Question: Please help solve the problem. (Note: Parentheses indicate a credit balance.) Prepare a worksheet to consolidate the separate 2021 financial statements for Gibson and Keller

Please help solve the problem.

(Note: Parentheses indicate a credit balance.) Prepare a worksheet to consolidate the separate 2021 financial statements for Gibson and Keller

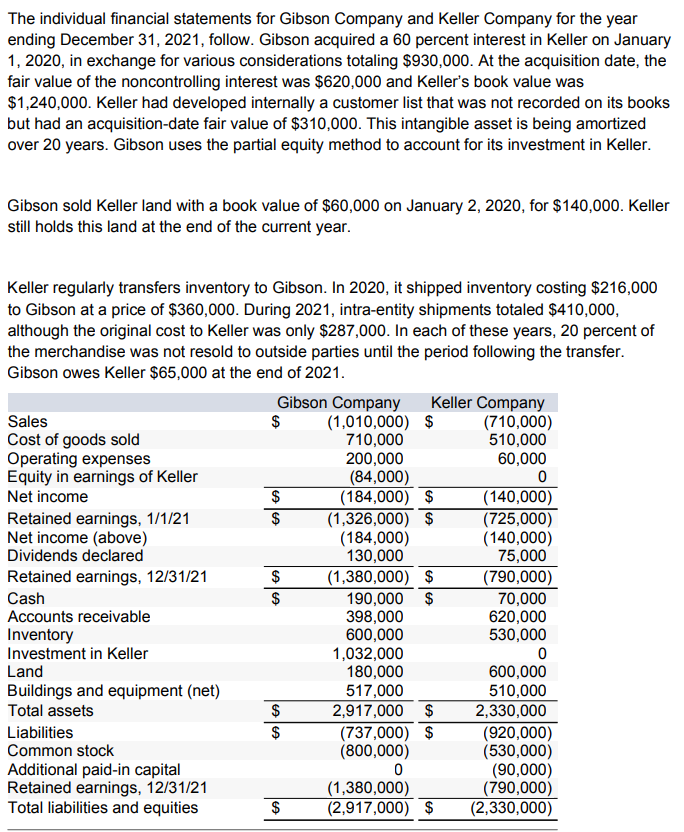

The individual financial statements for Gibson Company and Keller Company for the year ending December 31, 2021, follow. Gibson acquired a 60 percent interest in Keller on January 1,2020 , in exchange for various considerations totaling $930,000. At the acquisition date, the fair value of the noncontrolling interest was $620,000 and Keller's book value was $1,240,000. Keller had developed internally a customer list that was not recorded on its books but had an acquisition-date fair value of $310,000. This intangible asset is being amortized over 20 years. Gibson uses the partial equity method to account for its investment in Keller. Gibson sold Keller land with a book value of $60,000 on January 2, 2020, for $140,000. Keller still holds this land at the end of the current year. Keller regularly transfers inventory to Gibson. In 2020, it shipped inventory costing $216,000 to Gibson at a price of $360,000. During 2021 , intra-entity shipments totaled $410,000, although the original cost to Keller was only $287,000. In each of these years, 20 percent of the merchandise was not resold to outside parties until the period following the transfer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts