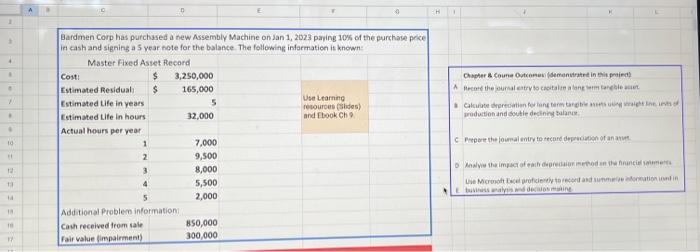

Question: Please help! Showing formulas would be helpful :) show formulas please Bardmen Corp has purchssed a hew Assembly Machine on Jan 1, 2923 paying 10%

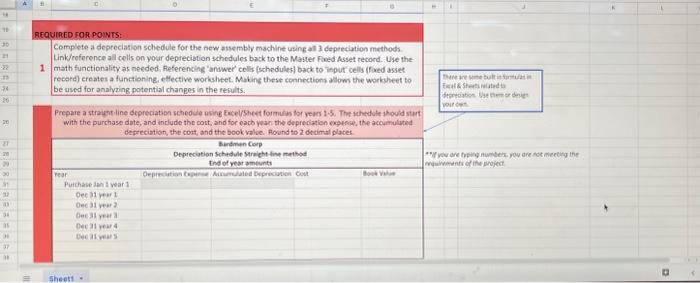

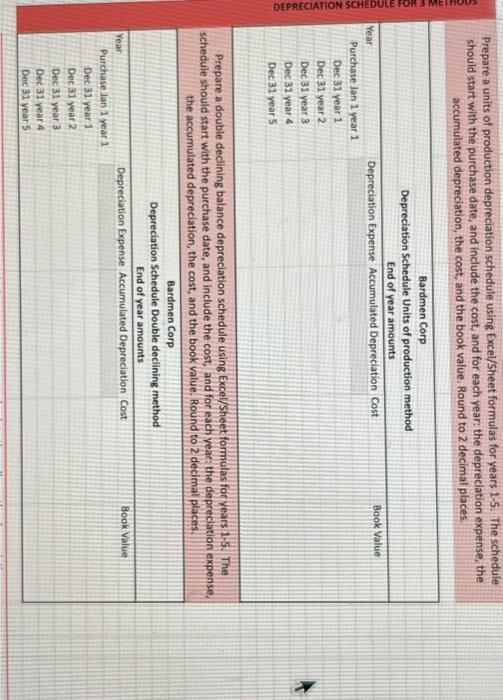

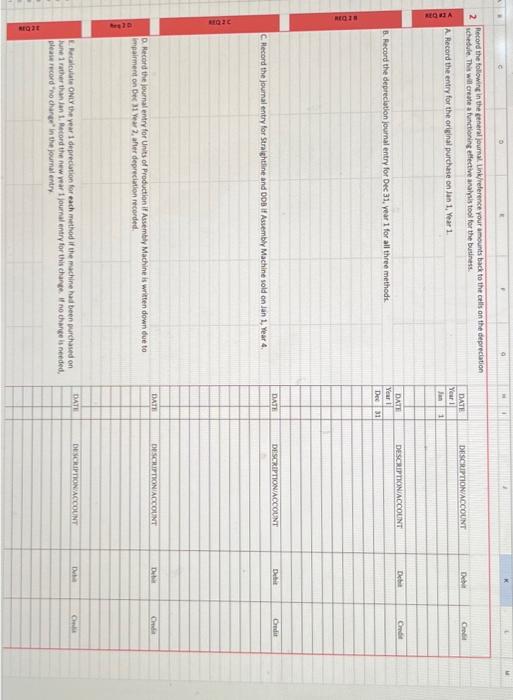

Bardmen Corp has purchssed a hew Assembly Machine on Jan 1, 2923 paying 10% of the purchase price ie cash and sienine as vear note for the balance. The follewine infarmation it knerwe 3 Expiain your antwers to heq 2C. Are the results different or the same for the 2 methods and why? Ansever: Prepare a units of production depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year the depreclation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places Prepare a double declining balance depreciation schedule using Exceysneet formulas ror years edule should start with the purchase date, and include the cost, and for each year: the depreciation expense. the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. ACQUIRED FOR PONTS: Complete a depreciation schedule for the new assembly machine using an 3 depeciation methods 1 Link/eoference all cells on your deprecistion schedules back to the Master Fied Asset record. Use the math functionality as needed. Fieferencing 'aniwer' colls (schedules) back to inpur' cells (fixed assee recore) creates a functionine, etfective workshet. Mabing these connections allow the workbheet to be used for analvzing potential changes in the results: with the purchase date, and include the cort, and for each yar the depreciation expence, the accuimuluted depreciation, the coat, and the bookvalie. Rlound to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts