Question: please help Question 11 3.34 pts Core Co., Inc. had sales in 2020 of $4,750,000 of which 75% were made on credit. At the end

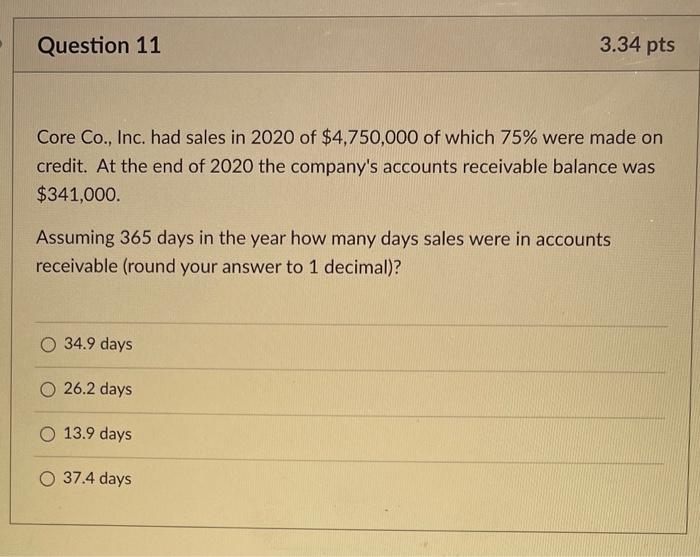

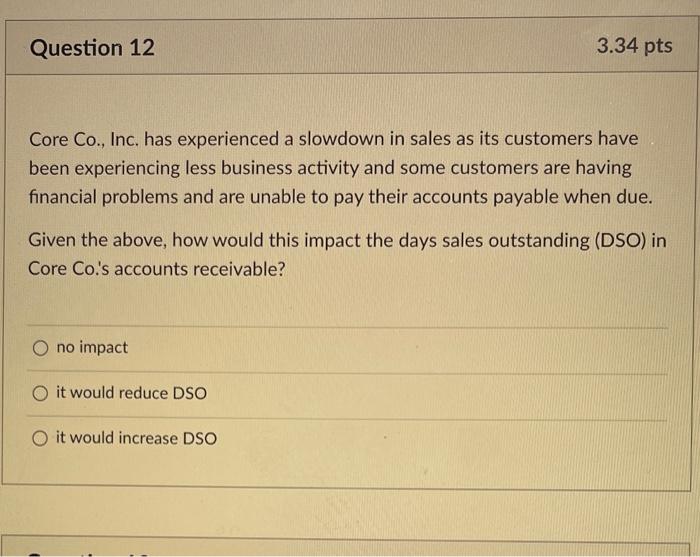

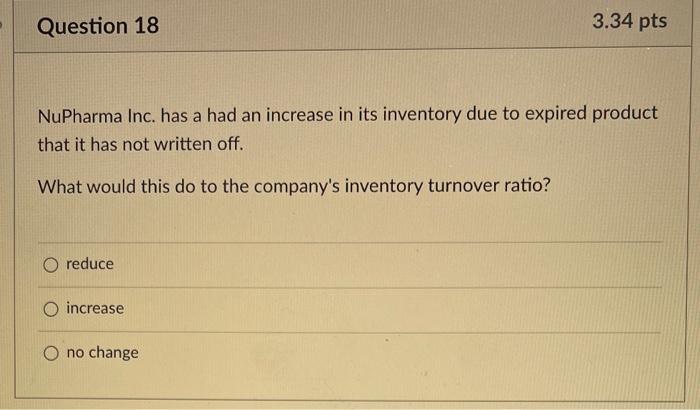

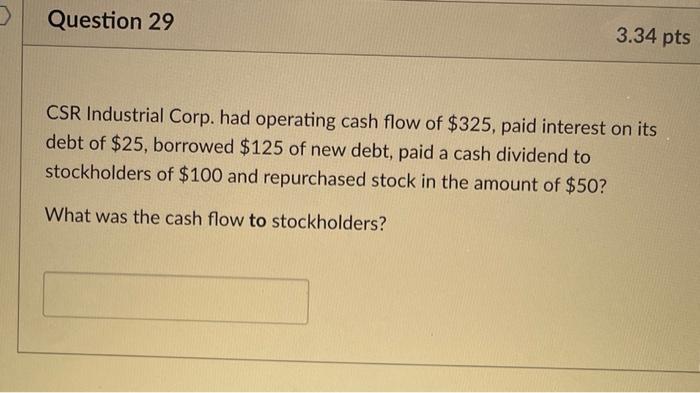

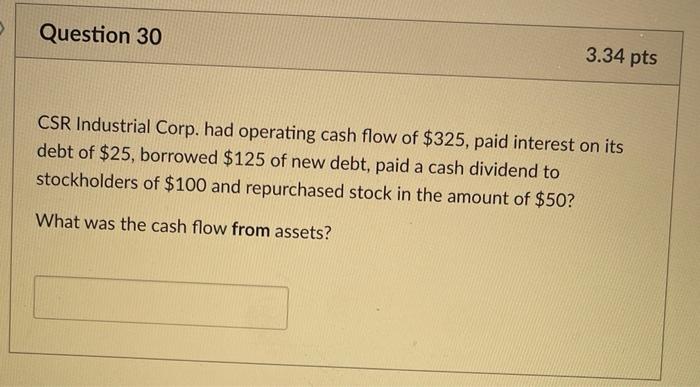

Question 11 3.34 pts Core Co., Inc. had sales in 2020 of $4,750,000 of which 75% were made on credit. At the end of 2020 the company's accounts receivable balance was $341,000. Assuming 365 days in the year how many days sales were in accounts receivable (round your answer to 1 decimal)? 34.9 days 26.2 days 13.9 days O 37.4 days Question 12 3.34 pts Core Co., Inc. has experienced a slowdown in sales as its customers have been experiencing less business activity and some customers are having financial problems and are unable to pay their accounts payable when due. Given the above, how would this impact the days sales outstanding (DSO) in Core Co.'s accounts receivable? no impact it would reduce DSO it would increase DSO Question 18 3.34 pts NuPharma Inc. has a had an increase in its inventory due to expired product that it has not written off. What would this do to the company's inventory turnover ratio? O reduce O increase O no change Question 29 3.34 pts CSR Industrial Corp. had operating cash flow of $325, paid interest on its debt of $25, borrowed $125 of new debt, paid a cash dividend to stockholders of $100 and repurchased stock in the amount of $50? What was the cash flow to stockholders? Question 30 3.34 pts CSR Industrial Corp. had operating cash flow of $325, paid interest on its debt of $25, borrowed $125 of new debt, paid a cash dividend to stockholders of $100 and repurchased stock in the amount of $50? What was the cash flow from assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts