Question: Question Help FastTrack Bikes Inc. is thinking of developing a new composite road bike Development will take six years and the cost is $178,000 per

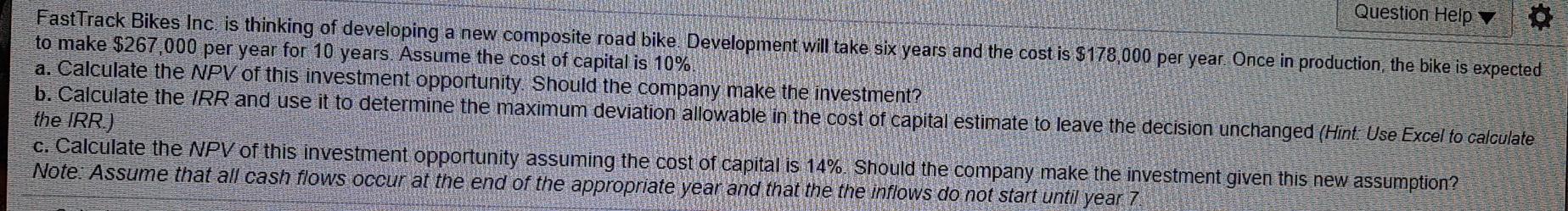

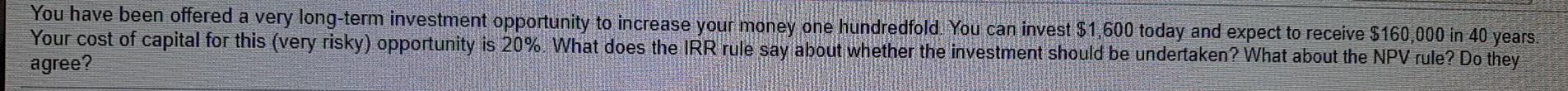

Question Help FastTrack Bikes Inc. is thinking of developing a new composite road bike Development will take six years and the cost is $178,000 per year. Once in production, the bike is expected to make $267,000 per year for 10 years. Assume the cost of capital is 10%. a. Calculate the NPV of this investment opportunity. Should the company make the investment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged (Hint: Use Excel to calculate the IRR.) c. Calculate the NPV of this investment opportunity assuming the cost of capital is 14%. Should the company make the investment given this new assumption? Note: Assume that all cash flows occur at the end of the appropriate year and that the the inflows do not start until year 7 You have been offered a very long-term investment opportunity to increase your money one hundredfold. You can invest $1,600 today and expect to receive $160,000 in 40 years. Your cost of capital for this (very risky) opportunity is 20%. What does the IRR rule say about whether the investment should be undertaken? What about the NPV rule? Do they agree

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts