Question: please help show work as well. this is from the course investments at. business school. it will be very much appreciated. thank you in advance.

please help show work as well. this is from the course investments at. business school. it will be very much appreciated. thank you in advance.

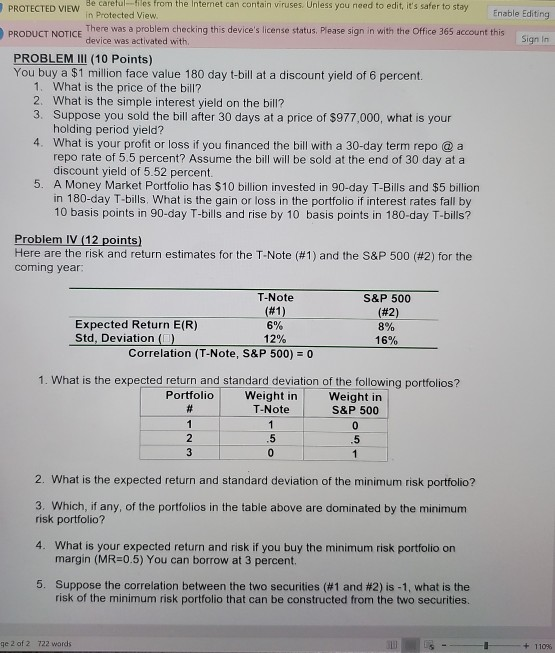

Be carefules from the Internet can contain viruses. Unless you need to edit, it's safer to stay PROTECTED VIEW in Protected View Enable Editing There was a problem checking this device's license status. Please sign in with the Office 365 account this PRODUCT NOTICE Sign In device was activated with PROBLEM III (10 Points) You buy a $1 million face value 180 day t-bill at a discount yield of 6 percent. 1. What is the price of the bill? 2. What is the simple interest yield on the bill? 3. Suppose you sold the bill after 30 days at a price of $977,000, what is your holding period yield? 4. What is your profit or loss if you financed the bill with a 30-day term repo @a repo rate of 5.5 percent? Assume the bill will be sold at the end of 30 day at a discount yield of 5.52 percent. 5. A Money Market Portfolio has $ 10 billion invested in 90-day T-Bills and $5 billion in 180-day T-bills. What is the gain or loss in the portfolio if interest rates fall by 10 basis points in 90-day T-bills and rise by 10 basis points in 180-day T-bills? Problem IV (12 points) Here are the risk and return estimates for the T-Note (#1) and the S&P 500 (#2) for the coming year T-Note (#1) Expected Return E(R) 6% Std, Deviation (0) 12% Correlation (T-Note, S&P 500) = 0 S&P 500 (#2) 8% 16% 1. What is the expected return and standard deviation of the following portfolios? Portfolio Weight in Weight in T-Note S&P 500 2. What is the expected return and standard deviation of the minimum risk portfolio? 3. Which, if any, of the portfolios in the table above are dominated by the minimum risk portfolio? 4. What is your expected return and risk if you buy the minimum risk portfolio on margin (MR=0.5) You can borrow at 3 percent. 5. Suppose the correlation between the two securities (#1 and #2) is -1, what is the risk of the minimum risk portfolio that can be constructed from the two securities. ge 2 of 2 722 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts