Question: please help! please help! LUISUKHOICES Eyes 2) Let's say you are 27 years old and planning on retiring when you are 70. You plan on

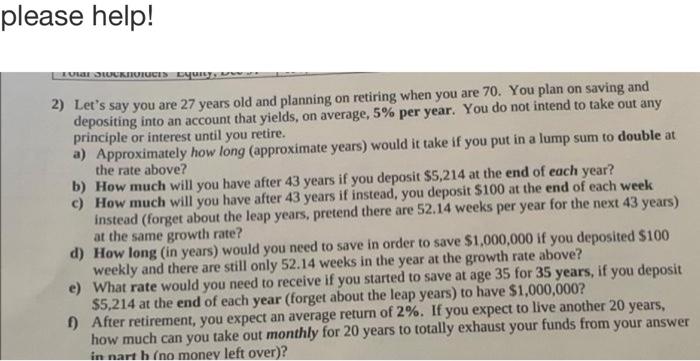

please help! LUISUKHOICES Eyes 2) Let's say you are 27 years old and planning on retiring when you are 70. You plan on saving and depositing into an account that yields, on average, 5% per year. You do not intend to take out any principle or interest until you retire. a) Approximately how long (approximate years) would it take if you put in a lump sum to double at the rate above? b) How much will you have after 43 years if you deposit $5,214 at the end of each year? c) How much will you have after 43 years if instead, you deposit $100 at the end of each week instead (forget about the leap years, pretend there are 52.14 weeks per year for the next 43 years) at the same growth rate? d) How long (in years) would you need to save in order to save $1,000,000 if you deposited $100 weekly and there are still only 52.14 weeks in the year at the growth rate above? e) What rate would you need to receive if you started to save at age 35 for 35 years, if you deposit $5,214 at the end of each year (forget about the leap years) to have $1,000,000? 1) After retirement, you expect an average return of 2%. If you expect to live another 20 years, how much can you take out monthly for 20 years to totally exhaust your funds from your answer in narth (no money left over)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts