Question: please help solve with steps as soon as possible it is very important the answer should be on $/feet HARRIS WOOD PRODUCTS Harris Wood Products

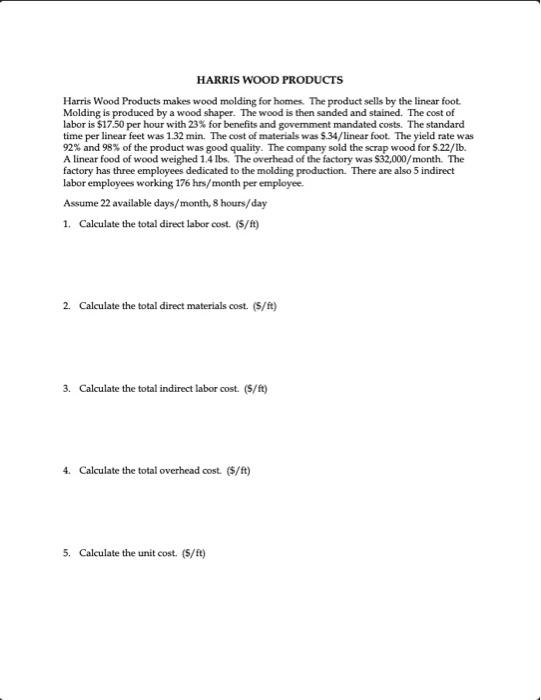

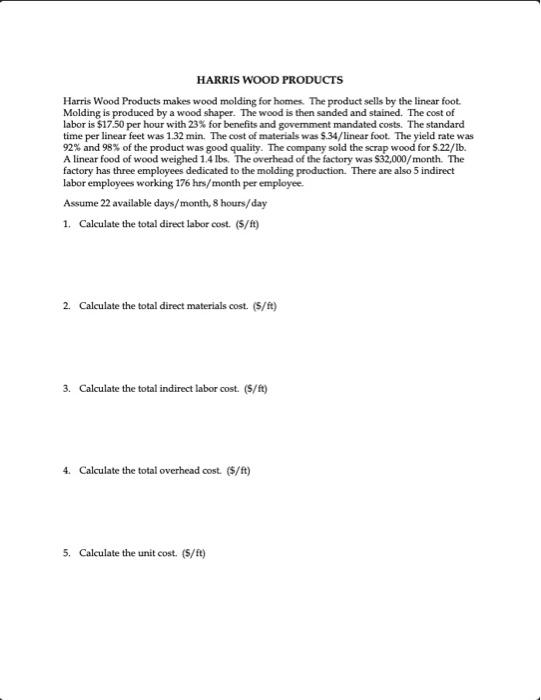

HARRIS WOOD PRODUCTS Harris Wood Products makes wood molding for homes. The product sells by the linear foot. Molding is produced by a wood shaper. The wood is then sanded and stained. The cost of labor is $17.50 per hour with 23% for benefits and government mandated costs. The standard time per linear feet was 1.32 min. The cost of materials was $.34/linear foot. The yield rate was 92% and 98% of the product was good quality. The company sold the scrap wood for S.22/1b. A linear food of wood weighed 1.4 lbs. The overhead of the factory was $32,000/month. The factory has three employees dedicated to the molding production. There are also 5 indirect labor employees working 176 hrs/month per employee. Assume 22 available days/month, 8 hours/day 1. Calculate the total direct labor cost. (5/4) 2. Calculate the total direct materials cost. (5/8) 3. Calculate the total indirect labor cost. (5/8) 4. Calculate the total overhead cost. ($/ft) 5. Calculate the unit cost. (5/4) HARRIS WOOD PRODUCTS Harris Wood Products makes wood molding for homes. The product sells by the linear foot. Molding is produced by a wood shaper. The wood is then sanded and stained. The cost of labor is $17.50 per hour with 23% for benefits and government mandated costs. The standard time per linear feet was 1.32 min. The cost of materials was $.34/linear foot. The yield rate was 92% and 98% of the product was good quality. The company sold the scrap wood for S.22/1b. A linear food of wood weighed 1.4 lbs. The overhead of the factory was $32,000/month. The factory has three employees dedicated to the molding production. There are also 5 indirect labor employees working 176 hrs/month per employee. Assume 22 available days/month, 8 hours/day 1. Calculate the total direct labor cost. (5/4) 2. Calculate the total direct materials cost. (5/8) 3. Calculate the total indirect labor cost. (5/8) 4. Calculate the total overhead cost. ($/ft) 5. Calculate the unit cost. (5/4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts