Question: please help Question 1: (80 points) Falcon.Com purchases its merchandise at current market costs and resells the product at a price 20 cents higher. Its

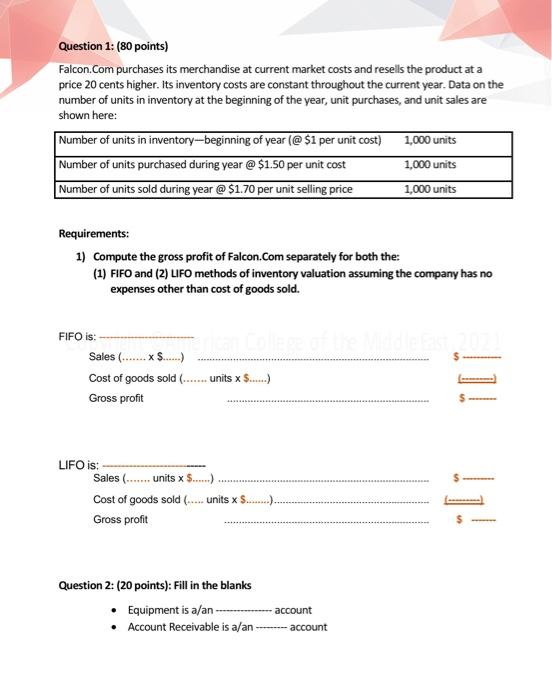

Question 1: (80 points) Falcon.Com purchases its merchandise at current market costs and resells the product at a price 20 cents higher. Its inventory costs are constant throughout the current year. Data on the number of units in inventory at the beginning of the year, unit purchases, and unit sales are shown here: Number of units in inventory--beginning of year (@ $1 per unit cost) 1,000 units Number of units purchased during year @ $1.50 per unit cost 1,000 units Number of units sold during year @ $1.70 per unit selling price 1,000 units Requirements: 1) Compute the gross profit of Falcon.Com separately for both the: (1) FIFO and (2) LIFO methods of inventory valuation assuming the company has no expenses other than cost of goods sold. FIFO is: Sales (....... ....) Cost of goods sold (....... units x S...) Gross profit | 1! LIFO is: Sales (....... units x $......) Cost of goods sold (..... units x S. Gross profit Question 2: (20 points): Fill in the blanks Equipment is a/an- Account Receivable is a/an -------account account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts