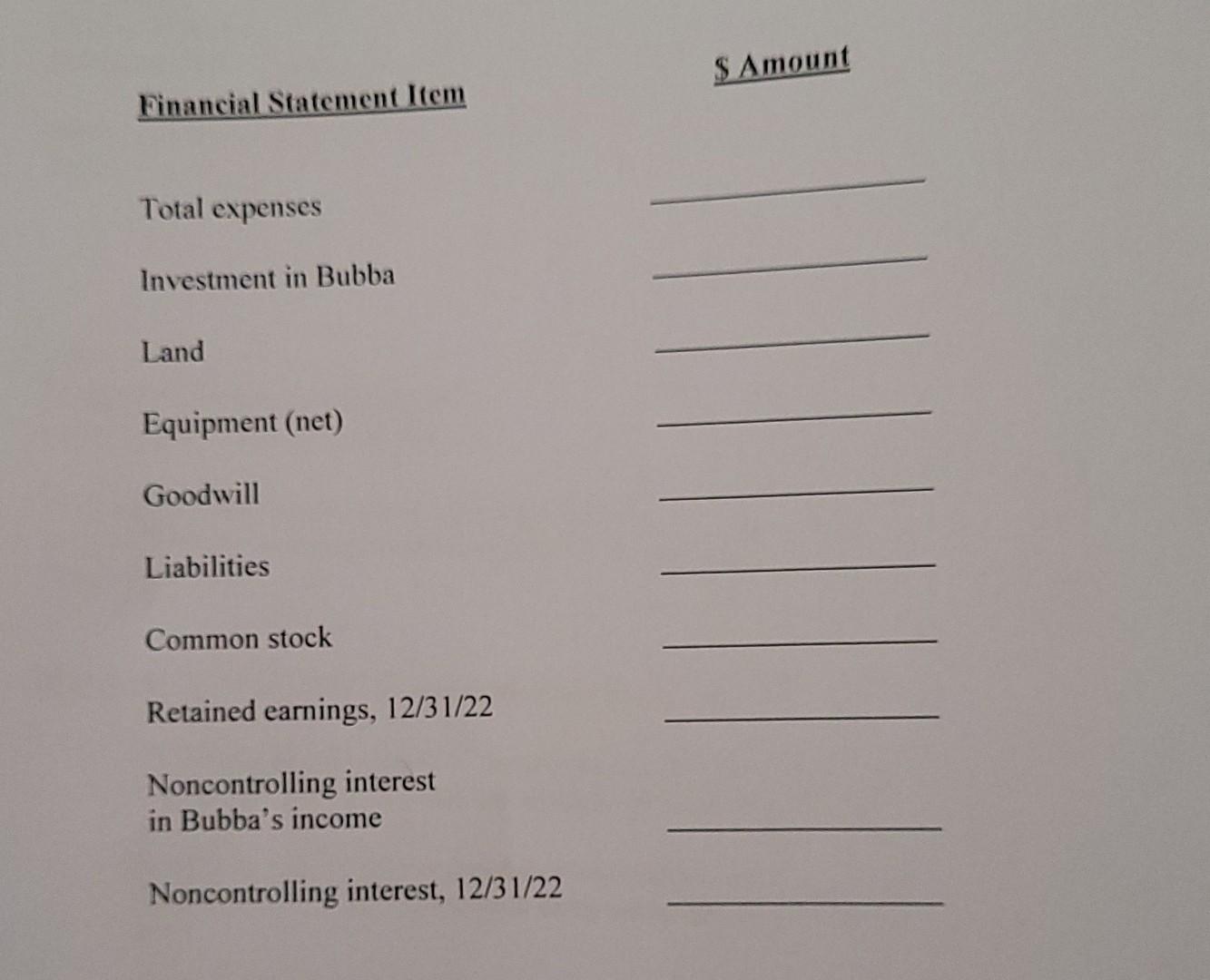

On January 1, 2022 John Doe Enterprises (JDE) bought an 80% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $440,000 in cold hard cash. At the time of the acquisition, BMI's total fair value was assessed at $550,000, although its book value was only $250,000. BMI reported the following accounts with fair values which differed from their book values on January 1, 2022. Fair Market Value Book Value Land $30,000 $40,000 Equipment (8-year remaining life) 50,000 110,000 Liabilities (10-year remaining life) 70,000 50,000 For internal reporting purposes, JDI employed the equity method to account for this investment. The account balances and work sheet template on the next page are for the year ending December 31, 2022 for both companies. Required: Assuming that the acquisition method is utilized: 1. Determine the allocation of the purchase price and related amortization amounts as of the date of acquisition. Show me your calculations below and/or on the extra page. 2. Prepare all necessary consolidation worksheet entries for the business combination as of December 31, 2022. Label each entry using the conventions we have used in class and in text. your 3. Provide the amounts which would be reported in the consolidated financial statements for the selected financial statement items as of December 31, 2022. (S) (A) (1) D. (D) (E) $ Amount Financial Statement Item Total expenses Investment in Bubba Land Equipment (net) Goodwill Liabilities Common stock Retained earnings, 12/31/22 Noncontrolling interest in Bubba's income Noncontrolling interest, 12/31/22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts