Question: Please help solve all 3 parts. Required information Problem 09.74 (LO 09-6) (Algo) [The following information applies to the questions displayad below] Nareh began the

![(Algo) [The following information applies to the questions displayad below] Nareh began](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e83b74ed1fa_60466e83b747ceef.jpg)

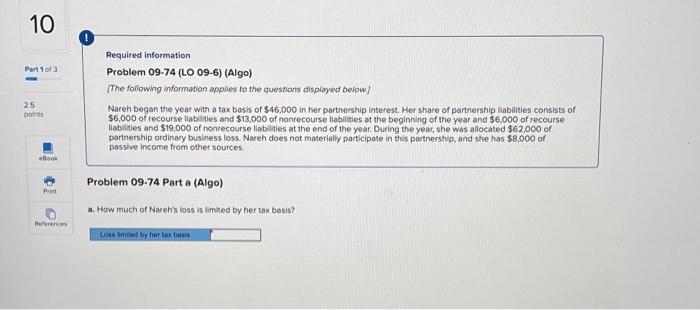

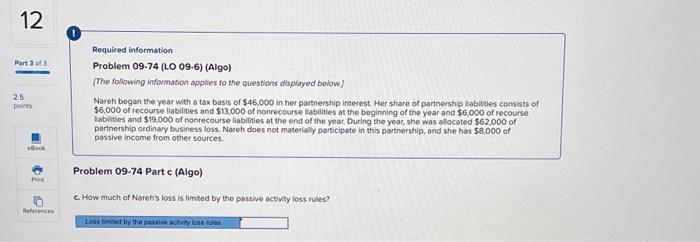

Required information Problem 09.74 (LO 09-6) (Algo) [The following information applies to the questions displayad below] Nareh began the year with o tax basis of $46,000 in her parthership interest. Her share of parthership liabilities consists of $6,000 of recourse liabilies and $13,000 of nonrecourse liabilities at the beginning of the year and $6,000 of recourse liabilies and $19,000 of nonrecourse liabilies at the end of the yeat. During the year, she was allocated $62,000 of partnership ordinary business loss. Nareh does not materially participate in this partnership, and she has $8,000 of passlve income from other sources. Problem 09.74 Part a (Algo) a. How much of Nach's loss is limned by her tax besis? Required information Problem 09-74 (LO 09-6) (Algo) [The following informotion applles to the questions displayed below.] Nareh began the year with a tax basis of $46,000 in her partnership interest. Her share of partnership liabilities consists of $6,000 of recourse liabilities and $13,000 of nonrecourse llabilities at the beginning of the year and $6,000 of recourse liabilities and $19,000 of nonrecourse lilabilities at the end of the year. During the year, she was allocated $62,000 of partnership ordinary business loss. Nareh does not materlally participate in this partnership, and she has $8,000 of passive income from other sources. Problem 09-74 Part b (Algo) b. How much of Nareh's loss is limited by hor at-risk amount? Required information Problem 09.74 (LO 09.6) (Algo) The following information applies to the questions disployed below] Nareh began the year with a tax basis of $46,000 in her partnership interest. Her share of partnership liabities consists of $6,000 of recourse Habilities and $13,000 of nonfecourse labilities at the beginning of the year and $6,000 of recourse Iabities and $19,000 of nonrecourse liabilties at the end of the yeat. During the year, she was allocated $62,000 of partnership ordinary business loss. Nareh does not materialy participate in this partnership, and she has $8,000 of passive income from other sources. Problem 09-74 Part c (Algo) c. How much of Nareh's less is limited by the passive activety loss rules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts