Question: please help stuck a. What are her expected returns and the risk from her investment in the three assets? How do they compare with invessing

please help stuck

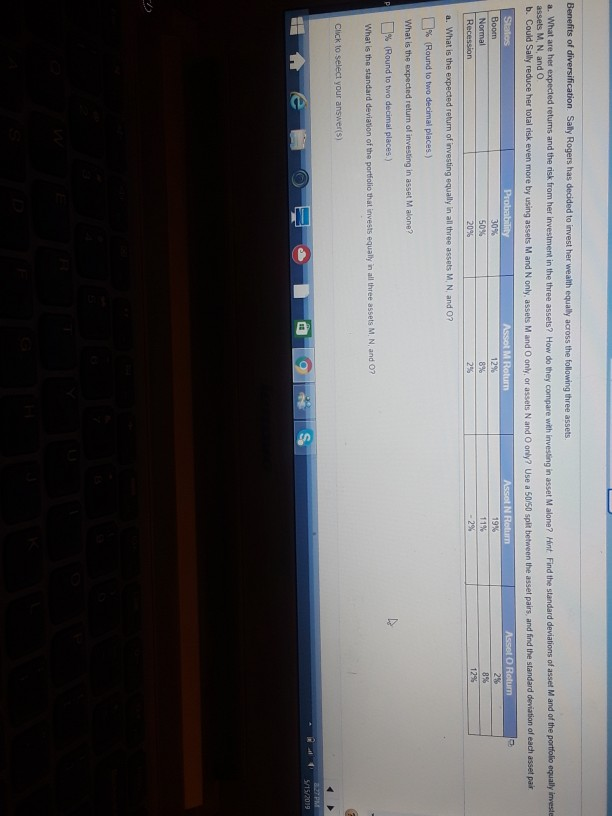

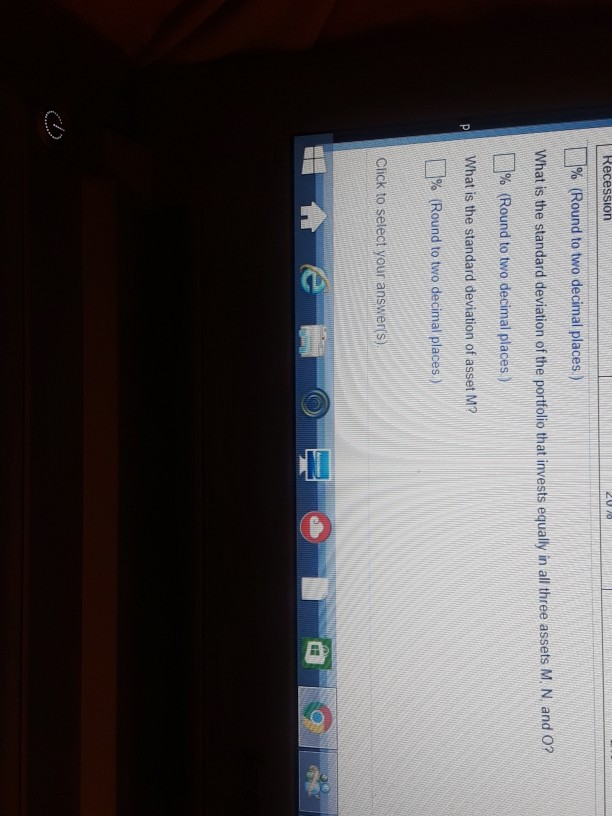

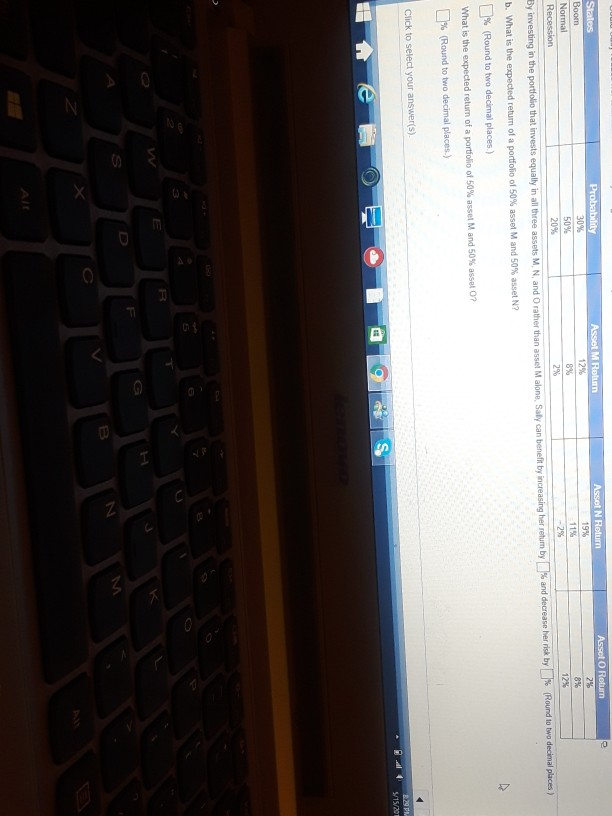

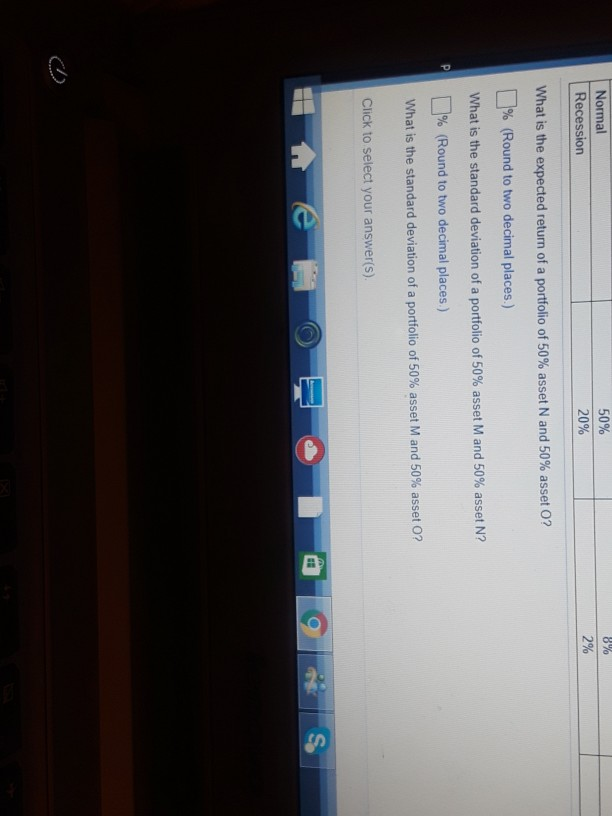

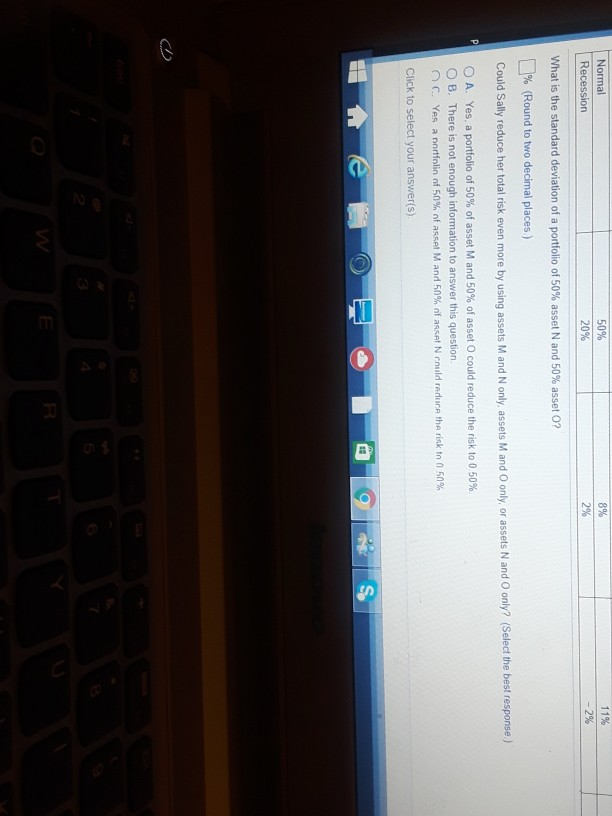

a. What are her expected returns and the risk from her investment in the three assets? How do they compare with invessing in asset M alone? Hint Find the standard deviations of asset M and of the portiolio equally investe assets M, N, and O b. Could Sally reduce her total risk even more by using assets M and N only, assets M and O only, or assets N and O only? Use a 50/50 spit between the asset pairs, and find the standard deviation of each asset pair Roturm 0% a. What is the expected return of investing equally in all three assets M, N, and 0? %(Round to two decimal places ) What is the expected return of investing in asset M alone? % (Round to two decimal places.) What is the standard deviation of the portfolio that invests equaly in all three assets M. N, and 07 Click to select your answer(s) Recessin | |% (Round to two decimal places) What is the standard deviation of the portfolio that invests equally in all three assets M, N, and O? % (Round to two decimal places) What is the standard deviation of asset M? 1% (Round to two decimal places ) Click to select your answer(s) 11% 12% b. What is the expected return of a portfolio of 50% asset M and 50% asset N? % (Round to two decmai places) What is the expected return of a portfolio of 50% asset M and 50% asset O? % (Round to two decimal places.) NA 50% Normal 2% 20% Recession What is the expected return of a portfolio of 50% asset N and 50% asset O? 96 (Round to two decimal places ) What is the standard deviation of a portfolio of 50% asset M and 50% asset N? 1% (Round to two decimal places) What is the standard deviation of a portfolio of 50% asset M and 50% asset? Click to select your answer(s) 11% 8% 50% Normal 2% 20% Recession What is the standard deviation of a portfolio of 50% asset N and 50% asset O? (Round to two decimal places.) % Could Sally reduce her total risk even more by using assets M and N only, assets M and O only, or assets N and O only? (Select the best response ) A. Yes, a portfolio of 50% of asset M and 50% of asset O could reduce the risk to 0 50%. O B. There is not enough information to answer this question C. Yes a nn rtinlin nf 5nsh nf asset M and 5n9h nf asset N rnld reduce the risk tn ( 50% Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts