Question: please help QUESTION ONE (a) Discuss four ways in which behavioral biases could affect portfolio construction (2Marks) (b). An investor wants to invest in the

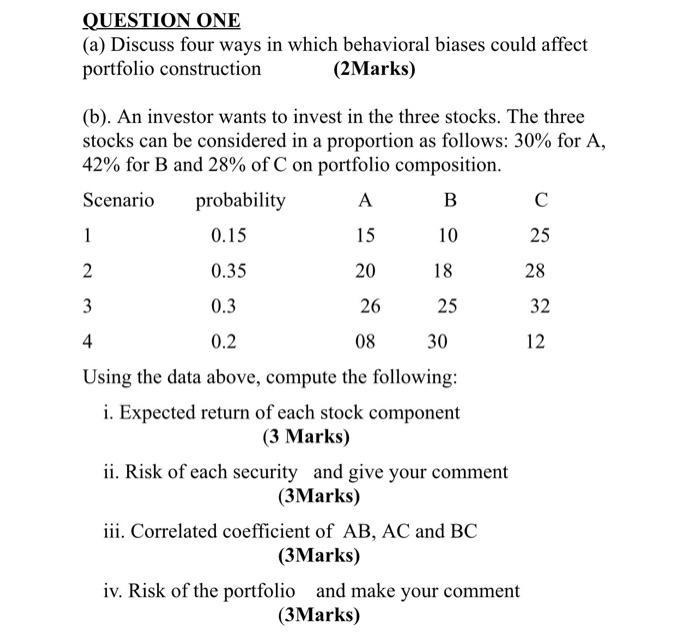

QUESTION ONE (a) Discuss four ways in which behavioral biases could affect portfolio construction (2Marks) (b). An investor wants to invest in the three stocks. The three stocks can be considered in a proportion as follows: 30% for A, 42% for B and 28% of C on portfolio composition. Scenario probability A B 1 0.15 15 10 25 2 0.35 20 18 28 3 0.3 26 25 32 30 4 0.2 08 12 Using the data above, compute the following: i. Expected return of each stock component (3 Marks) ii. Risk of each security and give your comment (3Marks) iii. Correlated coefficient of AB, AC and BC (3Marks) iv. Risk of the portfolio and make your comment (3Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts