Question: pls help solve using excel Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are

pls help solve using excel

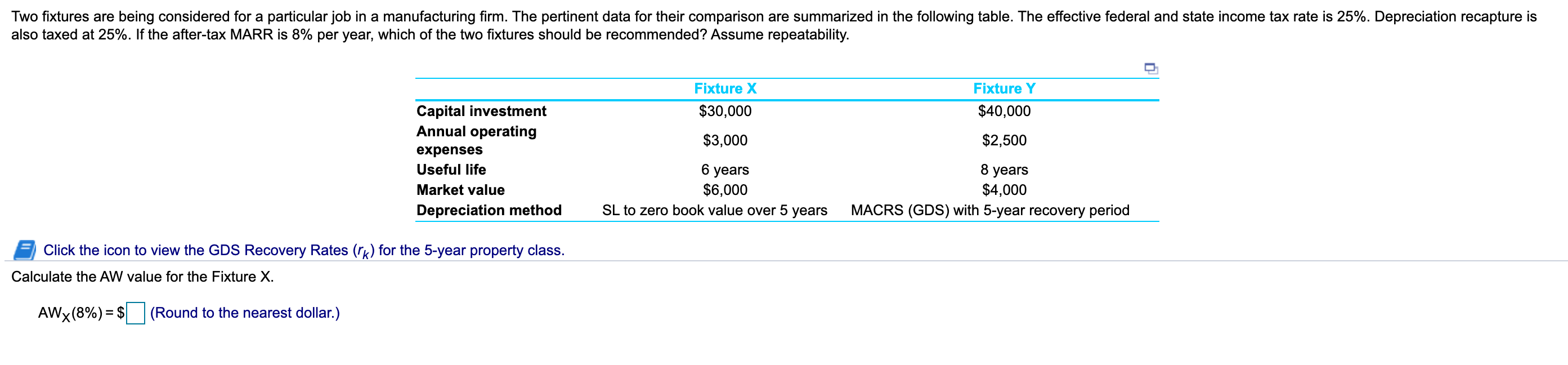

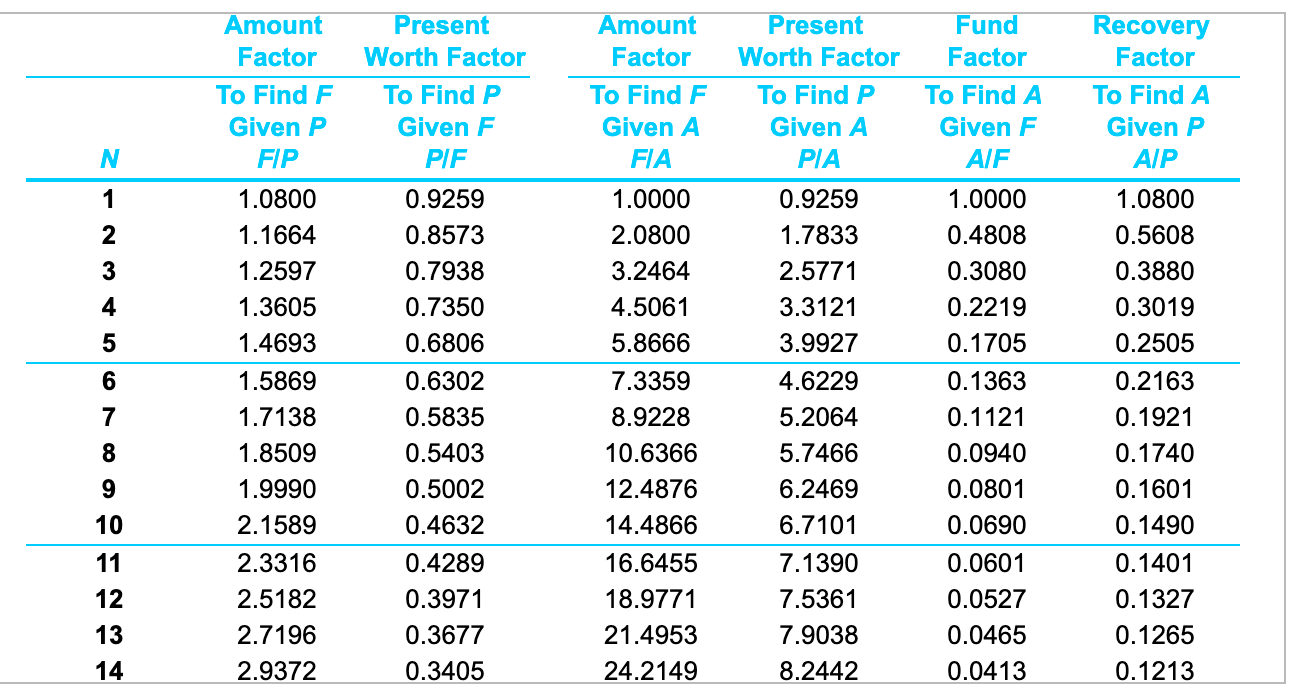

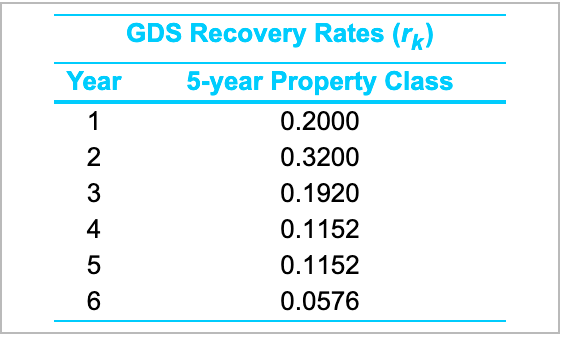

Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. The effective federal and state income tax rate is 25%. Depreciation recapture is also taxed at 25%. If the after-tax MARR is 8% per year, which of the two fixtures should be recommended? Assume repeatability. Fixture Y Fixture X $30,000 $40,000 $3,000 $2,500 Capital investment Annual operating expenses Useful life Market value Depreciation method 6 years $6,000 SL to zero book value over 5 years 8 years $4,000 MACRS (GDS) with 5-year recovery period Click the icon to view the GDS Recovery Rates (rk) for the 5-year property class. Calculate the AW value for the Fixture X. AWx(8%) = $ (Round to the nearest dollar.) Fund Factor Amount Factor To Find F Given P FIP Present Worth Factor To Find P Given F PIF Amount Factor To Find F Given A FIA Present Worth Factor To Find P Given A PIA To Find A Given F AIF Recovery Factor To Find A Given P AIP N 1 2 3 0.9259 0.8573 0.7938 0.7350 0.6806 0.9259 1.7833 2.5771 3.3121 3.9927 4 5 6 7 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 2.3316 2.5182 2.7196 2.9372 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 14.4866 16.6455 18.9771 21.4953 24.2149 4.6229 5.2064 5.7466 6.2469 6.7101 7.1390 7.5361 7.9038 8.2442 1.0000 0.4808 0.3080 0.2219 0.1705 0.1363 0.1121 0.0940 0.0801 0.0690 0.0601 0.0527 0.0465 0.0413 1.0800 0.5608 0.3880 0.3019 0.2505 0.2163 0.1921 0.1740 0.1601 0.1490 0.1401 0.1327 0.1265 0.1213 11 12 13 GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. The effective federal and state income tax rate is 25%. Depreciation recapture is also taxed at 25%. If the after-tax MARR is 8% per year, which of the two fixtures should be recommended? Assume repeatability. Fixture Y Fixture X $30,000 $40,000 $3,000 $2,500 Capital investment Annual operating expenses Useful life Market value Depreciation method 6 years $6,000 SL to zero book value over 5 years 8 years $4,000 MACRS (GDS) with 5-year recovery period Click the icon to view the GDS Recovery Rates (rk) for the 5-year property class. Calculate the AW value for the Fixture X. AWx(8%) = $ (Round to the nearest dollar.) Fund Factor Amount Factor To Find F Given P FIP Present Worth Factor To Find P Given F PIF Amount Factor To Find F Given A FIA Present Worth Factor To Find P Given A PIA To Find A Given F AIF Recovery Factor To Find A Given P AIP N 1 2 3 0.9259 0.8573 0.7938 0.7350 0.6806 0.9259 1.7833 2.5771 3.3121 3.9927 4 5 6 7 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 2.3316 2.5182 2.7196 2.9372 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 14.4866 16.6455 18.9771 21.4953 24.2149 4.6229 5.2064 5.7466 6.2469 6.7101 7.1390 7.5361 7.9038 8.2442 1.0000 0.4808 0.3080 0.2219 0.1705 0.1363 0.1121 0.0940 0.0801 0.0690 0.0601 0.0527 0.0465 0.0413 1.0800 0.5608 0.3880 0.3019 0.2505 0.2163 0.1921 0.1740 0.1601 0.1490 0.1401 0.1327 0.1265 0.1213 11 12 13 GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts