Question: Please help .. Please help .. Very urgent ya Question 2 Yummylicious W. Sdn Bhd (YW) open a shop, selling potato and banana chips and

Please help .. Please help .. Very urgent ya

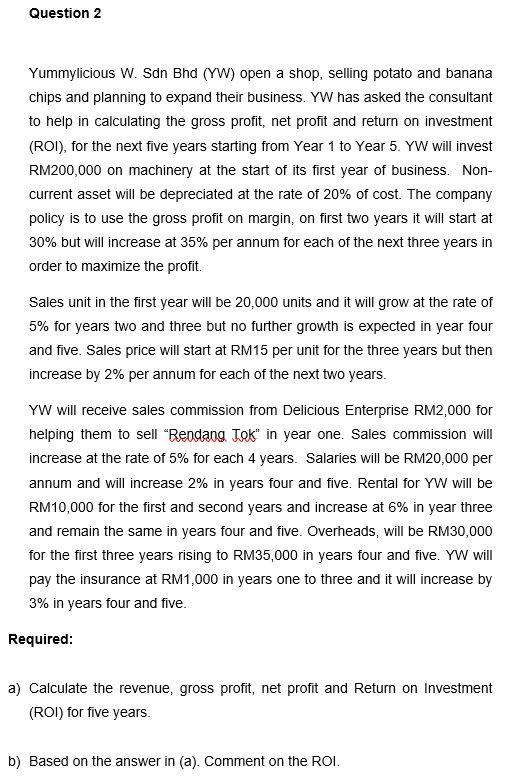

Question 2 Yummylicious W. Sdn Bhd (YW) open a shop, selling potato and banana chips and planning to expand their business. YW has asked the consultant to help in calculating the gross profit, net profit and return on investment (ROI), for the next five years starting from Year 1 to Year 5. YW will invest RM200,000 on machinery at the start of its first year of business. Non- current asset will be depreciated at the rate of 20% of cost. The company policy is to use the gross profit on margin, on first two years it will start at 30% but will increase at 35% per annum for each of the next three years in order to maximize the profit. Sales unit in the first year will be 20,000 units and it will grow at the rate of 5% for years two and three but no further growth is expected in year four and five. Sales price will start at RM15 per unit for the three years but then increase by 2% per annum for each of the next two years. YW will receive sales commission from Delicious Enterprise RM2,000 for helping them to sell "Rendang Tok" in year one. Sales commission will increase at the rate of 5% for each 4 years. Salaries will be RM20,000 per annum and will increase 2% in years four and five. Rental for YW will be RM10,000 for the first and second years and increase at 6% in year three and remain the same in years four and five. Overheads, will be RM30,000 for the first three years rising to RM35,000 in years four and five. YW will pay the insurance at RM1,000 in years one to three and it will increase by 3% in years four and five. Required: a) Calculate the revenue, gross profit, net profit and Return on Investment (ROI) for five years. b) Based on the answer in (a). Comment on the ROI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts