Question: Please help PROBLEMS PROBLEM 1: MULTIPLE CHOICE 1. Entity A's employees are entitled to six days paid sick leaves employee resigns or retires. The sick

Please help

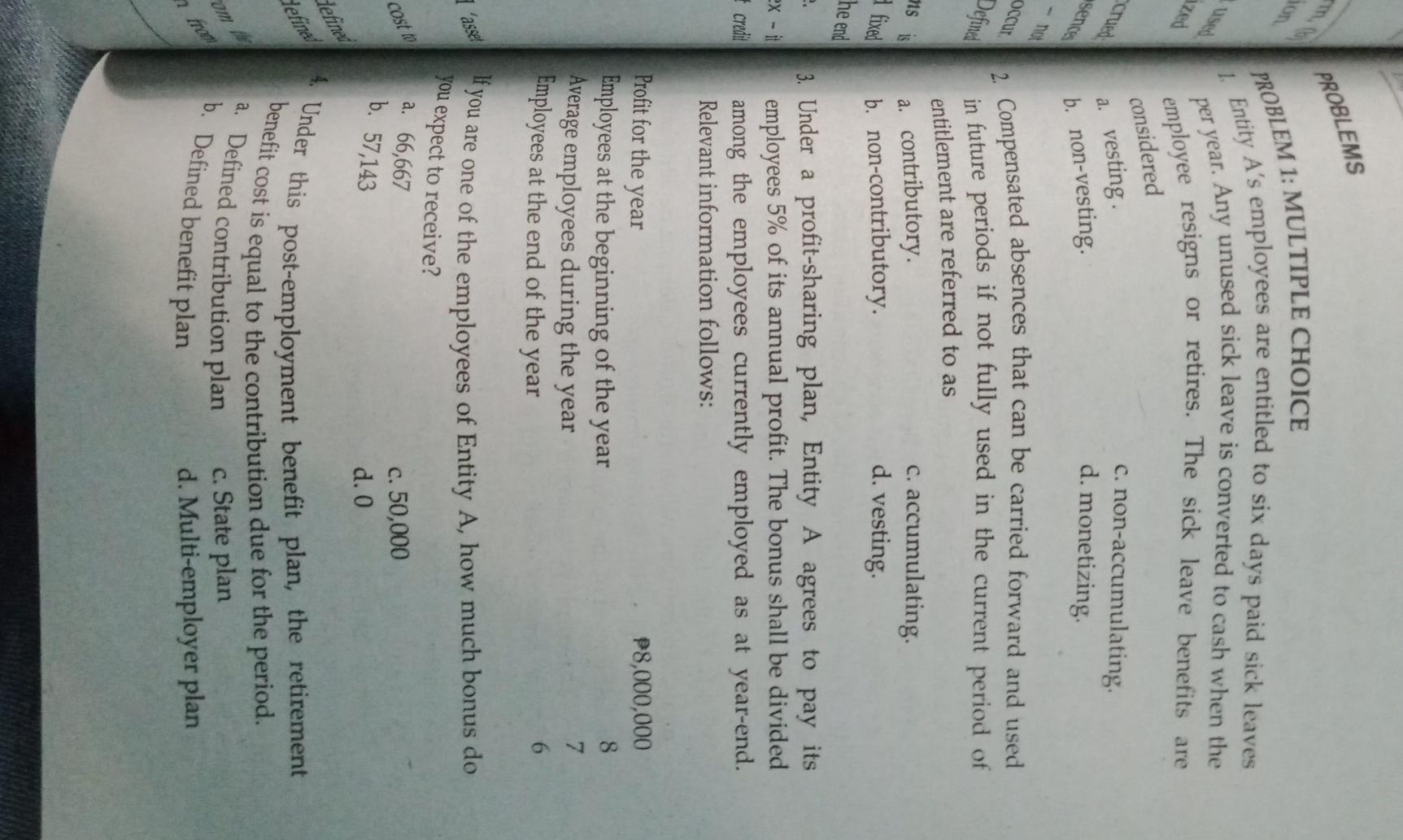

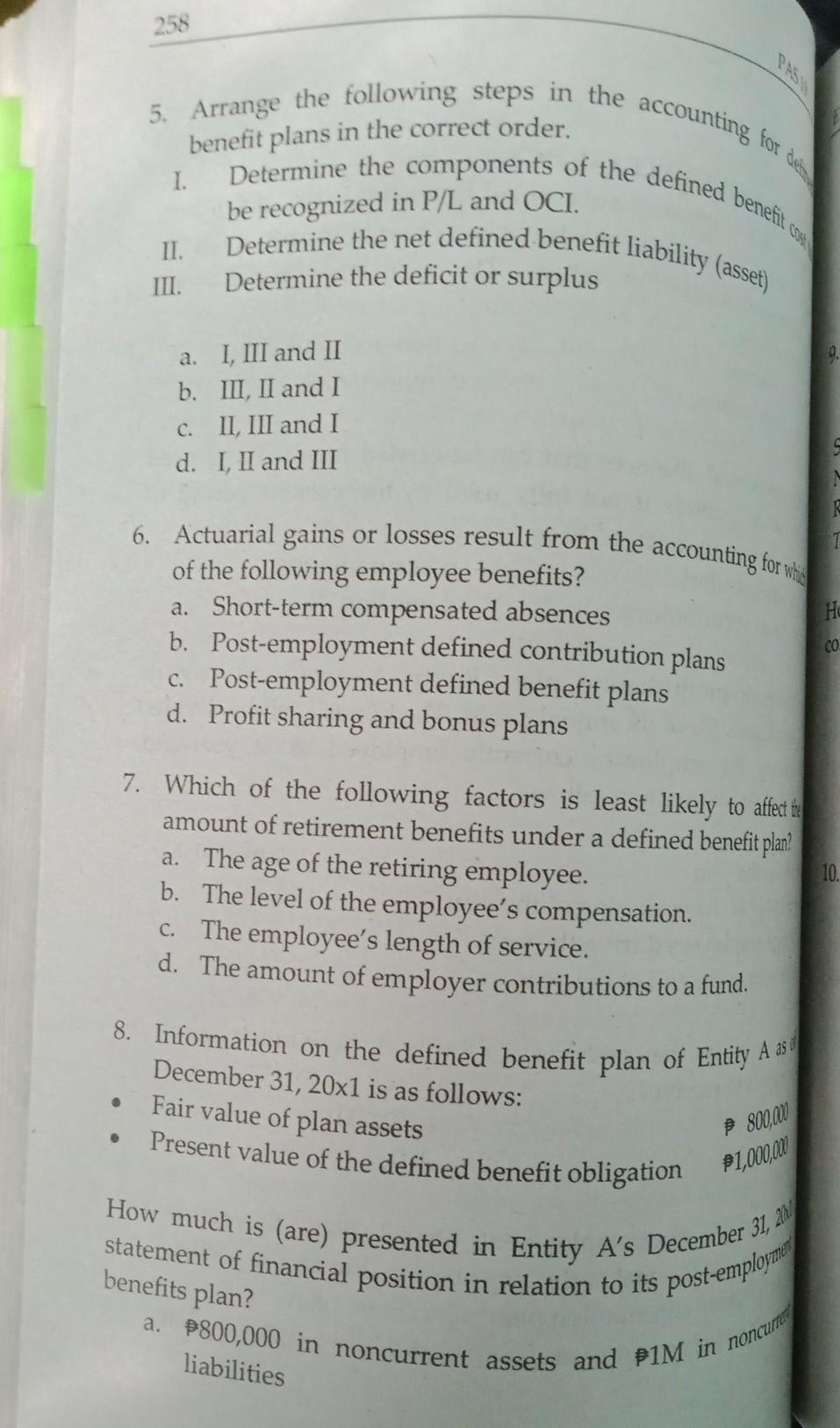

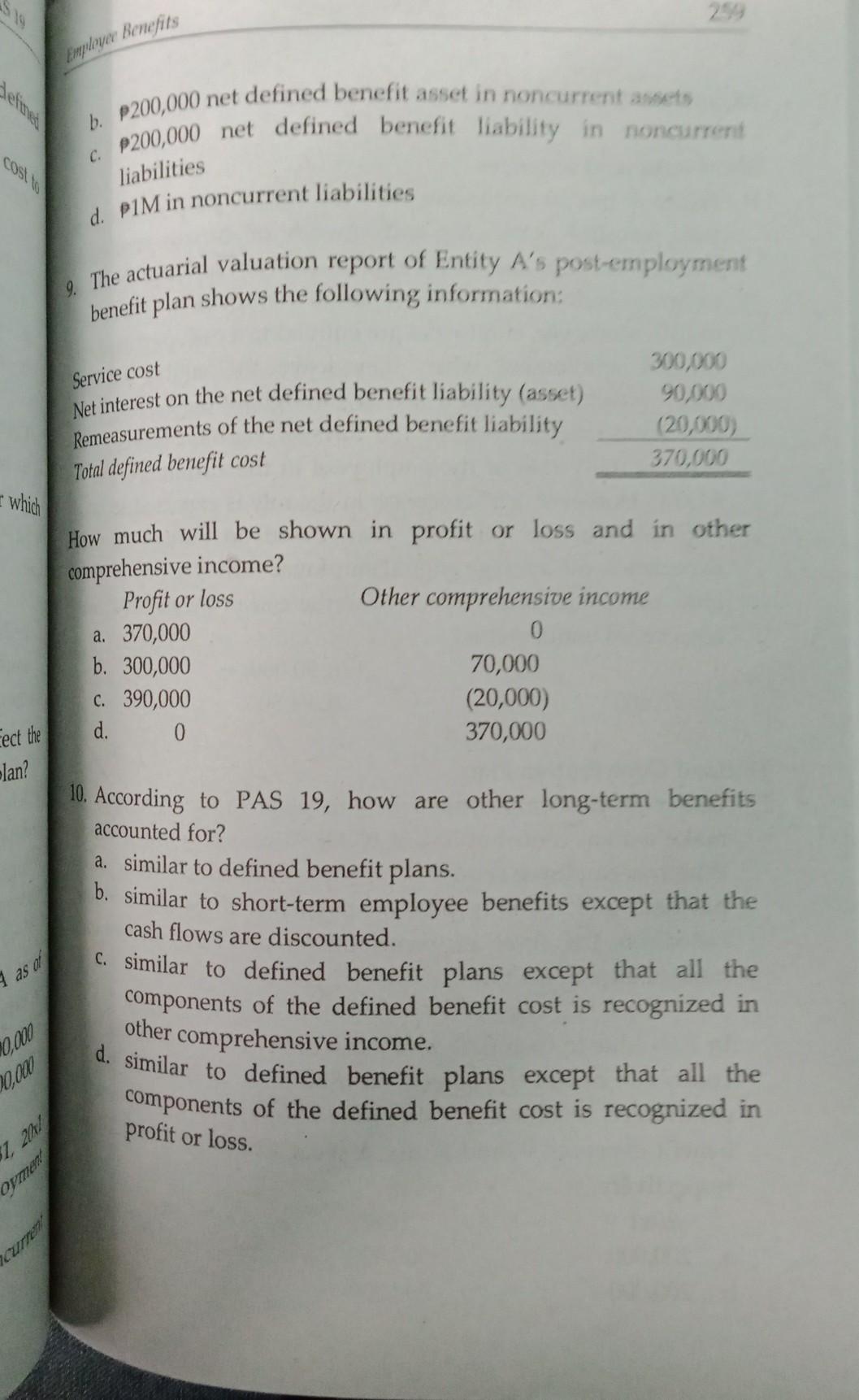

PROBLEMS PROBLEM 1: MULTIPLE CHOICE 1. Entity A's employees are entitled to six days paid sick leaves employee resigns or retires. The sick leave benefits are per year. Any unused sick leave is converted to cash when the ized CTURA sence considered a. vesting c. non-accumulating d. monetizing b. non-vesting OCCUE Defined 2. Compensated absences that can be carried forward and used in future periods if not fully used in the current period of entitlement are referred to as a. contributory. c. accumulating b. non-contributory. d. vesting Ons is a fixed he end 2. 2x - it 3. Under a profit-sharing plan, Entity A agrees to pay its employees 5% of its annual profit. The bonus shall be divided among the employees currently employed as at year-end. Relevant information follows: credit P8,000,000 Profit for the year Employees at the beginning of the year Average employees during the year Employees at the end of the year 7 6 1 asset If you are one of the employees of Entity A, how much bonus do you expect to receive? a. 66,667 cost to b. 57,143 c. 50,000 d. O defined Vefina 4. Under this post-employment benefit plan, the retirement benefit cost is equal to the contribution due for the period. Um a. Defined contribution plan b. Defined benefit plan c. State plan d. Multi-employer plan 258 5. Arrange the following steps in the accounting for det benefit plans in the correct order. Determine the components of the defined benefits be recognized in P/L and OCI. Determine the net defined benefit liability (asset) II. III. Determine the deficit or surplus 1. a. I, III and II b. III, II and I c. II, III and I d. I, II and III 6. Actuarial gains or losses result from the accounting for white of the following employee benefits? a. Short-term compensated absences b. Post-employment defined contribution plans c. Post-employment defined benefit plans d. Profit sharing and bonus plans . CO 7. Which of the following factors is least likely to affect the amount of retirement benefits under a defined benefit plan? a. The age of the retiring employee. b. The level of the employee's compensation. C. The employee's length of service. d. The amount of employer contributions to a fund. 10. 8. Information on the defined benefit plan of Entity A as d December 31, 20x1 is as follows: Fair value of plan assets 800,00 Present value of the defined benefit obligation P1,000,00 How much is (are) presented in Entity A's December 31, AN statement of financial position in relation to its post-employmen a. 800,000 in noncurrent assets and 1M in noncurs benefits plan? liabilities Employee Benefits b. P200,000 net defined benefit asset in noncurrent assets P200,000 net defined benefit liability in noncurrent C. liabilities d. p1M in noncurrent liabilities 9. The actuarial valuation report of Entity A's post-employment benefit plan shows the following information: Service cost Net interest on the net defined benefit liability (asset) Remeasurements of the net defined benefit liability Total defined benefit cost 300,000 90,000 (20,000) 370,000 which How much will be shown in profit or loss and in other comprehensive income? Profit or loss Other comprehensive income a. 370,000 0 b. 300,000 70,000 c. 390,000 (20,000) d. 0 370,000 Eect the lan? 10. According to PAS 19, how are other long-term benefits accounted for? a. similar to defined benefit plans. b. similar to short-term employee benefits except that the cash flows are discounted. C. similar to defined benefit plans except that all the components of the defined benefit cost is recognized in other comprehensive income. d. similar to defined benefit plans except that all the components of the defined benefit cost is recognized in as di 0,000 10,00 profit or loss. 7. 2011 oyment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts