Question: Please help, previous answer on chegg was incorrect, thanks in advance!!!! This answer was wrong from prev question on chegg: (unfortunately) Required information [The following

Please help, previous answer on chegg was incorrect, thanks in advance!!!!

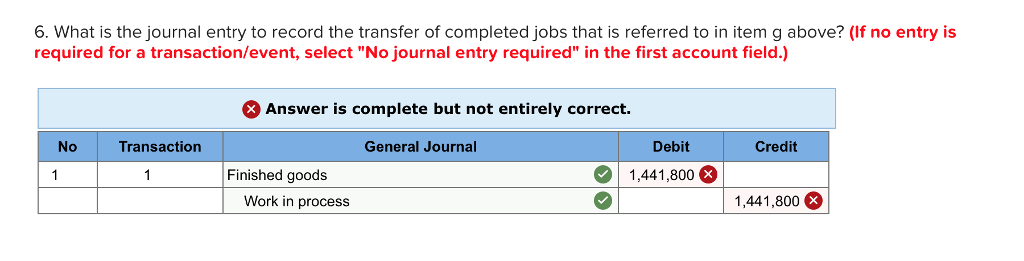

This answer was wrong from prev question on chegg: (unfortunately)

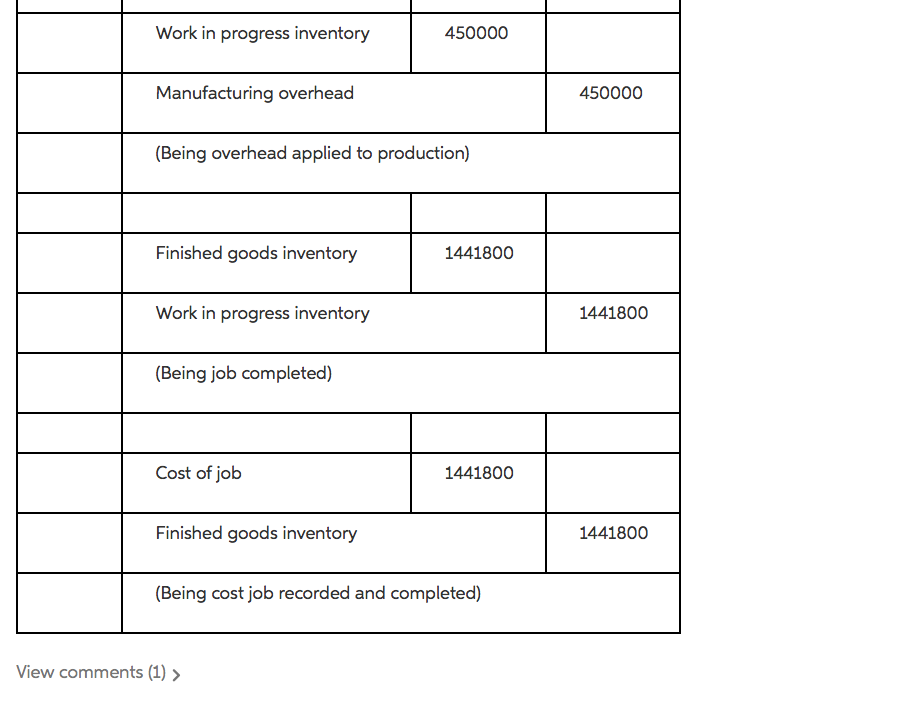

This answer was wrong from prev question on chegg: (unfortunately)

![[The following information applies to the questions displayed below.] Bunnell Corporation is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e55423b9fb2_31566e5542324498.jpg)

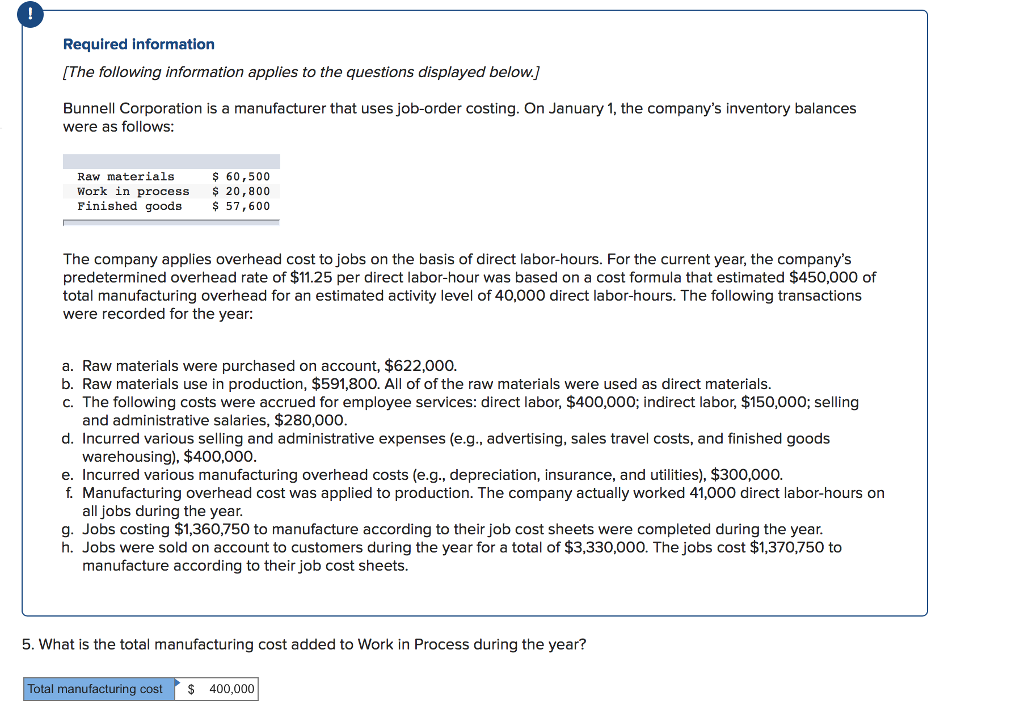

Required information [The following information applies to the questions displayed below.] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Raw materials 60,500 Work in process 20,800 Finished goods57,600 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $11.25 per direct labor-hour was based on a cost formula that estimated $450,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $622,000 b. Raw materials use in production, $591,800. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $400,000; indirect labor, $150,000; selling and administrative salaries, $280,000 d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing). $400,000. e. Incurred various manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $300,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. g. Jobs costing $1,360,750 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $3,330,000. The jobs cost $1,370,750 to manufacture according to their job cost sheets. 5. What is the total manufacturing cost added to Work in Process during the year? Total manufacturing cost $ 400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts