Question: please help Question 12 a) Somid plc is considering a project that will contribute 5 million in free cash flows the first year, growing by

please help

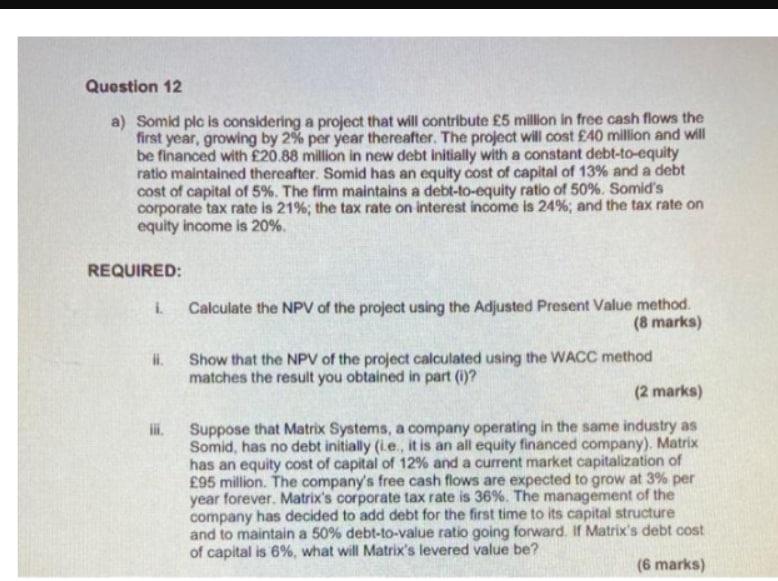

Question 12 a) Somid plc is considering a project that will contribute 5 million in free cash flows the first year, growing by 2% per year thereafter. The project will cost 40 million and will be financed with 20.88 million in new debt initially with a constant debt-to-equity ratio maintained thereafter. Somid has an equity cost of capital of 13% and a debt cost of capital of 5%. The fimm maintains a debt-to-equity ratio of 50%. Somid's corporate tax rate is 21%; the tax rate on interest income is 24%, and the tax rate on equity income is 20% REQUIRED: i. i. Calculate the NPV of the project using the Adjusted Present Value method (8 marks) Show that the NPV of the project calculated using the WACC method matches the result you obtained in part (1)? (2 marks) IH Suppose that Matrix Systems, a company operating in the same industry as Somid, has no debt initially (ie, it is an all equity financed company). Matrix has an equity cost of capital of 12% and a current market capitalization of 95 million. The company's free cash flows are expected to grow at 3% per year forever. Matrix's corporate tax rate is 36%. The management of the company has decided to add debt for the first time to its capital structure and to maintain a 50% debt-to-value ratio going forward, if Matrix's debt cost of capital is 6%, what will Matrix's levered value be? (6 marks) Question 12 a) Somid plc is considering a project that will contribute 5 million in free cash flows the first year, growing by 2% per year thereafter. The project will cost 40 million and will be financed with 20.88 million in new debt initially with a constant debt-to-equity ratio maintained thereafter. Somid has an equity cost of capital of 13% and a debt cost of capital of 5%. The fimm maintains a debt-to-equity ratio of 50%. Somid's corporate tax rate is 21%; the tax rate on interest income is 24%, and the tax rate on equity income is 20% REQUIRED: i. i. Calculate the NPV of the project using the Adjusted Present Value method (8 marks) Show that the NPV of the project calculated using the WACC method matches the result you obtained in part (1)? (2 marks) IH Suppose that Matrix Systems, a company operating in the same industry as Somid, has no debt initially (ie, it is an all equity financed company). Matrix has an equity cost of capital of 12% and a current market capitalization of 95 million. The company's free cash flows are expected to grow at 3% per year forever. Matrix's corporate tax rate is 36%. The management of the company has decided to add debt for the first time to its capital structure and to maintain a 50% debt-to-value ratio going forward, if Matrix's debt cost of capital is 6%, what will Matrix's levered value be? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts