Question: Question 3 Assume that Smith Corp. will need to purchase 200,000 British pounds in 90 days. A call option exists on British pounds with an

Question 3

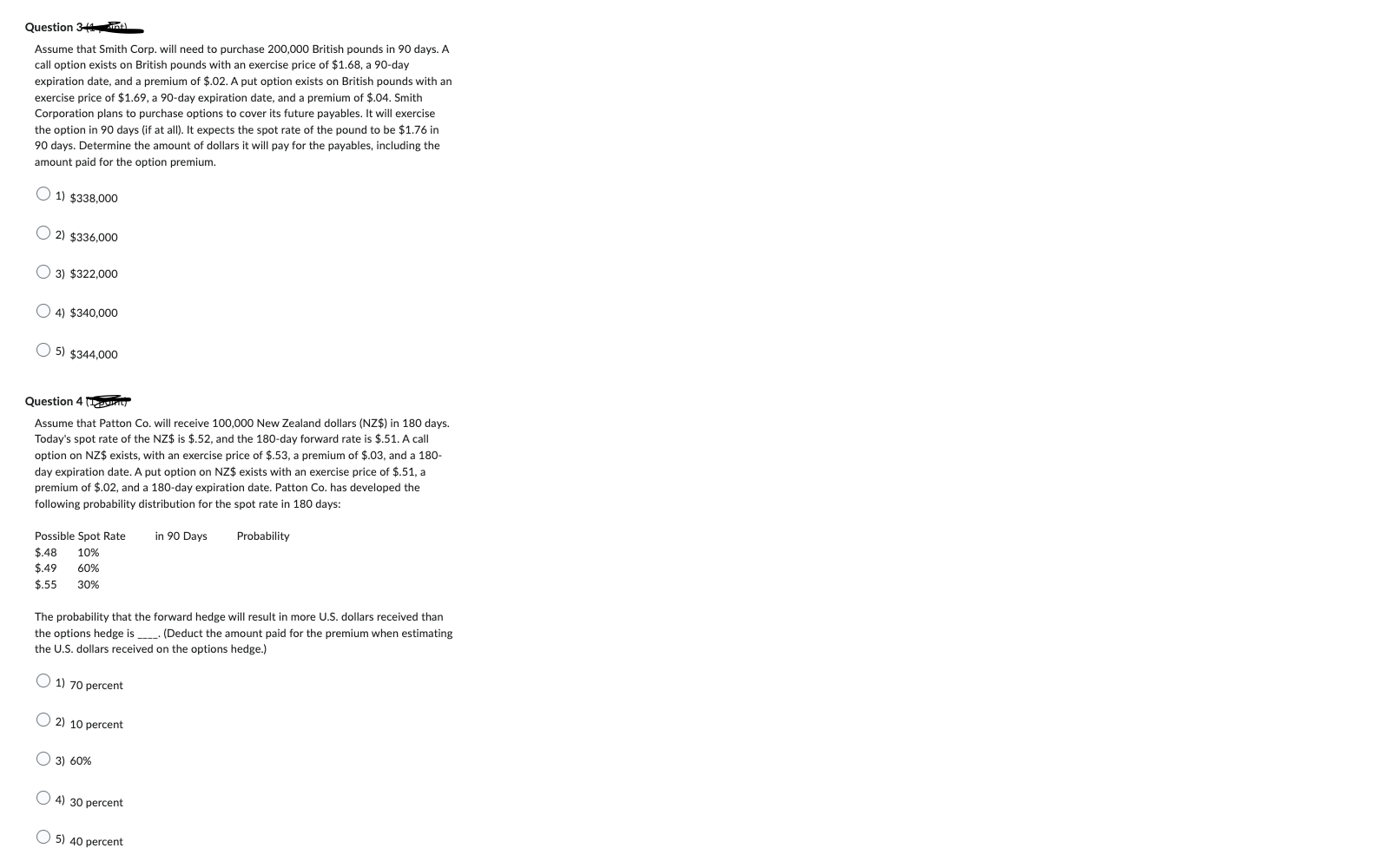

Assume that Smith Corp. will need to purchase 200,000 British pounds in 90 days. A call option exists on British pounds with an exercise price of $1.68, a 90-day expiration date, and a premium of $.02. A put option exists on British pounds with an exercise price of $1.69, a 90-day expiration date, and a premium of $.04. Smith Corporation plans to purchase options to cover its future payables. It will exercise the option in 90 days (if at all). It expects the spot rate of the pound to be $1.76 in 90 days. Determine the amount of dollars it will pay for the payables, including the amount paid for the option premium.

Question 4

Assume that Patton Co. will receive 100,000 New Zealand dollars (NZ$) in 180 days. Today's spot rate of the NZ$ is $.52, and the 180-day forward rate is $.51. A call option on NZ$ exists, with an exercise price of $.53, a premium of $.03, and a 180-day expiration date. A put option on NZ$ exists with an exercise price of $.51, a premium of $.02, and a 180-day expiration date. Patton Co. has developed the following probability distribution for the spot rate in 180 days: Possible Spot Rate in 90 Days Probability $.48 10% $.49 60% $.55 30% The probability that the forward hedge will result in more U.S. dollars received than the options hedge is ____. (Deduct the amount paid for the premium when estimating the U.S. dollars received on the options hedge.)

Assume that Smith Corp. will need to purchase 200,000 British pounds in 90 days. A call option exists on British pounds with an exercise price of $1.68, a 90 -day expiration date, and a premium of $.02. A put option exists on British pounds with an exercise price of $1.69, a 90-day expiration date, and a premium of $.04. Smith Corporation plans to purchase options to cover its future payables. It will exercise the option in 90 days (if at all). It expects the spot rate of the pound to be $1.76 in 90 days. Determine the amount of dollars it will pay for the payables, including the amount paid for the option premium. 1) $338,000 2) $336,000 3) $322,000 4) $340,000 5) $344,000 Question 4 (1)=4ht) Assume that Patton Co. will receive 100,000 New Zealand dollars (NZ $ ) in 180 days. Today's spot rate of the NZ$ is $.52, and the 180 -day forward rate is $.51. A call option on NZ $ exists, with an exercise price of $.53, a premium of $.03, and a 180 day expiration date. A put option on NZ $ exists with an exercise price of $.51, a premium of $.02, and a 180-day expiration date. Patton Co. has developed the following probability distribution for the spot rate in 180 days: The probability that the forward hedge will result in more U.S. dollars received than the options hedge i (Deduct the amount paid for the premium when estimating the U.S. dollars received on the options hedge.) 1) 70 percent 2) 10 percent 3) 60% 4) 30 percent 5) 40 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts