Question: please help solve Solve the following problems. Future Value Annuity Due & Present Value Annuity Due Future Value of an Annuity Due 1. An investor

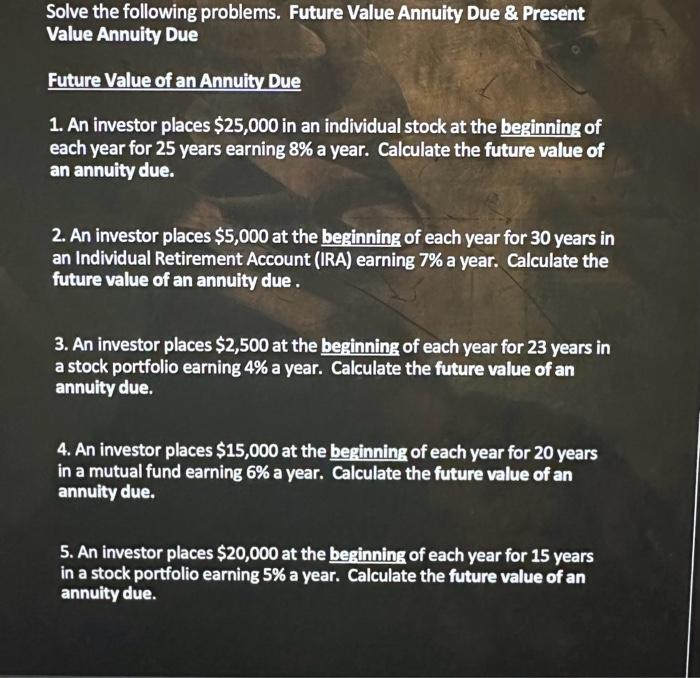

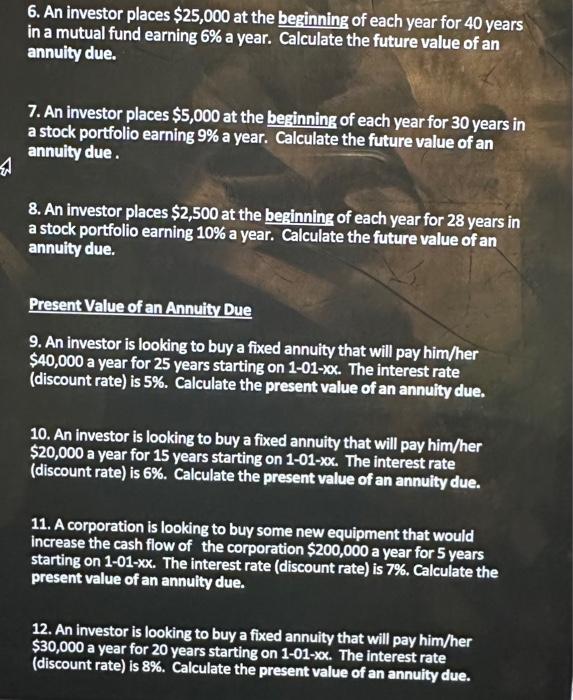

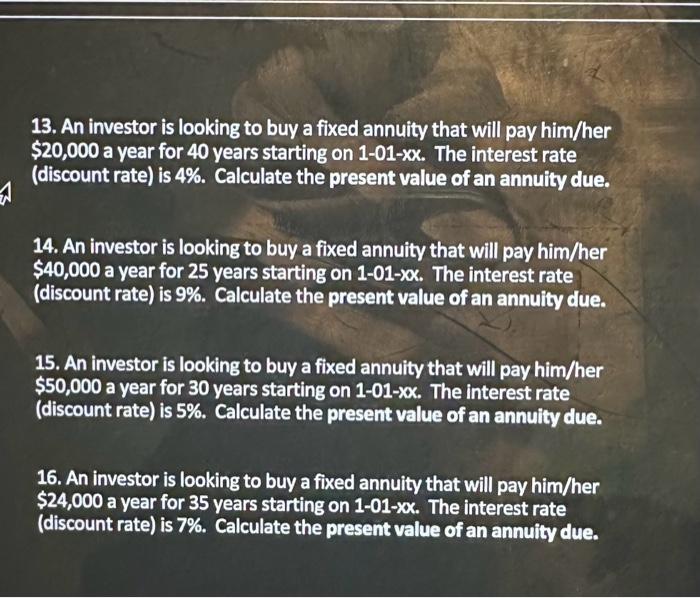

Solve the following problems. Future Value Annuity Due & Present Value Annuity Due Future Value of an Annuity Due 1. An investor places $25,000 in an individual stock at the beginning of each year for 25 years earning 8% a year. Calculate the future value of an annuity due. 2. An investor places $5,000 at the beginning of each year for 30 years in an Individual Retirement Account (IRA) earning 7% a year. Calculate the future value of an annuity due. 3. An investor places $2,500 at the beginning of each year for 23 years in a stock portfolio earning 4% a year. Calculate the future value of an annulty due. 4. An investor places $15,000 at the beginning of each year for 20 years in a mutual fund earning 6% a year. Calculate the future value of an annulty due. 5. An investor places $20,000 at the beginning of each year for 15 years in a stock portfolio earning 5% a year. Calculate the future value of an annuity due. 6. An investor places $25,000 at the beginning of each year for 40 years in a mutual fund earning 6% a year. Calculate the future value of an annulty due. 7. An investor places $5,000 at the besinning of each year for 30 years in a stock portfolio earning 9% a year. Calculate the future value of an annuity due. 8. An investor places $2,500 at the beginning of each year for 28 years in a stock portfolio earning 10% a year. Calculate the future value of an annuity due. Present Value of an Annulty Due 9. An investor is looking to buy a fixed annulty that will pay him/her $40,000 a year for 25 years starting on 1-01-xx. The interest rate (discount rate) is 5\%. Calculate the present value of an annulity due. 10. An investor is looking to buy a fixed annuity that will pay him/her $20,000 a year for 15 years starting on 1-01-xx. The interest rate (discount rate) is 6%. Calculate the present value of an annulty due. 11. A corporation is looking to buy some new equipment that would increase the cash flow of the corporation $200,000 a year for 5 years starting on 1-01-xx. The interest rate (discount rate) is 7%. Calculate the present value of an annulty due. 12. An investor is looking to buy a fixed annuity that will pay him/her $30,000 a year for 20 years starting on 1-01-xx. The interest rate (discount rate) is 8%. Calculate the present value of an annuity due. 13. An investor is looking to buy a fixed annuity that will pay him/her $20,000 a year for 40 years starting on 101xx. The interest rate (discount rate) is 4%. Calculate the present value of an annuity due. 14. An investor is looking to buy a fixed annuity that will pay him/her $40,000 a year for 25 years starting on 1-01-xo. The interest rate (discount rate) is 9%. Calculate the present value of an annulity due. 15. An investor is looking to buy a fixed annuity that will pay him/her $50,000 a year for 30 years starting on 101x. The interest rate (discount rate) is 5\%. Calculate the present value of an annuity due. 16. An investor is looking to buy a fixed annuity that will pay him/her $24,000 a year for 35 years starting on 1-01-xx. The interest rate (discount rate) is 7%. Calculate the present value of an annuity due

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts