Question: please help question 4 part I, part III and Part IV. I have done Part II already. This question is intended for personal knowledge and

please help question 4 part I, part III and Part IV. I have done Part II already. This question is intended for personal knowledge and not for assignment purposes.

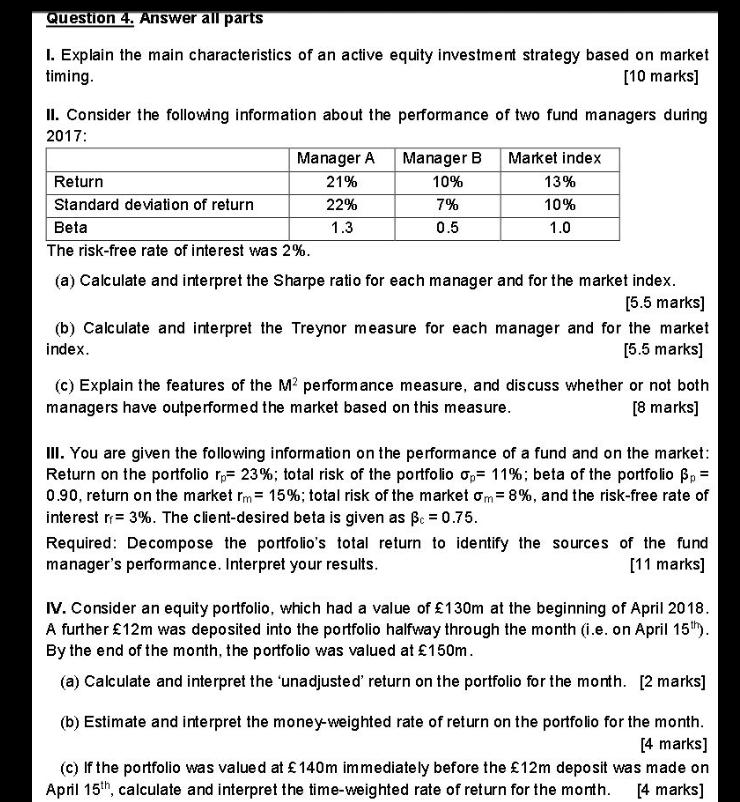

Question 4. Answer all parts I. Explain the main characteristics of an active equity investment strategy based on market timing. [10 marks] l. Consider the following information about the performance of two fund managers during 2017: Manager A Manager B Market index Return 21% 10% 13% Standard deviation of return 22% 7% 10% Beta 1.3 0.5 1.0 The risk-free rate of interest was 2%. (a) Calculate and interpret the Sharpe ratio for each manager and for the market index. [5.5 marks] (b) Calculate and interpret the Treynor measure for each manager and for the market index. [5.5 marks] (c) Explain the features of the M' performance measure, and discuss whether or not both managers have outperformed the market based on this measure. [8 marks] Ill. You are given the following information on the performance of a fund and on the market: Return on the portfolio rp= 23%; total risk of the portfolio op= 11%; beta of the portfolio B, = 0.90, return on the market I'm = 15%; total risk of the market om =8%, and the risk-free rate of interest ry= 3%. The client-desired beta is given as Bc = 0.75. Required: Decompose the portfolio's total return to identify the sources of the fund manager's performance. Interpret your results. [11 marks] IV. Consider an equity portfolio, which had a value of $130m at the beginning of April 2018. A further $12m was deposited into the portfolio halfway through the month (i.e. on April 15"). By the end of the month, the portfolio was valued at $150m. (a) Calculate and interpret the 'unadjusted' return on the portfolio for the month. [2 marks] (b) Estimate and interpret the money-weighted rate of return on the portfolio for the month. [4 marks] (c) If the portfolio was valued at $ 140m immediately before the $12m deposit was made on April 15th, calculate and interpret the time-weighted rate of return for the month. [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts