Question: Please help solve using excel: Find Annual Worth for Fix X & Y (AW) Two fixtures are being considered for a particular job in a

Please help solve using excel: Find Annual Worth for Fix X & Y (AW)

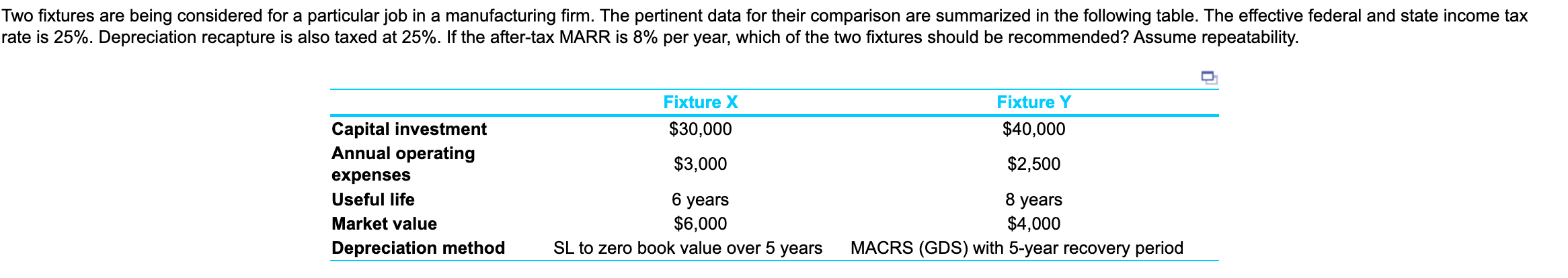

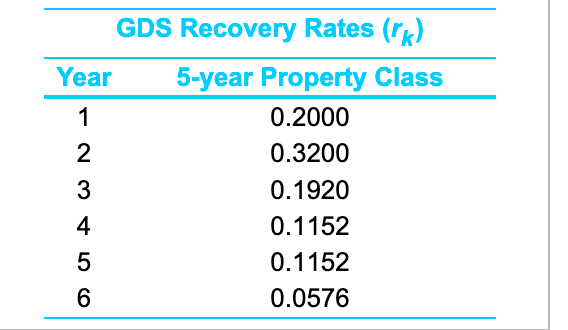

Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. The effective federal and state income tax rate is 25%. Depreciation recapture is also taxed at 25%. If the after-tax MARR is 8% per year, which of the two fixtures should be recommended? Assume repeatability. Fixture X $30,000 Fixture Y $40,000 $3,000 $2,500 Capital investment Annual operating expenses Useful life Market value Depreciation method 6 years $6,000 SL to zero book value over 5 years 8 years $4,000 MACRS (GDS) with 5-year recovery period GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 - N O = 0 O Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. The effective federal and state income tax rate is 25%. Depreciation recapture is also taxed at 25%. If the after-tax MARR is 8% per year, which of the two fixtures should be recommended? Assume repeatability. Fixture X $30,000 Fixture Y $40,000 $3,000 $2,500 Capital investment Annual operating expenses Useful life Market value Depreciation method 6 years $6,000 SL to zero book value over 5 years 8 years $4,000 MACRS (GDS) with 5-year recovery period GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 - N O = 0 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts