Question: please help Question 4 3 points Saved Assume a British firm expects to receive U.S. dollars 60 days from now. Assume that the forward rate

please help

please help

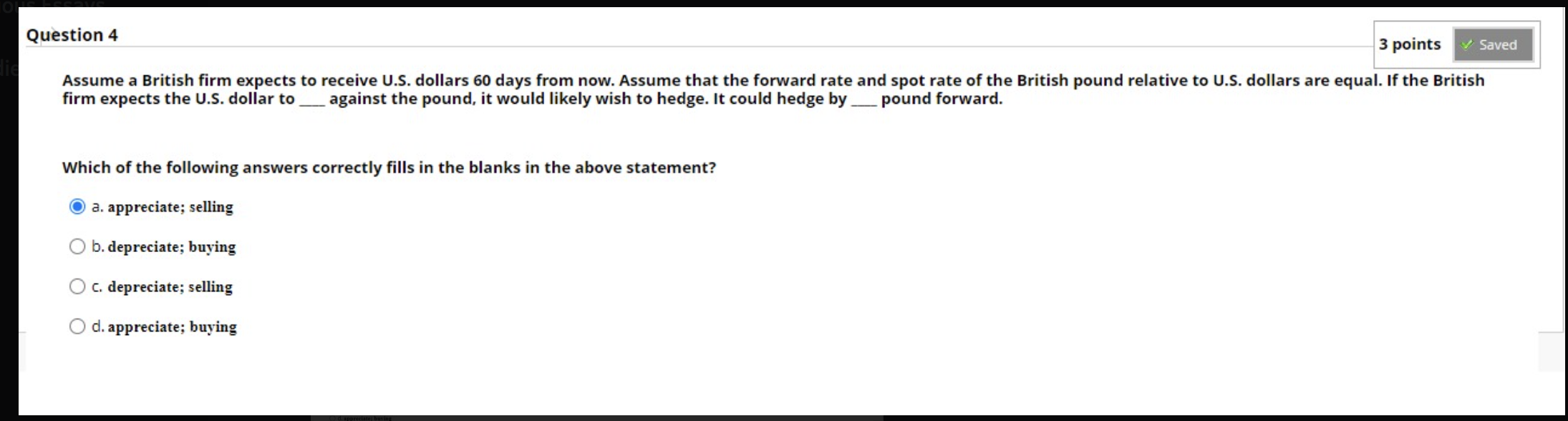

Question 4 3 points Saved Assume a British firm expects to receive U.S. dollars 60 days from now. Assume that the forward rate and spot rate of the British pound relative to U.S. dollars are equal. If the British firm expects the U.S. dollar to _ against the pound, it would likely wish to hedge. It could hedge by pound forward. Which of the following answers correctly fills in the blanks in the above statement? a. appreciate; selling b.depreciate; buying O C. depreciate; selling O d. appreciate; buying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts