Question: Please help! Question 3 1. An analyst is evaluating two bonds, Bond A and Bond B. The effective maturity of both bonds is 5 years.

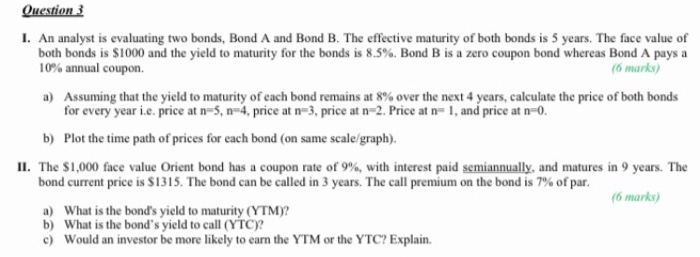

Question 3 1. An analyst is evaluating two bonds, Bond A and Bond B. The effective maturity of both bonds is 5 years. The face value of both bonds is $1000 and the yield to maturity for the bonds is 8.5%. Bond B is a zero coupon bond whereas Bond A pays a 10% annual coupon. (6 marks) a) Assuming that the yield to maturity of each bond remains at 8% over the next 4 years, calculate the price of both bonds for every year i.e. price at n-5, n-4, price at n-3, price at n=2. Price at = 1, and price at n0. b) Plot the time path of prices for each bond (on same scale/graph). II. The $1,000 face value Orient bond has a coupon rate of 9%, with interest paid semiannually, and matures in 9 years. The bond current price is $1315. The bond can be called in 3 years. The call premium on the bond is 7% of par. (6 marks) a) What is the bond's yield to maturity (YTM)? b) What is the bond's yield to call (YTC)? c) Would an investor be more likely to earn the YTM or the YTC? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts