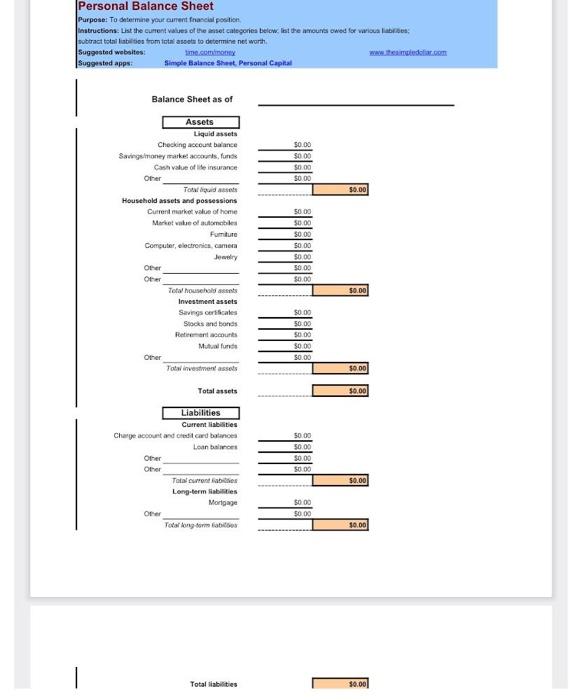

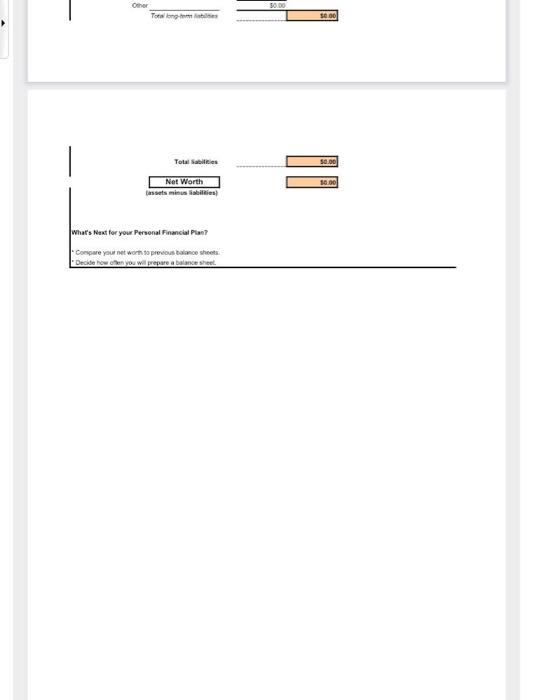

Question: please help, show the work. All work. Personal Balance Sheet Purpose: To determine your cantent francial postion. soberac Sugont Sugger slarcan Instructions: Note: Sample numbers

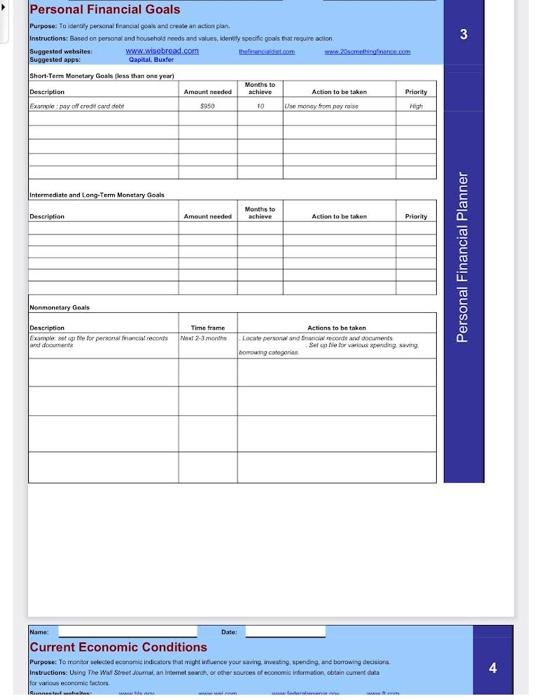

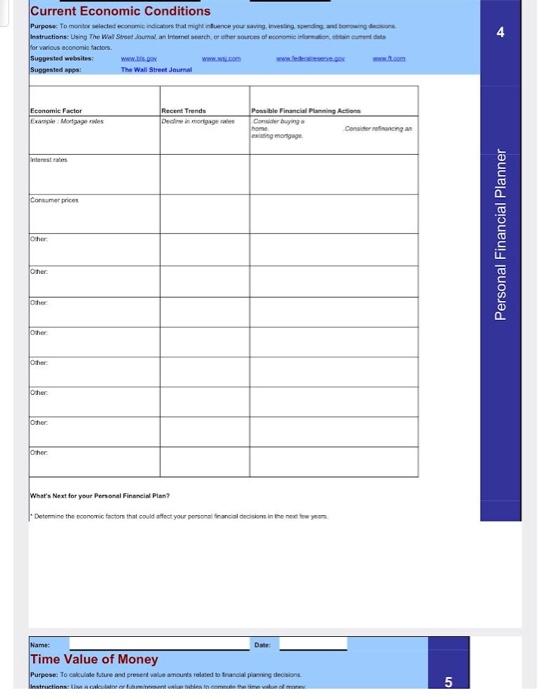

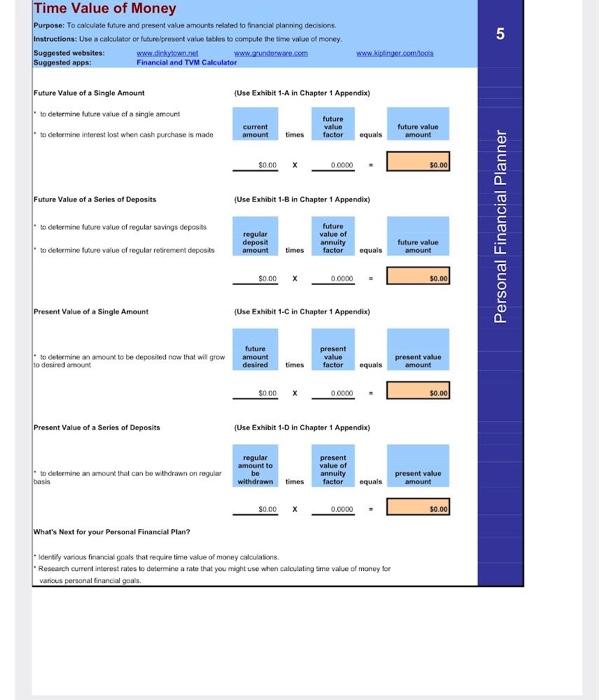

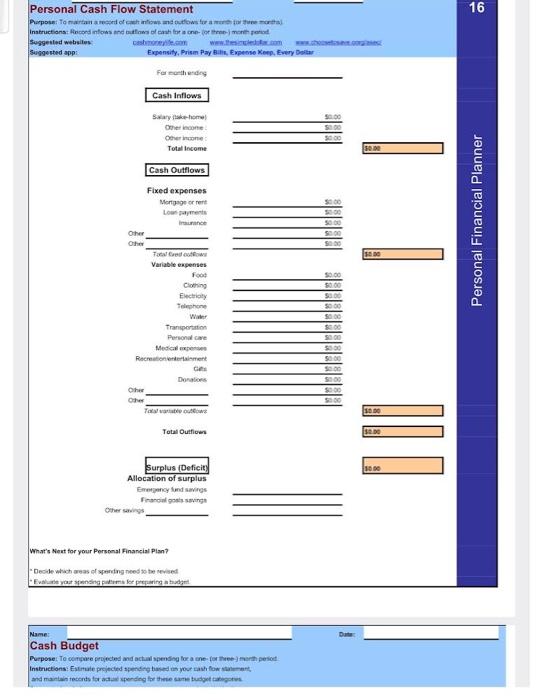

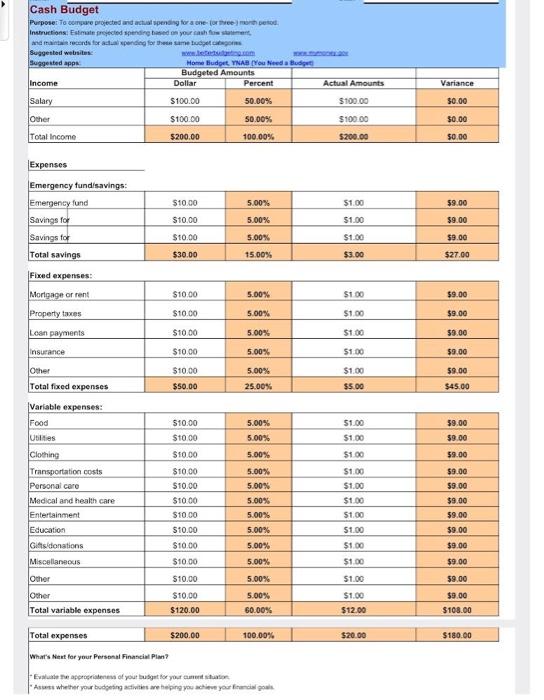

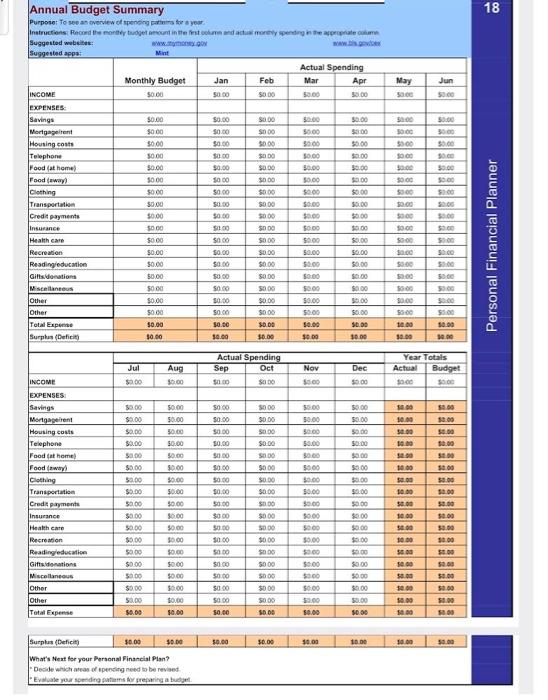

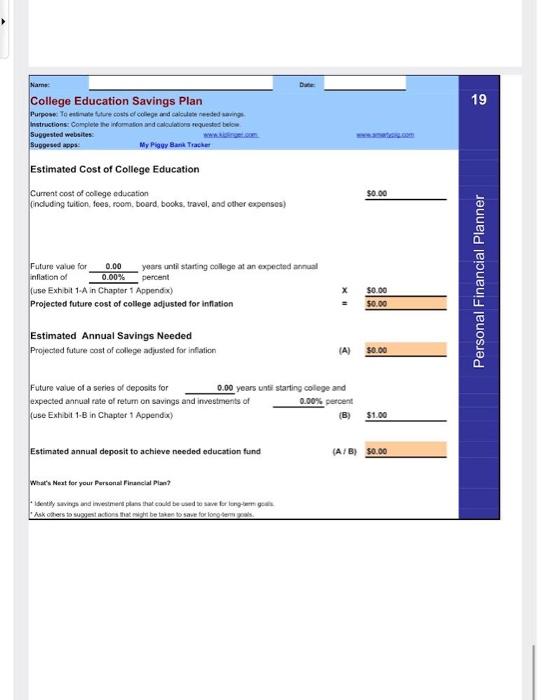

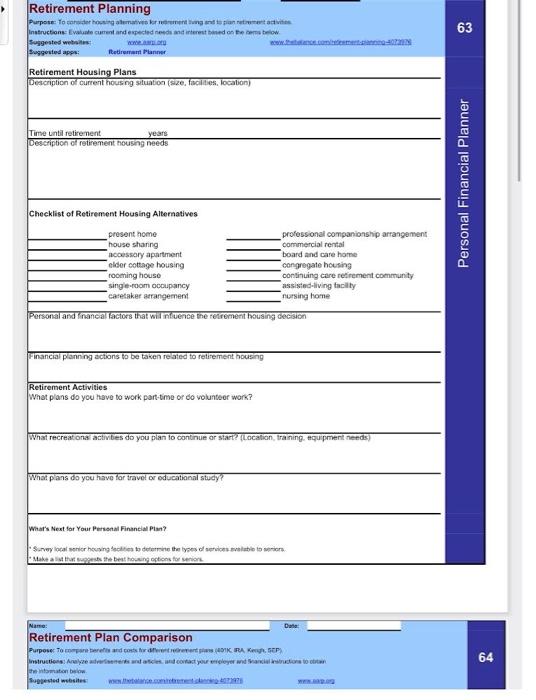

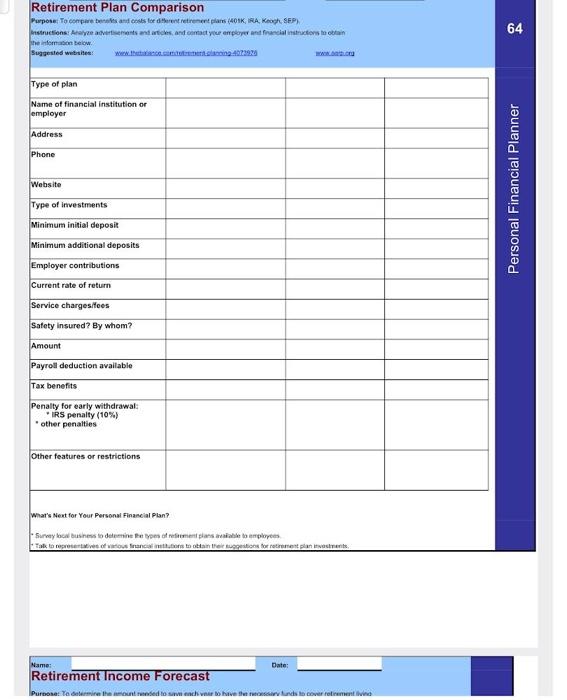

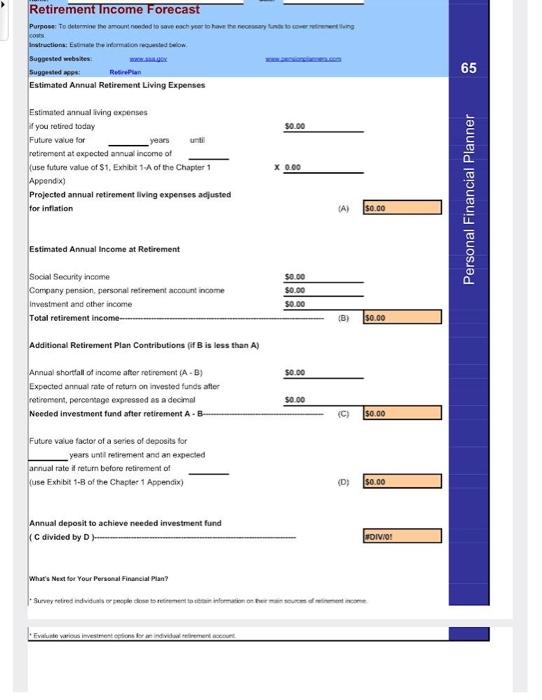

Personal Balance Sheet Purpose: To determine your cantent francial postion. soberac Sugont Sugger slarcan Instructions: Note: Sample numbers have been inserted into this workheet. Student wil need to replace sample numbers with their oun in white spaces. Colared spaces art automatic calculations. Namp Die 19 College Education Savings Plan Instructions: Conpleie the information ard caloulabsra requestod beloer Suguested websites: Suggeted apps: My Plauy Bank Tracker Estimated Cost of College Education Current cost of college education [indiuding tuition, foes, room, board, books, trawol, end cther expenses) $0.00 Future value for Fillation of 0.00 0.00% years unti starfing college at an expected annual percent (use Exhbit 1-A in Chapter 1 Append x ) Projected future cost of college adjusted for inflation Estimated Annual Savings Needed Projectind future cost of college adjusted for infation 0.00 years unti starting college and Future value of a series of deposits for Q.00\% petcent expected annual rate of retum on savings and imvestrments of (use Exhibit 1.B in Chapter 1 Appendx) (A) x = 50.0050.00 Estimated annual deposit to achieve needed education fund (A.t B) $0.00 Whak Next for your Persenal Finanelat Plan? Retirement Planning 63 Susgested wetiolin: ame antion Suggosted appes: Rediremant Flanner Retirement Housing Plans Description of current housng stuation (size, facilties, location) Checklist of Retirement Housing Altematives present home house shaning accessory apartment. - elder cottage housing rocening house singlevoom occupancy casesaker arrangenent protessional companionship arrangement commencial rental board and care home congrogate housing continuing care refirement community assistedriving faclity nursing home Financial planning actions to be taken reated to retiement housing Retirement Activities What plans do you have to work part-time of do volunteor work? What recreations activbes do you plan to continue dor start? (Location, franing. efqupment needs) Whot plans do you have for travel or educatianal study? Whars Next for Your Persenal Financial Pian? Name: Dase: Retirement Plan Comparison 64 Finitionation belion. Suevested mesites 64 Current Economic Conditions br wlous economin tactoos. What's Next for your Personal Financinl Plan? Personal Financial Goals Suggestedapps:GapitalEuater: 3 Short-Terme Menetary Goals Dess than ons yean \begin{tabular}{|c|c|c|c|c|} \hline Description & Ambant needed & \begin{tabular}{c} Monehs to \\ achirve \end{tabular} & Action to be taken & Prionity \\ \hline Exymiv : pay of crost cared debet & & 10 & Wee mopey som poy raien & regh \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Intermedinte and Leng-Ferm Monstary Goghs \begin{tabular}{|c|c|c|c|c|} \hline Description & Amevent needed & \begin{tabular}{l} Months to \\ mhiteve \end{tabular} & Actien to be takes & Prionty \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Nennenetary Geals Wame: Date: Current Economic Conditions 4 far varicus esoncmic fictors Retirement Income Forecast conts. Sugersted werbikes: 5ugpested ape: Estimated Annual Retirement Living Expenses Estimated annual living expenses if you relired today Future vaive for years retirement at expected annual income of (use future value of $1. Exhibit 1.A of the Chapter 1 Appond x ) Projected annual retirement llving expenses adjusted for inflation Estimated Annual income at Retirement Social Security income Company pension, personal retrement account income investment and other income Total retirement income Additional Retirement Plan Contributions (if B is less than A) Annual shorttall of income after retinement (A - B) Expected annual rate of return on imvested funds afler retiroment, porcontage expressed as a decimel Needed investment fund after retirement A - B- Future value factor of a series of deposits for years until relirement and an expected annual rate if return before retirement of (use Exhibet 1B of the Chapler 1 Appendix) (D) $0.00 Annual deposit to achieve needed investment fund ( C dividied by D ) ( C dividied by D) What's Next for Your Personal Financiat Plan? 65 (A) 50.00 \begin{tabular}{|c|} \hline 50.00 \\ \hline$0.00 \\ \hline$0.00 \\ \hline \end{tabular} (b) 50.00 50.00 0.00 $0.00 $0.00 (C) $50.00 (C) $0.00 Annual Budaet Summarv Personal Cash Flow Statement 16 Suggested wobsiles: Suigoested app: Expensity, Prisin Pay Bilis, Expewse Kerp, Every Doltar Fer nuethendieg Cash Inflews Swary jeschenerme! oner hane . Cover insome Total income Cash Outflows Fixed expenses Martiage or rent Lows parments. irainance Other Otien Tacal Geed authow Variable experses foot Clothing Electriaty Teleshere Wuner Transpotation Personal cave Medical expentive Racmobonverterlasment cies Donations Oher Oher Totak Outhum Surplus (Deficit) Allocation of surplus Emetipency lund savires Francil gonts swingh Other savings Other savings \begin{tabular}{r} 500500 \\ \hline500500 \\ \hline 500 \\ \hline \end{tabular} 1tbe 14 be 1000 What's Nent for your Personal Financial Pian? - Deside which areas of sprening need to to nevised Name: Cash Budget Time Value of Money Purpose: To calculate future and present value amounts related fo finandid planneng decsions. Future Value of a Single Amount - to determine hrue vaue ef a single ameurs - to determine inferest lost when cash purchase is made Future Value of a Series of Deposits - Ia determine have value of regular savings deposids. - to determine fifure value of regular resirement deposts (Use Exhibit 1-A in Chapter 1 Appendix) (Use Exhibit 1-B in Chapter 1 Appendix) \begin{tabular}{|c|c|c|c|c|} \hline \begin{tabular}{l} regular \\ deposit \\ amount \end{tabular} & times & \begin{tabular}{l} future \\ value of \\ annuity \\ factor \end{tabular} & equals & \begin{tabular}{c} future value \\ amosint \end{tabular} \\ \hline \end{tabular} $0.00 0.0000 = 50.00 (Use Exhibit 1-C in Chapter 1 Appendix) 50.00 m 50.00 - Io delermine an atrouk to be deposited new that wil grew to desired amoun Present Value of a Series of Depesits - to delermine an amourk that can be withdrawn on regular basia Present Value of a Single Amount desired times x 0.0000 5 future value $0.00 0.0000 amosint amount (Use Exhibit 1-D in Chapter 1 Appendix) \begin{tabular}{|c|c|c|c|c|} \hline \begin{tabular}{l} regular \\ amount to \\ be \\ withdram \end{tabular} & times & \begin{tabular}{l} present \\ value of \\ annuity \\ factor \end{tabular} & equals & \begin{tabular}{c} present value \\ amouns \end{tabular} \\ \hline 50.00 & x & 0.0000 & n & 50.00 \\ \hline \end{tabular} Whar's Neat for your Personal Financial Plan? - Iderilly various finacisi goals that require time value of money calculasions. - Reseaveh curfent interest rabes to determine a fate that you might use when calo,iating sme value of money lor varices persanal trancial goals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts