Question: same question. help solve asap TY!! (Present value of an annuity due) Determine the present value of an annuity due of $4,000 per year for

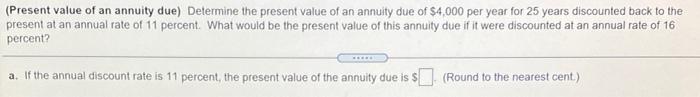

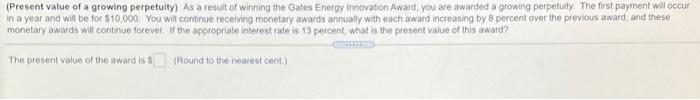

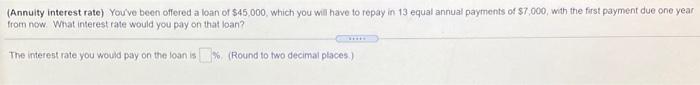

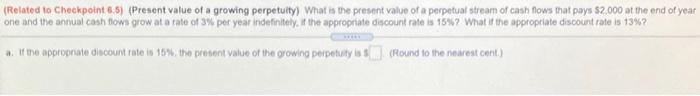

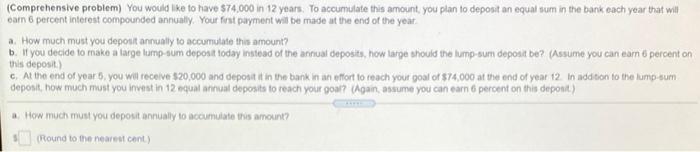

(Present value of an annuity due) Determine the present value of an annuity due of $4,000 per year for 25 years discounted back to the present at an annual rate of 11 percent. What would be the present value of this annuity due if it were discounted at an annual rate of 16 percent? a. If the annual discount rate is 11 percent, the present value of the annuity due is $(Round to the nearest cent) (Present value of a growing perpetulty) As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The first payment will occur in a year and will be for $10,000 You will continue receiving monetary awards annually with each award increasing by 8 percent over the previous award and these monetary awards will continue forever. If the appropriate interest rate is 13 percent, what is the present value of this award? The present Value of the award is (Round to the nearest cont.) (Annuity interest rate) You've been offered a loan of $45.000, which you will have to repay in 13 equal annual payments of $7,000 with the first payment due one year from now. What interest rate would you pay on that loan? The interest rate you would pay on the loan is (Round to two decimal places) (Related to Checkpoint 6.5) (Present value of a growing perpetuity) What is the present value of a perpetual stream of cash flows that pays $2.000 at the end of year one and the annual cash flows grow at a cate of 3% per year indefinitely. In the appropriate discount rate is 15%? What if the appropriate discount rate is 13%? at the appropriate discount rate is 10% the present value of the growing perpetuty (Round to the nearest ont) (Comprehensive problem) You would like to have $74,000 in 12 years. To accumulate this amount, you plan to deposit an equal sum in the bank each year that will car 6 percent interest compounded annually. Your first payment will be made at the end of the year a How much must you deposit annually to accumulate this amount? b. ll you decide to make a large lump sum deposit today instead of the annual deposits, how large should the lump-sum deposit be? (Assume you can earn o percent on this deposit.) c. At the end of year 5, you will receive $20,000 and deposit it in the bank in an effort to reach your goal of 874,000 at the end of year 12 In addition to the lumip-sum deposit, how much must you invest in 12 equat anual deposits to reach your goal? Ugan, assume you can earn 6 percent on this depont.) a How much must you deposit annually to accumulate this amount? (Round to the nearest cont)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts