Question: Please help me solve this project. Calculate depreciation for long term tangible assets using straight line, units of production, and double declining balance. Prepare the

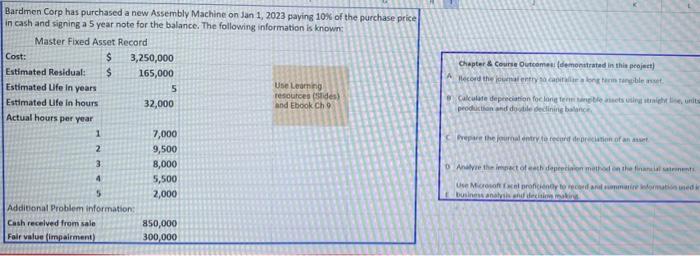

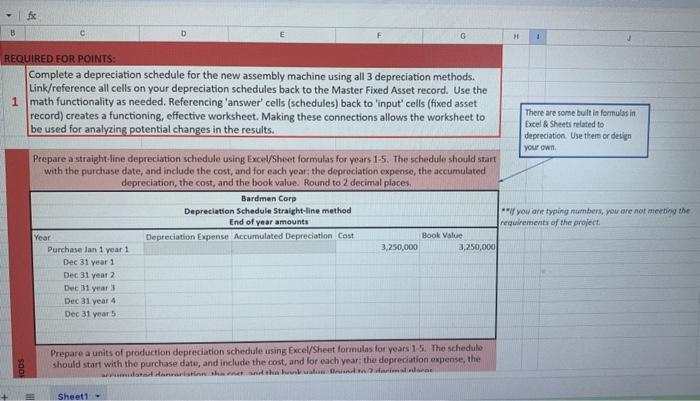

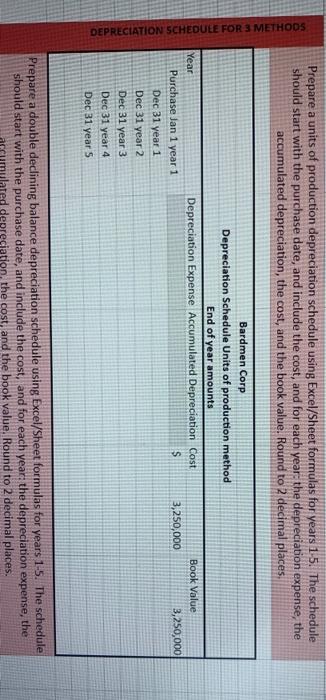

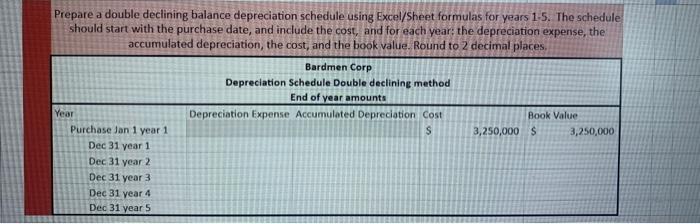

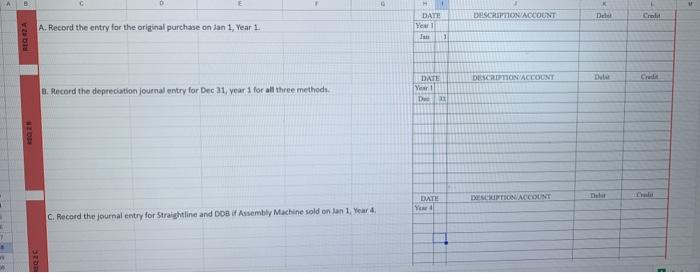

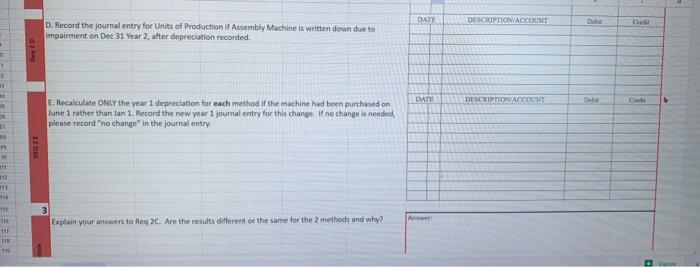

Bardmen Corp has purchased a new Assembly Machine on Jan 1, 2023 paying 101 of the purchase price in cash and signing a 5 year note for the balance. The following information is known: Chapter \& Course Outcemen (demonitratad in thit peoject) Use toarning resoutces (itiges) ind Ebookch 9 peoduction and dodile dedining balance. Complete a depreciation schedule for the new assembly machine using all 3 depreciation methods. Link/reference all cells on your depreciation schedules back to the Master Fixed Asset record. Use the math functionality as needed. Referencing 'answer' cells (schedules) back to 'input' cells (fixed asset record) creates a functioning, effective worksheet. Making these connections allows the worksheet to There are some tult in formulas in be used for analyzing potential changes in the results. Excel \& sheeti related to depreciation. Use then or deilen Prepare a straight-line depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the deprociation expense, the accurnulated deoreciation. the cost. and the book value. Round to 2 decimal slaces. w.if you are typing nimbers, nou are not mecting the requinementr of the propect. Prepare a units of production depreciation schedule using Excel/Sheet formulas for years 1.5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. Prepare a double declining balance depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated deoreciation, the cost, and the book value. Round to 2 decimal places. Prepare a double declining balance depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation experise, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. A. Record the entry for the original purchase on lan 1; Vear 1. B. Mecord the depreciation journal entry for Dec 31, year 1 for all three methods. D. Record the journal entry for Units of Production if Assembly Machine is written down due to impairment on Dec 31 Year 2, atter depreciution recorded. E. Pecalculate ONiY the year 1 depreciation for each method if the machine had been purchused on lune 1 rather than ian 1 . Recond the new year 1 journal entry for this change. It no change is needed please record "no change" in the journal entry. 3 Explain your anwwens to Heq 2C. Are the results different oo the same for the 2 methods and why? Bardmen Corp has purchased a new Assembly Machine on Jan 1, 2023 paying 101 of the purchase price in cash and signing a 5 year note for the balance. The following information is known: Chapter \& Course Outcemen (demonitratad in thit peoject) Use toarning resoutces (itiges) ind Ebookch 9 peoduction and dodile dedining balance. Complete a depreciation schedule for the new assembly machine using all 3 depreciation methods. Link/reference all cells on your depreciation schedules back to the Master Fixed Asset record. Use the math functionality as needed. Referencing 'answer' cells (schedules) back to 'input' cells (fixed asset record) creates a functioning, effective worksheet. Making these connections allows the worksheet to There are some tult in formulas in be used for analyzing potential changes in the results. Excel \& sheeti related to depreciation. Use then or deilen Prepare a straight-line depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the deprociation expense, the accurnulated deoreciation. the cost. and the book value. Round to 2 decimal slaces. w.if you are typing nimbers, nou are not mecting the requinementr of the propect. Prepare a units of production depreciation schedule using Excel/Sheet formulas for years 1.5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. Prepare a double declining balance depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation expense, the accumulated deoreciation, the cost, and the book value. Round to 2 decimal places. Prepare a double declining balance depreciation schedule using Excel/Sheet formulas for years 1-5. The schedule should start with the purchase date, and include the cost, and for each year: the depreciation experise, the accumulated depreciation, the cost, and the book value. Round to 2 decimal places. A. Record the entry for the original purchase on lan 1; Vear 1. B. Mecord the depreciation journal entry for Dec 31, year 1 for all three methods. D. Record the journal entry for Units of Production if Assembly Machine is written down due to impairment on Dec 31 Year 2, atter depreciution recorded. E. Pecalculate ONiY the year 1 depreciation for each method if the machine had been purchused on lune 1 rather than ian 1 . Recond the new year 1 journal entry for this change. It no change is needed please record "no change" in the journal entry. 3 Explain your anwwens to Heq 2C. Are the results different oo the same for the 2 methods and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts