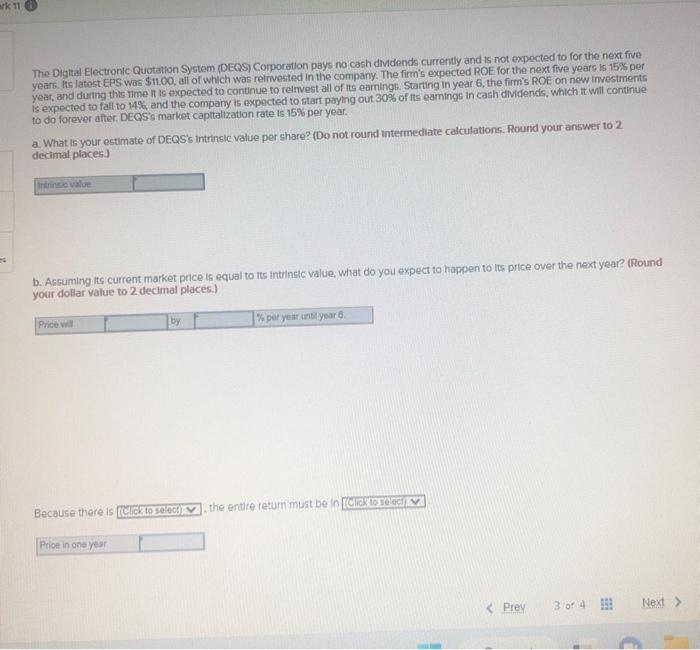

Question: Please help solve this question thank you The Digltal Electronic Quotation System (DEQS) Corporaton pays no cash divdends currently and is not expected to for

The Digltal Electronic Quotation System (DEQS) Corporaton pays no cash divdends currently and is not expected to for the next five years. Its latest EPS was \$1100, all of which was relnvested in the company. The firm's expected ROE for the next five years is 15% per year, and during thts ume it is expected to continue to remvest all of its earnings. Starting in year 6 , the firm's ROE on new investments is expected to fall to 14% and the company is expocted to start paying out 30% of its earnings in cash dividends, which itt will continue to do forever after. DEQSs market capitalization rate is 15% per year. a. What is your ectimate of DEQS's intrinslc value per share? (Do not round intermedlate calculations. Round your answer to 2 decimal places] b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Round your dollar value to 2 decimal places.) Because there is , the entire return must be in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts