Question: PLEASE HELP ! Required information Problem 6-48 (LO 6-3) (Algo) (The following information applies to the questions displayed below.] Clem is married and is a

PLEASE HELP

![information applies to the questions displayed below.] Clem is married and is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717b2731f356_2586717b27290be5.jpg)

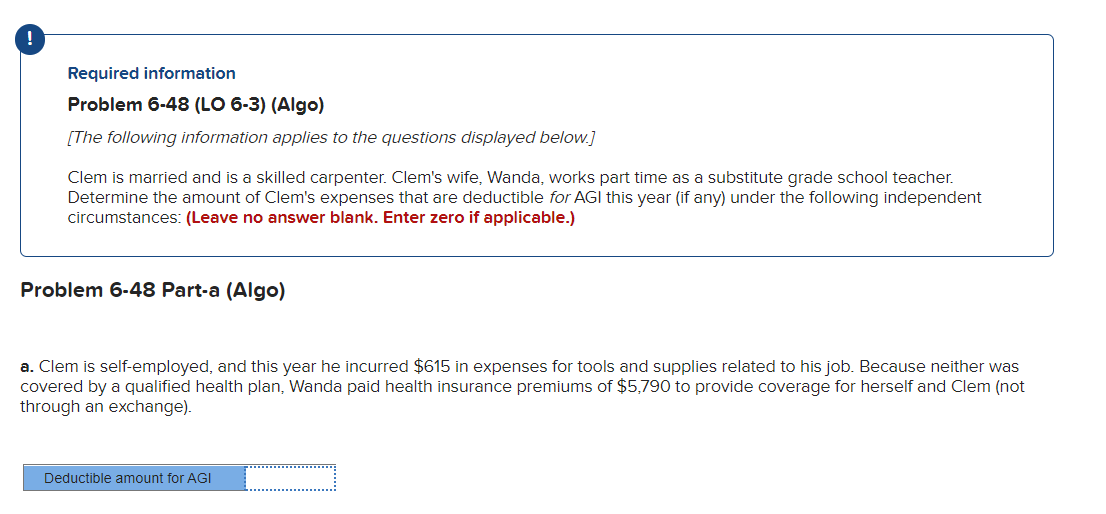

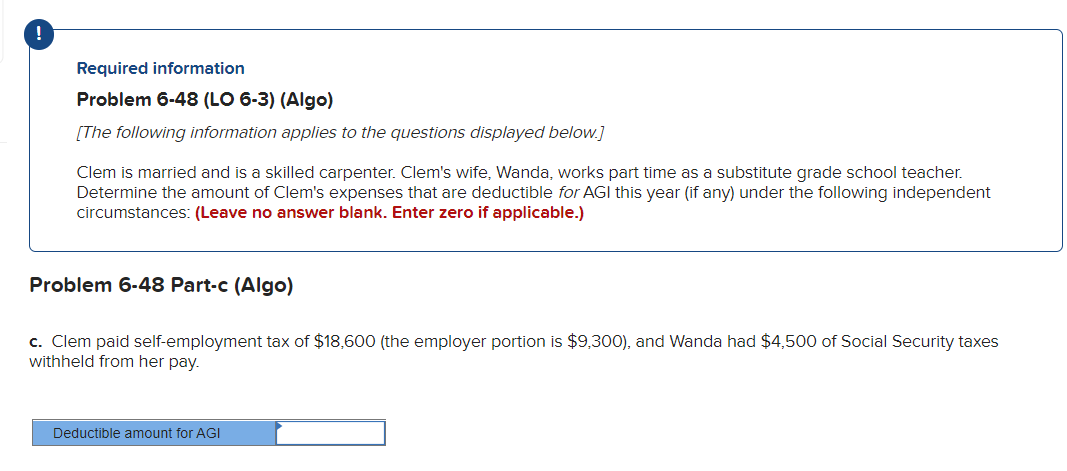

! Required information Problem 6-48 (LO 6-3) (Algo) (The following information applies to the questions displayed below.] Clem is married and is a skilled carpenter. Clem's wife, Wanda, works part time as a substitute grade school teacher. Determine the amount of Clem's expenses that are deductible for AGI this year (if any) under the following independent circumstances: (Leave no answer blank. Enter zero if applicable.) Problem 6-48 Part-a (Algo) a. Clem is self-employed, and this year he incurred $615 expenses for tools and supplies related to his job. Because neither was covered by a qualified health plan, Wanda paid health insurance premiums of $5,790 to provide coverage for herself and Clem (not through an exchange). Deductible amount for AGI ! Required information Problem 6-48 (LO 6-3) (Algo) [The following information applies to the questions displayed below.) Clem is married and is a skilled carpenter. Clem's wife, Wanda, works part time as a substitute grade school teacher. Determine the amount of Clem's expenses that are deductible for AGI this year (if any) under the following independent circumstances: (Leave no answer blank. Enter zero if applicable.) Problem 6-48 Part-b (Algo) b. Clem and Wanda own a garage downtown that they rent to a local business for storage. This year they incurred expenses of $1,840 in utilities and $1,115 in depreciation. Deductible amount for AGI ! Required information Problem 6-48 (LO 6-3) (Algo) (The following information applies to the questions displayed below.) Clem is married and is a skilled carpenter. Clem's wife, Wanda, works part time as a substitute grade school teacher. Determine the amount of Clem's expenses that are deductible for AGI this year (if any) under the following independent circumstances: (Leave no answer blank. Enter zero if applicable.) Problem 6-48 Part-c (Algo) c. Clem paid self-employment tax of $18,600 (the employer portion is $9,300), and Wanda had $4,500 of Social Security taxes withheld from her pay. Deductible amount for AGI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts