Question: PLEASE HELP ! Required information Problem 6-48 (LO 6-3) (Algo) [The following information applies to the questions displayed below. Clem is married and is a

PLEASE HELP

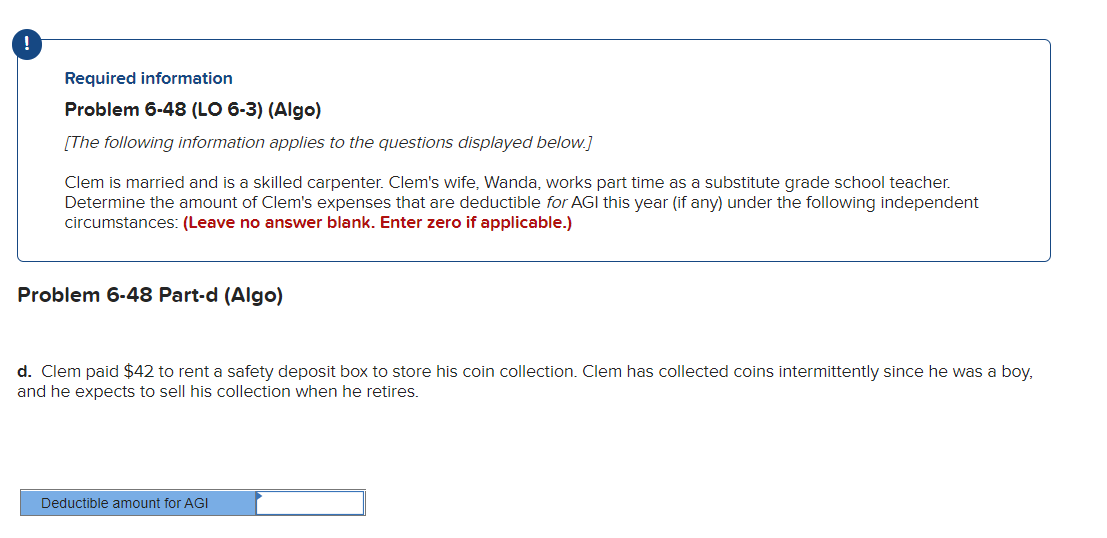

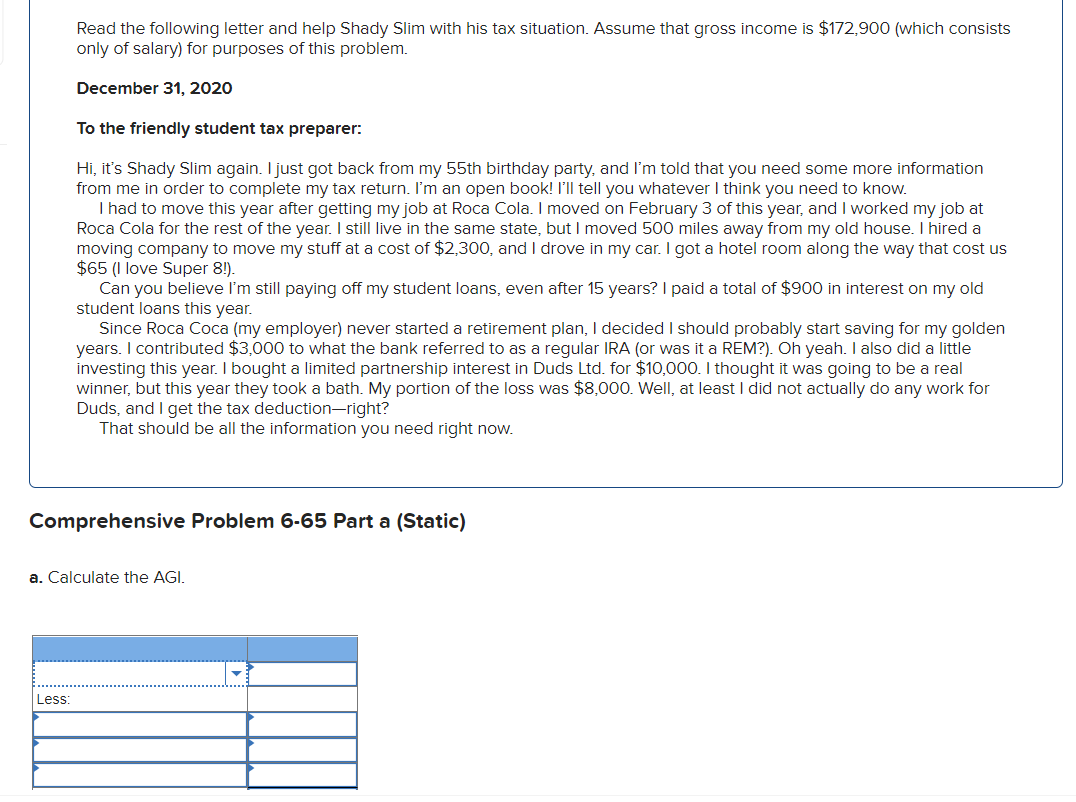

! Required information Problem 6-48 (LO 6-3) (Algo) [The following information applies to the questions displayed below. Clem is married and is a skilled carpenter. Clem's wife, Wanda, works part time as a substitute grade school teacher. Determine the amount of Clem's expenses that are deductible for AGI this year (if any) under the following independent circumstances: (Leave no answer blank. Enter zero if applicable.) Problem 6-48 Part-d (Algo) d. Clem paid $42 to rent a safety deposit box to store his coin collection. Clem has collected coins intermittently since he was a boy, and he expects to sell his collection when he retires. Deductible amount for AGI Read the following letter and help Shady Slim with his tax situation. Assume that gross income is $172,900 (which consists only of salary) for purposes of this problem. December 31, 2020 To the friendly student tax preparer: Hi, it's Shady Slim again. I just got back from my 55th birthday party, and I'm told that you need some more information from me in order to complete my tax return. I'm an open book! I'll tell you whatever I think you need to know. I had to move this year after getting my job at Roca Cola. I moved on February 3 of this year, and I worked my job at Roca Cola for the rest of the year. I still live in the same state, but I moved 500 miles away from my old house. I hired a moving company to move my stuff at a cost of $2,300, and I drove in my car. I got a hotel room along the way that cost us $65 (I love Super 8!). Can you believe I'm still paying off my student loans, even after 15 years? I paid a total of $900 in interest on my old student loans this year. Since Roca Coca (my employer) never started a retirement plan, I decided I should probably start saving for my golden years. I contributed $3,000 to what the bank referred to as a regular IRA (or was it a REM?). Oh yeah. I also did a little investing this year. I bought a limited partnership interest in Duds Ltd. for $10,000. I thought it was going to be a real winner, but this year they took a bath. My portion of the loss was $8,000. Well, at least I did not actually do any work for Duds, and I get the tax deduction-right? That should be all the information you need right now. Comprehensive Problem 6-65 Part a (Static) a. Calculate the AGI. Less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts