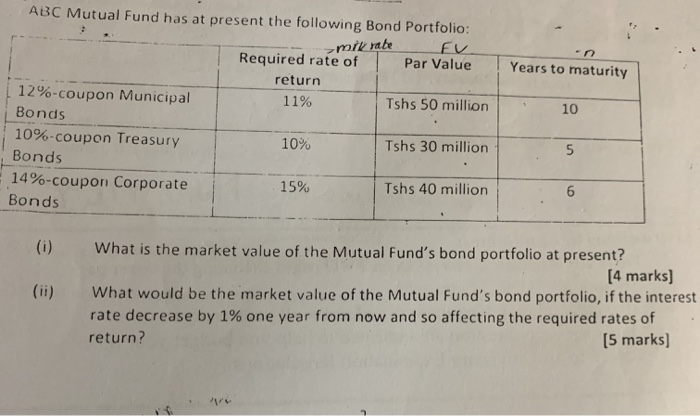

Question: please help solution Years to maturity ABC Mutual Fund has at present the following Bond Portfolio: ...mik rate FV Required rate of Par Value return

Years to maturity ABC Mutual Fund has at present the following Bond Portfolio: ...mik rate FV Required rate of Par Value return | 12%-coupon Municipal 11% Tshs 50 million Bonds 10%-coupon Treasury 10% Tshs 30 million Bonds 14%-coupon Corporate 15% Tshs 40 million Bonds 10 5 What is the market value of the Mutual Fund's bond portfolio at present? (4 marks) What would be the market value of the Mutual Fund's bond portfolio, if the interest rate decrease by 1% one year from now and so affecting the required rates of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts