Question: please help! summarize and pull key concepts from the reading. The past several years have witnessed a growing awareness among American managers of the central

please help! summarize and pull key concepts from the reading.

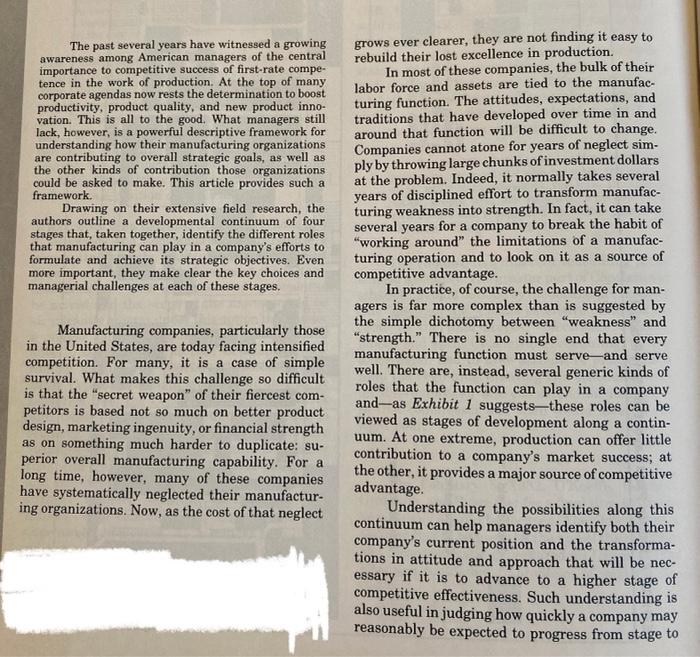

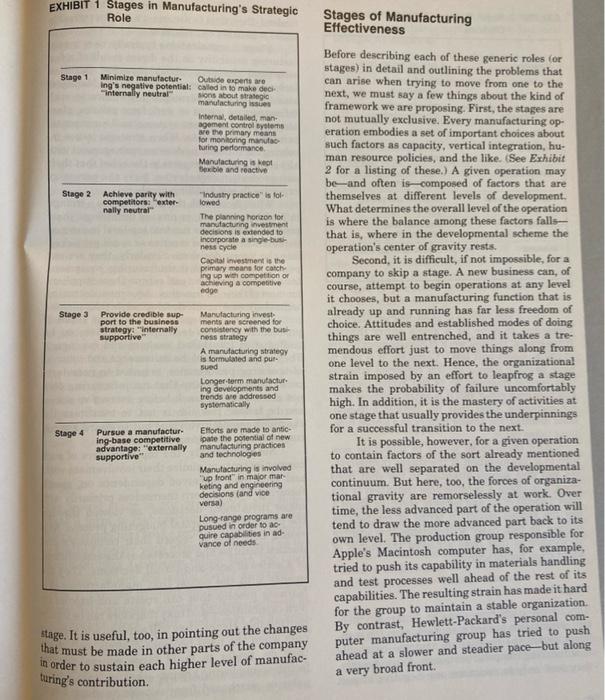

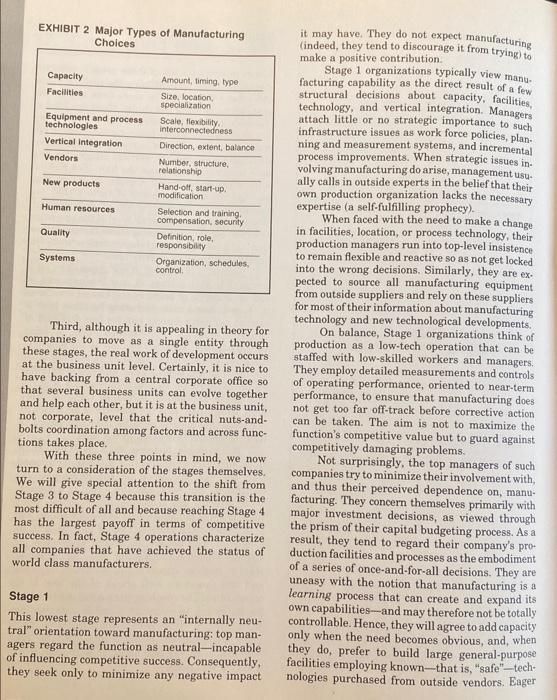

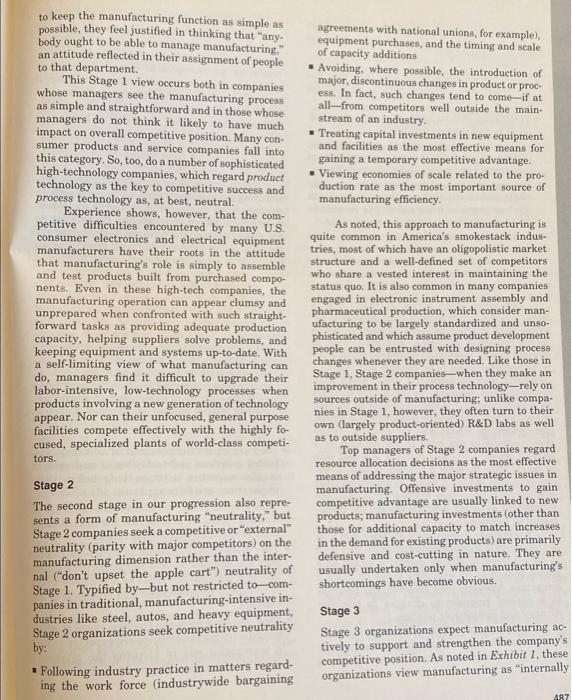

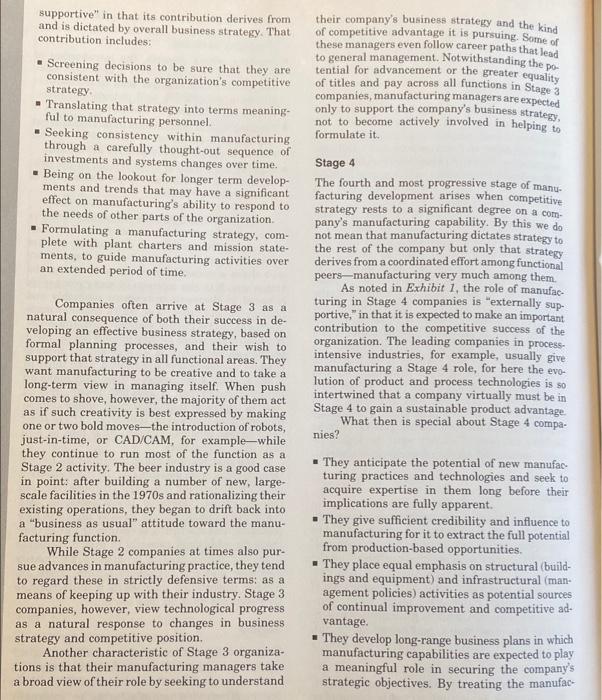

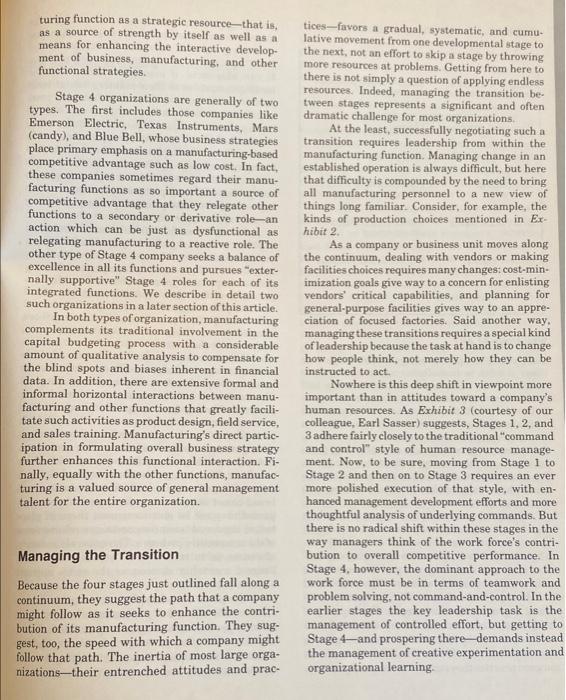

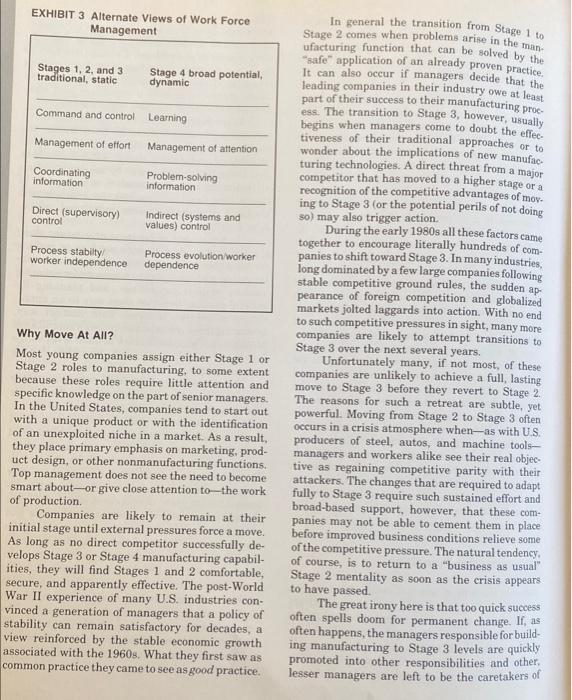

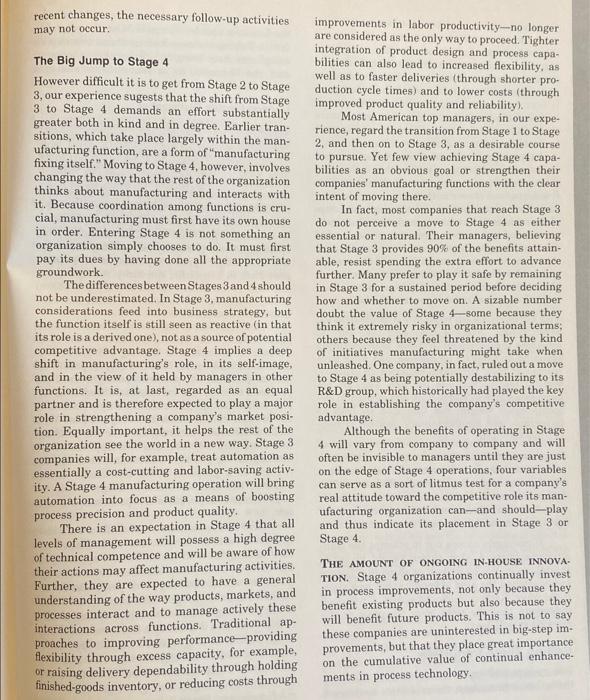

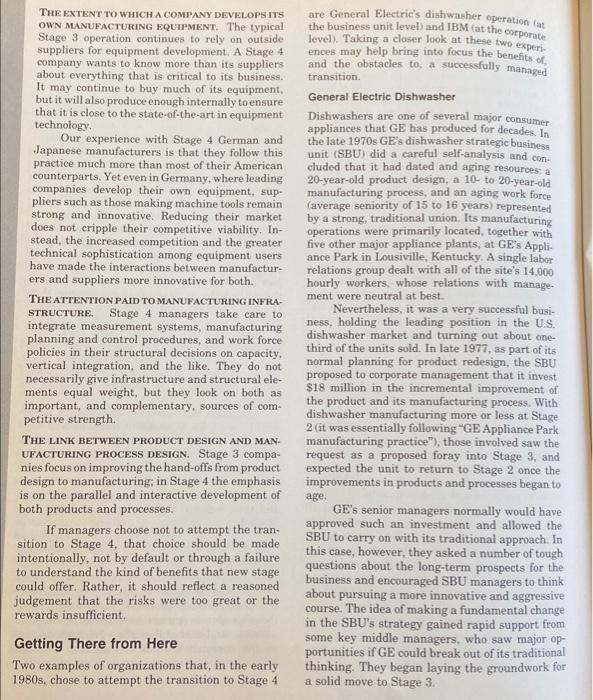

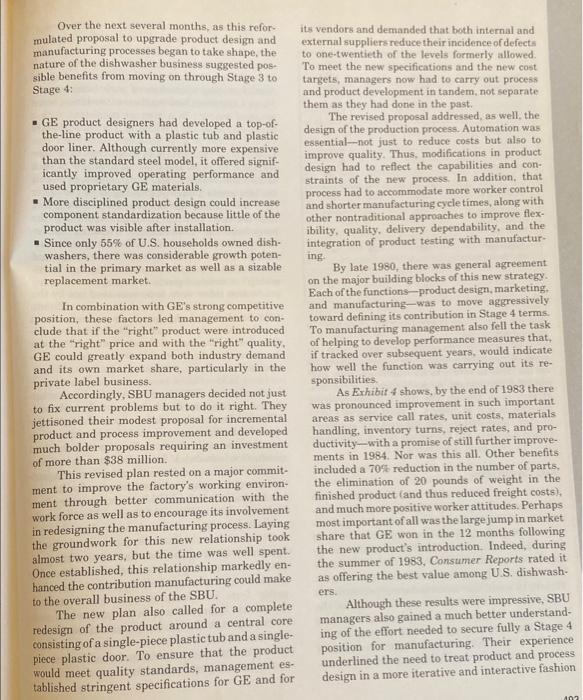

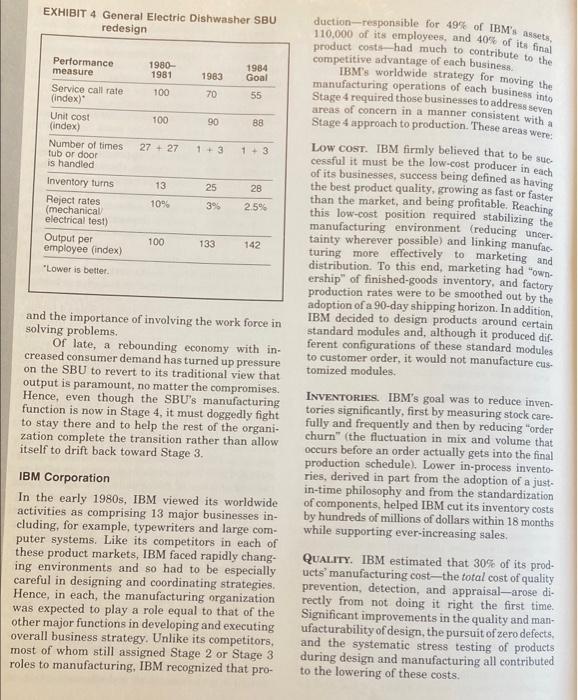

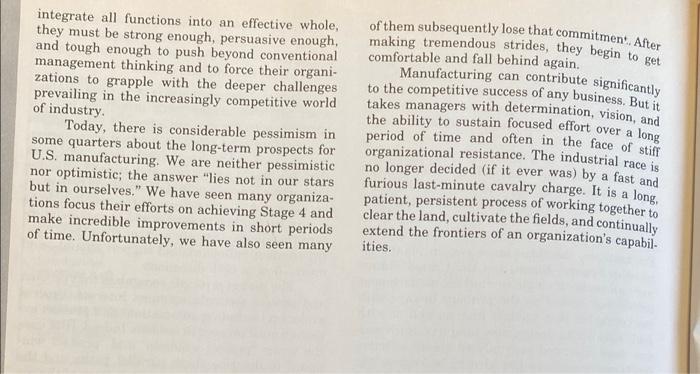

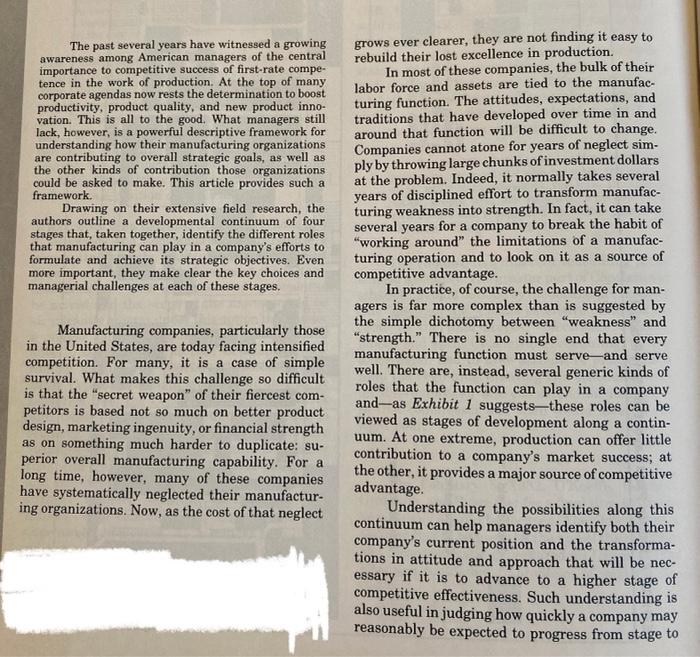

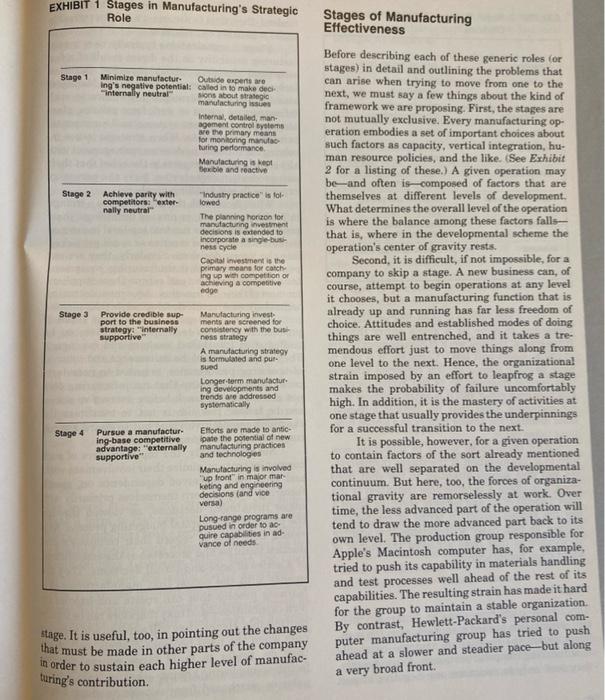

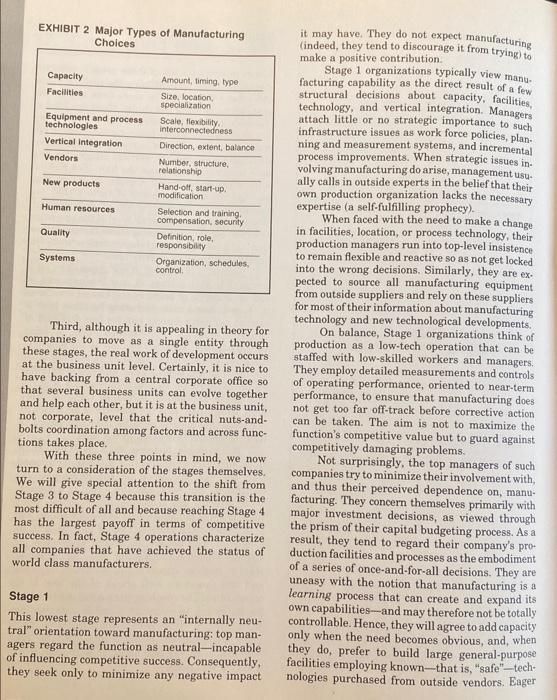

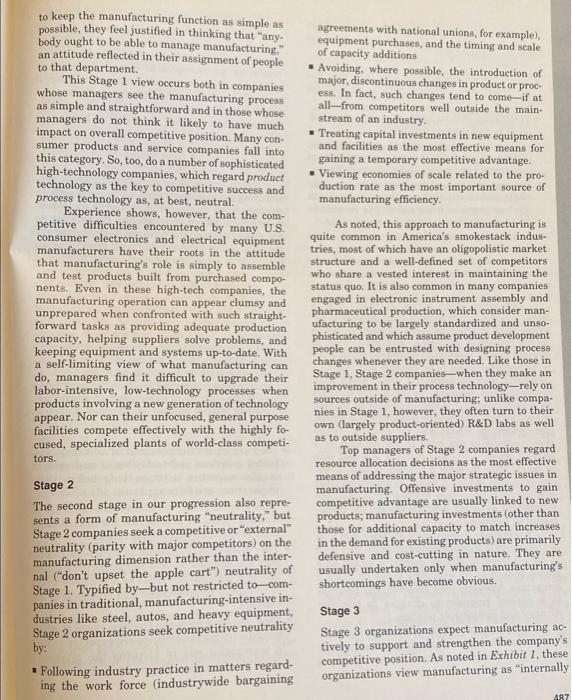

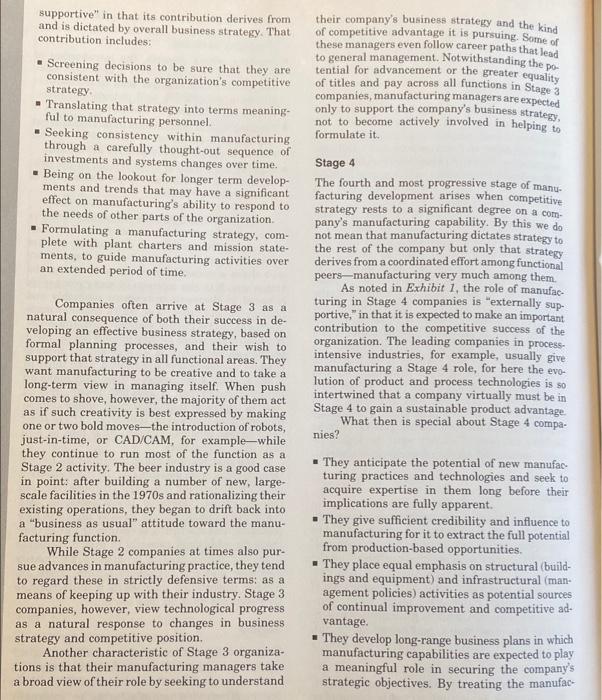

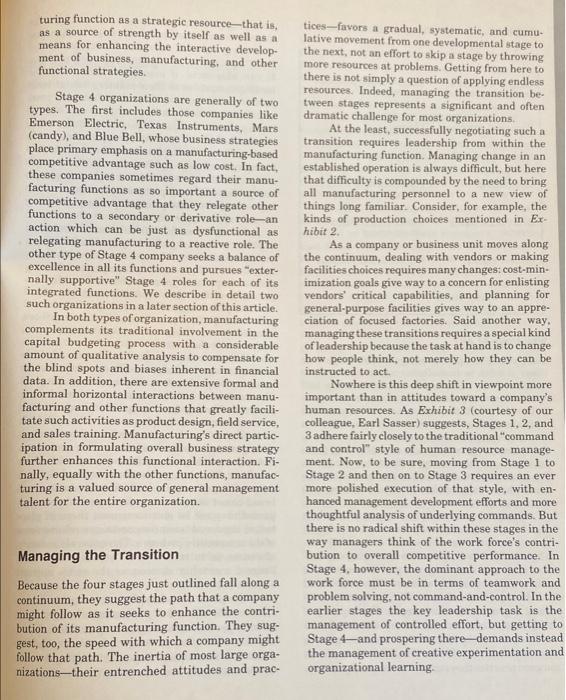

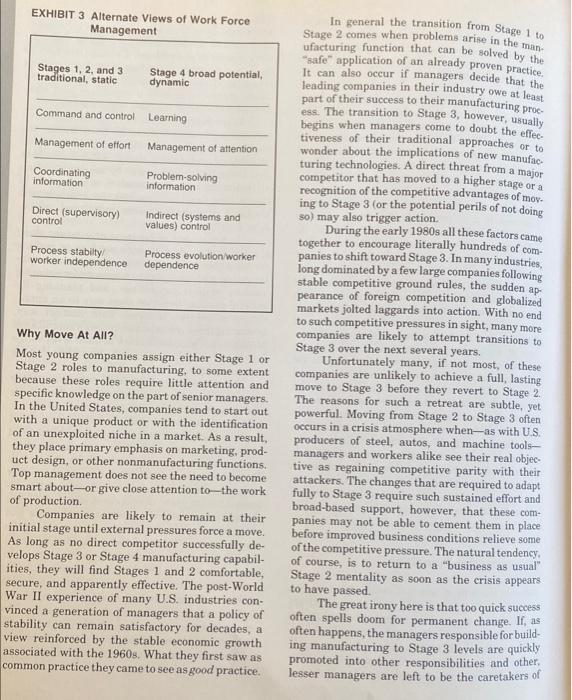

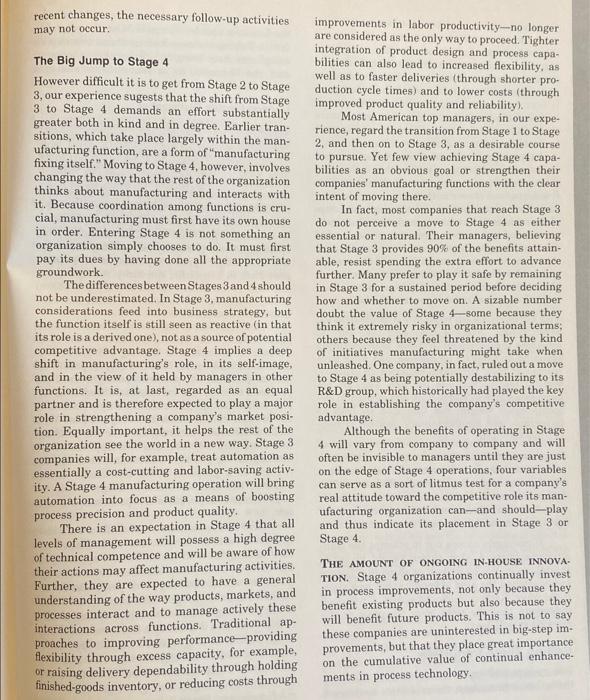

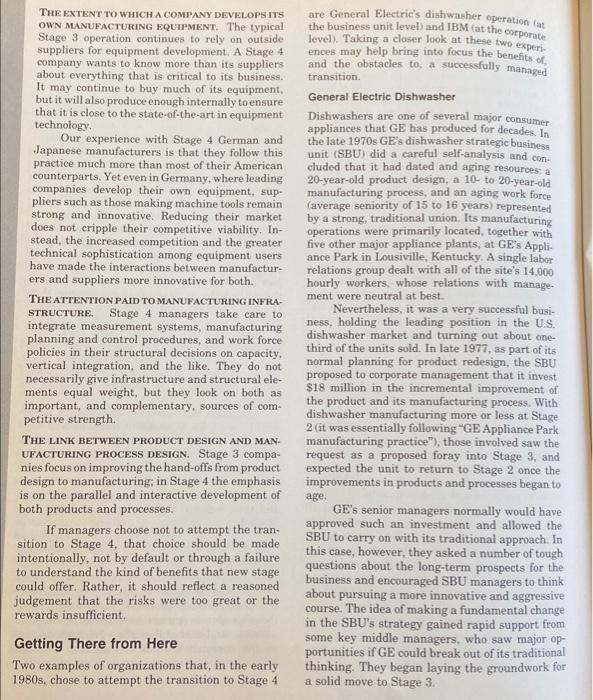

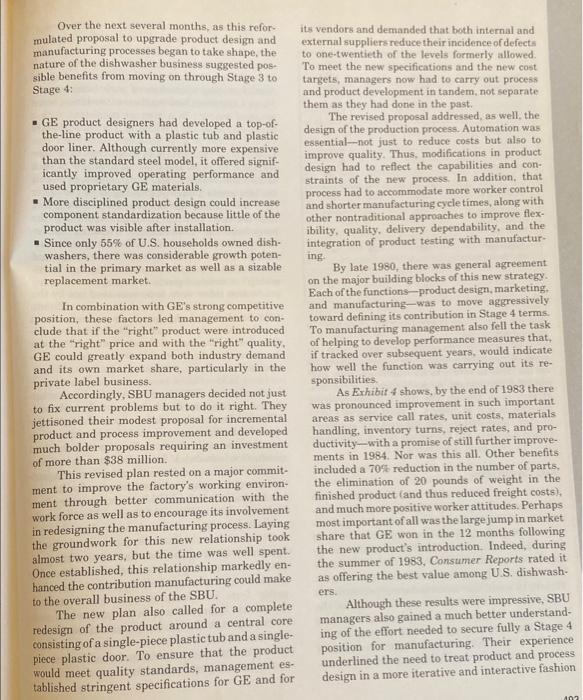

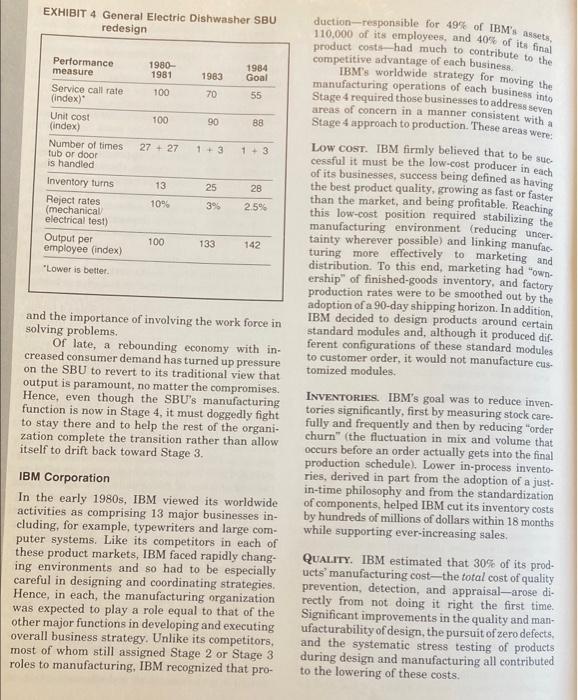

The past several years have witnessed a growing awareness among American managers of the central importance to competitive success of first-rate compe- tence in the work of production. At the top of many corporate agendas now rests the determination to boost productivity, product quality, and new product inno- vation. This is all to the good. What managers still lack, however, is a powerful descriptive framework for understanding how their manufacturing organizations are contributing to overall strategic goals, as well as the other kinds of contribution those organizations could be asked to make. This article provides such a framework. Drawing on their extensive field research, the authors outline a developmental continuum of four stages that, taken together, identify the different roles that manufacturing can play in a company's efforts to formulate and achieve its strategic objectives. Even more important, they make clear the key choices and managerial challenges at each of these stages. Manufacturing companies, particularly those in the United States, are today facing intensified competition. For many, it is a case of simple survival. What makes this challenge so difficult is that the "secret weapon" of their fiercest com- petitors is based not so much on better product design, marketing ingenuity, or financial strength as on something much harder to duplicate: su- perior overall manufacturing capability. For a long time, however, many of these companies have systematically neglected their manufactur- ing organizations. Now, as the cost of that neglect grows ever clearer, they are not finding it easy to rebuild their lost excellence in production. In most of these companies, the bulk of their labor force and assets are tied to the manufac- turing function. The attitudes, expectations, and traditions that have developed over time in and around that function will be difficult to change. Companies cannot atone for years of neglect sim- ply by throwing large chunks of investment dollars at the problem. Indeed, it normally takes several years of disciplined effort to transform manufac- turing weakness into strength. In fact, it can take several years for a company to break the habit of "working around" the limitations of a manufac- turing operation and to look on it as a source of competitive advantage. In practice, of course, the challenge for man- agers is far more complex than is suggested by the simple dichotomy between "weakness" and "strength." There is no single end that every manufacturing function must serve-and serve well. There are, instead, several generic kinds of roles that the function can play in a company and-as Exhibit 1 suggests-these roles can be viewed as stages of development along a contin- uum. At one extreme, production can offer little contribution to a company's market success; at the other, it provides a major source of competitive advantage. Understanding the possibilities along this continuum can help managers identify both their company's current position and the transforma- tions in attitude and approach that will be nec- essary if it is to advance to a higher stage of competitive effectiveness. Such understanding is also useful in judging how quickly a company may reasonably be expected to progress from stage to EXHIBIT 1 Stages in Manufacturing's Strategic Role Stage 1 Minimize manufactur Ing's negative potential: "internally neutral Outside experts are called in to make deci sions about strategic manufacturing issues Internal, detailed, man- agement control systems are the primary means for monitoring manufac turing performance. Manufacturing is kept Bexible and reactive Stage 2 Achieve parity with competitors: "exter- nally neutral" "Industry practice" is fol- lowed The planning horizon for manufacturing investment decisions is extended to incorporate a single-busi- ness cycle Capital investment is the primary means for catch- ing up with competition of achieving a competitive edge Provide credible sup port to the business strategy: "internally supportive" Manufacturing invest ments are screened for consistency with the busi ness strategy A manufacturing strategy is formulated and pur sued Longer-term manufactur ing developments and trends are addressed systematically Pursue a manufactur- ing-base competitive advantage: "externally supportive" Efforts are made to antic- ipate the potential of new manufacturing practices and technologies Manufacturing is involved "up front" in major mar keting and engineering decisions (and vice versa) Long-range programs are pusued in order to ac quire capabilities in ad- vance of needs stage. It is useful, too, in pointing out the changes that must be made in other parts of the company in order to sustain each higher level of manufac- turing's contribution. Stage 3 Stage 4 Stages of Manufacturing Effectiveness Before describing each of these generic roles (or stages) in detail and outlining the problems that can arise when trying to move from one to the next, we must say a few things about the kind of framework we are proposing. First, the stages are not mutually exclusive. Every manufacturing op- eration embodies a set of important choices about such factors as capacity, vertical integration, hu- man resource policies, and the like. (See Exhibit 2 for a listing of these.) A given operation may be and often is-composed of factors that are themselves at different levels of development. What determines the overall level of the operation is where the balance among these factors falls- that is, where in the developmental scheme the operation's center of gravity rests. Second, it is difficult, if not impossible, for a company to skip a stage. A new business can, of course, attempt to begin operations at any level it chooses, but a manufacturing function that is already up and running has far less freedom of choice. Attitudes and established modes of doing things are well entrenched, and it takes a tre- mendous effort just to move things along from one level to the next. Hence, the organizational strain imposed by an effort to leapfrog a stage makes the probability of failure uncomfortably high. In addition, it is the mastery of activities at one stage that usually provides the underpinnings for a successful transition to the next. It is possible, however, for a given operation to contain factors of the sort already mentioned that are well separated on the developmental continuum. But here, too, the forces of organiza- tional gravity are remorselessly at work. Over time, the less advanced part of the operation will tend to draw the more advanced part back to its own level. The production group responsible for Apple's Macintosh computer has, for example, tried to push its capability in materials handling and test processes well ahead of the rest of its capabilities. The resulting strain has made it hard for the group to maintain a stable organization. By contrast, Hewlett-Packard's personal com- puter manufacturing group has tried to push ahead at a slower and steadier pace-but along a very broad front. EXHIBIT 2 Major Types of Manufacturing Choices Capacity Amount, timing, type Facilities Size, location, specialization Equipment and process technologies Scale, flexibility. interconnectedness Vertical Integration Direction, extent, balance Vendors Number, structure. relationship New products Hand-off, start-up. modification. Human resources Selection and training. compensation, security Quality Definition, role, responsibility Systems Organization, schedules, control. Third, although it is appealing in theory for companies to move as a single entity through these stages, the real work of development occurs at the business unit level. Certainly, it is nice to have backing from a central corporate office so that several business units can evolve together and help each other, but it is at the business unit, not corporate, level that the critical nuts-and- bolts coordination among factors and across func- tions takes place. With these three points in mind, we now i turn to a consideration of the stages themselves. We will give special attention to the shift from Stage 3 to Stage 4 because this transition is the most difficult of all and because reaching Stage 4 has the largest payoff in terms of competitive success. In fact, Stage 4 operations characterize all companies that have achieved the status of world class manufacturers. Stage 1 This lowest stage represents an "internally neu- tral" orientation toward manufacturing: top man- agers regard the function as neutral-incapable of influencing competitive success. Consequently, they seek only to minimize any negative impact it may have. They do not expect manufacturing (indeed, they tend to discourage it from trying) to make a positive contribution. Stage 1 organizations typically view manu- facturing capability as the direct result of a few structural decisions about capacity, facilities, technology, and vertical integration. Managers attach little or no strategic importance to such infrastructure issues as work force policies, plan- ning and measurement systems, and incremental process improvements. When strategic issues in volving manufacturing do arise, management usu- ally calls in outside experts in the belief that their own production organization lacks the necessary expertise (a self-fulfilling prophecy). When faced with the need to make a change in facilities, location, or process technology, their production managers run into top-level insistence to remain flexible and reactive so as not get locked into the wrong decisions. Similarly, they are ex- pected to source all manufacturing equipment from outside suppliers and rely on these suppliers for most of their information about manufacturing technology and new technological developments. On balance, Stage 1 organizations think of production as a low-tech operation that can be staffed with low-skilled workers and managers. They employ detailed measurements and controls of operating performance, oriented to near-term performance, to ensure that manufacturing does not get too far off-track before corrective action can be taken. The aim is not to maximize the function's competitive value but to guard against competitively damaging problems. Not surprisingly, the top managers of such companies try to minimize their involvement with, and thus their perceived dependence on, manu- facturing. They concern themselves primarily with major investment decisions, as viewed through the prism of their capital budgeting process. As a result, they tend to regard their company's pro- duction facilities and processes as the embodiment of a series of once-and-for-all decisions. They are uneasy with the notion that manufacturing is a learning process that can create and expand its own capabilities and may therefore not be totally controllable. Hence, they will agree to add capacity only when the need becomes obvious, and, when they do, prefer to build large general-purpose facilities employing known-that is, "safe"-tech- nologies purchased from outside vendors. Eager to keep the manufacturing function as simple as possible, they feel justified in thinking that "any- body ought to be able to manage manufacturing." an attitude reflected in their assignment of people to that department. This Stage 1 view occurs both in companies whose managers see the manufacturing process as simple and straightforward and in those whose managers do not think it likely to have much impact on overall competitive position. Many con- sumer products and service companies fall into this category. So, too, do a number of sophisticated high-technology companies, which regard product technology as the key to competitive success and process technology as, at best, neutral. Experience shows, however, that the com- petitive difficulties encountered by many U.S. consumer electronics and electrical equipment manufacturers have their roots in the attitude that manufacturing's role is simply to assemble and test products built from purchased compo- nents. Even in these high-tech companies, the manufacturing operation can appear clumsy and unprepared when confronted with such straight- forward tasks as providing adequate production capacity, helping suppliers solve problems, and keeping equipment and systems up-to-date. With a self-limiting view of what manufacturing can do, managers find it difficult to upgrade their labor-intensive, low-technology processes when products involving a new generation of technology appear. Nor can their unfocused, general purpose facilities compete effectively with the highly fo- cused, specialized plants of world-class competi- tors. Stage 2 The second stage in our progression also repre- sents a form of manufacturing "neutrality," but Stage 2 companies seek a competitive or "external" neutrality (parity with major competitors) on the manufacturing dimension rather than the inter- nal ("don't upset the apple cart") neutrality of Stage 1. Typified by-but not restricted to-com- panies in traditional, manufacturing-intensive in- dustries like steel, autos, and heavy equipment, Stage 2 organizations seek competitive neutrality by: Following industry practice in matters regard- ing the work force (industrywide bargaining agreements with national unions, for example), equipment purchases, and the timing and scale of capacity additions Avoiding, where possible, the introduction of major, discontinuous changes in product or proc- ess. In fact, such changes tend to come-if at all-from competitors well outside the main- stream of an industry. Treating capital investments in new equipment and facilities as the most effective means for gaining a temporary competitive advantage. Viewing economies of scale related to the pro- duction rate as the most important source of manufacturing efficiency. As noted, this approach to manufacturing is quite common in America's smokestack indus- tries, most of which have an oligopolistic market structure and a well-defined set of competitors who share a vested interest in maintaining the status quo. It is also common in many companies engaged in electronic instrument assembly and pharmaceutical production, which consider man- ufacturing to be largely standardized and unso- phisticated and which assume product development people can be entrusted with designing process changes whenever they are needed. Like those in Stage 1, Stage 2 companies when they make an improvement in their process technology-rely on sources outside of manufacturing, unlike compa- nies in Stage 1, however, they often turn to their own (largely product-oriented) R&D labs as well. as to outside suppliers. Top managers of Stage 2 companies regard. resource allocation decisions as the most effective means of addressing the major strategic issues in manufacturing. Offensive investments to gain competitive advantage are usually linked to new products; manufacturing investments (other than those for additional capacity to match increases in the demand for existing products) are primarily defensive and cost-cutting in nature. They are. usually undertaken only when manufacturing's shortcomings have become obvious. Stage 3 Stage 3 organizations expect manufacturing ac- tively to support and strengthen the company's competitive position. As noted in Exhibit 1, these organizations view manufacturing as "internally 487 supportive" in that its contribution derives from and is dictated by overall business strategy. That contribution includes: Screening decisions to be sure that they are consistent with the organization's competitive strategy. Translating that strategy into terms meaning- ful to manufacturing personnel. Seeking consistency within manufacturing through a carefully thought-out sequence of investments and systems changes over time. Being on the lookout for longer term develop- ments and trends that may have a significant effect on manufacturing's ability to respond to the needs of other parts of the organization. Formulating a manufacturing strategy, com- plete with plant charters and mission state- ments, to guide manufacturing activities over an extended period of time. Companies often arrive at Stage 3 as a natural consequence of both their success in de- veloping an effective business strategy, based on formal planning processes, and their wish to support that strategy in all functional areas. They want manufacturing to be creative and to take a long-term view in managing itself. When push comes to shove, however, the majority of them act as if such creativity is best expressed by making one or two bold moves-the introduction of robots, just-in-time, or CAD/CAM, for example-while they continue to run most of the function as a Stage 2 activity. The beer industry is a good case in point: after building a number of new, large- scale facilities in the 1970s and rationalizing their existing operations, they began to drift back into a "business as usual" attitude toward the manu- facturing function. While Stage 2 companies at times also pur- sue advances in manufacturing practice, they tend to regard these in strictly defensive terms: as a means of keeping up with their industry. Stage 3 companies, however, view technological progress as a natural response to changes in business strategy and competitive position.. Another characteristic of Stage 3 organiza- tions is that their manufacturing managers take a broad view of their role by seeking to understand their company's business strategy and the kind of competitive advantage it is pursuing. Some of these managers even follow career paths that lead to general management. Notwithstanding the po- tential for advancement or the greater equality of titles and pay across all functions in Stage 3 companies, manufacturing managers are expected only to support the company's business strategy, not to become actively involved in helping to formulate it. Stage 4 The fourth and most progressive stage of manu- facturing development arises when competitive strategy rests to a significant degree on a com- pany's manufacturing capability. By this we do not mean that manufacturing dictates strategy to the rest of the company but only that strategy derives from a coordinated effort among functional peers manufacturing very much among them. As noted in Exhibit 1, the role of manufac turing in Stage 4 companies is "externally sup- portive," in that it is expected to make an important contribution to the competitive success of the organization. The leading companies in process- intensive industries, for example, usually give manufacturing a Stage 4 role, for here the evo- lution of product and process technologies is so intertwined that a company virtually must be in Stage 4 to gain a sustainable product advantage. What then is special about Stage 4 compa- nies? They anticipate the potential of new manufac- turing practices and technologies and seek to acquire expertise in them long before their implications are fully apparent. They give sufficient credibility and influence to manufacturing for it to extract the full potential from production-based opportunities. They place equal emphasis on structural (build- ings and equipment) and infrastructural (man- agement policies) activities as potential sources of continual improvement and competitive ad- vantage. They develop long-range business plans in which manufacturing capabilities are expected to play a meaningful role in securing the company's strategic objectives. By treating the manufac turing function as a strategic resource that is, as a source of strength by itself as well as a means for enhancing the interactive develop- ment of business, manufacturing, and other functional strategies. Stage 4 organizations are generally of two types. The first includes those companies like Emerson Electric, Texas Instruments, Mars (candy), and Blue Bell, whose business strategies place primary emphasis on a manufacturing-based competitive advantage such as low cost. In fact, these companies sometimes regard their manu- facturing functions as so important a source of competitive advantage that they relegate other functions to a secondary or derivative role-an action which can be just as dysfunctional as relegating manufacturing to a reactive role. The other type of Stage 4 company seeks a balance of excellence in all its functions and pursues "exter- nally supportive" Stage 4 roles for each of its integrated functions. We describe in detail two such organizations in a later section of this article. In both types of organization, manufacturing complements its traditional involvement in the capital budgeting process with a considerable amount of qualitative analysis to compensate for the blind spots and biases inherent in financial data. In addition, there are extensive formal and informal horizontal interactions between manu- facturing and other functions that greatly facili- tate such activities as product design, field service, and sales training. Manufacturing's direct partic- ipation in formulating overall business strategy further enhances this functional interaction. Fi- nally, equally with the other functions, manufac- turing is a valued source of general management talent for the entire organization. Managing the Transition Because the four stages just outlined fall along a continuum, they suggest the path that a company might follow as it seeks to enhance the contri- bution of its manufacturing function. They sug- gest, too, the speed with which a company might follow that path. The inertia of most large orga- nizations-their entrenched attitudes and prac- tices-favors a gradual, systematic, and cumu- lative movement from one developmental stage to the next, not an effort to skip a stage by throwing more resources at problems. Getting from here to there is not simply a question of applying endless resources. Indeed, managing the transition be- tween stages represents a significant and often dramatic challenge for most organizations. At the least, successfully negotiating such a transition requires leadership from within the manufacturing function. Managing change in an established operation is always difficult, but here that difficulty is compounded by the need to bring all manufacturing personnel to a new view of things long familiar. Consider, for example, the kinds of production choices mentioned in Ex- hibit 2. As a company or business unit moves along i the continuum, dealing with vendors or making facilities choices requires many changes: cost-min- imization goals give way to a concern for enlisting vendors' critical capabilities, and planning for general-purpose facilities gives way to an appre- ciation of focused factories. Said another way, managing these transitions requires a special kind of leadership because the task at hand is to change how people think, not merely how they can be instructed to act. Nowhere is this deep shift in viewpoint more important than in attitudes toward a company's human resources. As Exhibit 3 (courtesy of our colleague, Earl Sasser) suggests, Stages 1, 2, and 3 adhere fairly closely to the traditional "command and control" style of human resource manage- ment. Now, to be sure, moving from Stage 1 to Stage 2 and then on to Stage 3 requires an ever more polished execution of that style, with en- hanced management development efforts and more thoughtful analysis of underlying commands. But there is no radical shift within these stages in the way managers think of the work force's contri- bution to overall competitive performance. In Stage 4, however, the dominant approach to the work force must be in terms of teamwork and problem solving, not command-and-control. In the earlier stages the key leadership task is the management of controlled effort, but getting to Stage 4-and prospering there-demands instead the management of creative experimentation and organizational learning. EXHIBIT 3 Alternate Views of Work Force Management Stages 1, 2, and 3 traditional, static Stage 4 broad potential, dynamic Command and control Learning Management of effort Management of attention Coordinating information Problem-solving information Direct (supervisory) control Indirect (systems and values) control Process stabilty/ worker independence Process evolution worker dependence Why Move At All? Most young companies assign either Stage 1 or Stage 2 roles to manufacturing, to some extent because these roles require little attention and specific knowledge on the part of senior managers. In the United States, companies tend to start out with a unique product or with the identification of an unexploited niche in a market. As a result, they place primary emphasis on marketing, prod- uct design, or other nonmanufacturing functions. Top management does not see the need to become smart about or give close attention to the work of production. Companies are likely to remain at their initial stage until external pressures force a move. As long as no direct competitor successfully de- velops Stage 3 or Stage 4 manufacturing capabil- ities, they will find Stages 1 and 2 comfortable, secure, and apparently effective. The post-World War II experience of many U.S. industries con- vinced a generation of managers that a policy of stability can remain satisfactory for decades, a view reinforced by the stable economic growth associated with the 1960s. What they first saw as common practice they came to see as good practice. In general the transition from Stage 1 to Stage 2 comes when problems arise in the man- ufacturing function that can be solved by the "safe" application of an already proven practice. It can also occur if managers decide that the leading companies in their industry owe at least part of their success to their manufacturing proe- ess. The transition to Stage 3, however, usually begins when managers come to doubt the effec tiveness of their traditional approaches or to wonder about the implications of new manufac turing technologies. A direct threat from a major competitor that has moved to a higher stage or a recognition of the competitive advantages of mov ing to Stage 3 (or the potential perils of not doing so) may also trigger action. During the early 1980s all these factors came together to encourage literally hundreds of com- panies to shift toward Stage 3. In many industries, long dominated by a few large companies following stable competitive ground rules, the sudden ap- pearance of foreign competition and globalized markets jolted laggards into action. With no end to such competitive pressures in sight, many more companies are likely to attempt transitions to Stage 3 over the next several years. Unfortunately many, if not most, of these i companies are unlikely to achieve a full, lasting move to Stage 3 before they revert to Stage 2. The reasons for such a retreat are subtle, yet powerful. Moving from Stage 2 to Stage 3 often occurs in a crisis atmosphere when-as with U.S. producers of steel, autos, and machine tools- managers and workers alike see their real objec- tive as regaining competitive parity with their attackers. The changes that are required to adapt fully to Stage 3 require such sustained effort and broad-based support, however, that these com- panies may not be able to cement them in place before improved business conditions relieve some of the competitive pressure. The natural tendency. of course, is to return to a "business as usual" Stage 2 mentality as soon as the crisis appears to have passed. The great irony here is that too quick success often spells doom for permanent change. If, as often happens, the managers responsible for build- ing manufacturing to Stage 3 levels are quickly promoted into other responsibilities and other. lesser managers are left to be the caretakers of recent changes, the necessary follow-up activities may not occur. The Big Jump to Stage 4 However difficult it is to get from Stage 2 to Stage 3, our experience sugests that the shift from Stage 3 to Stage 4 demands an effort substantially greater both in kind and in degree. Earlier tran- sitions, which take place largely within the man- ufacturing function, are a form of "manufacturing fixing itself." Moving to Stage 4, however, involves changing the way that the rest of the organization thinks about manufacturing and interacts with it. Because coordination among functions is cru- cial, manufacturing must first have its own house in order. Entering Stage 4 is not something an organization simply chooses to do. It must first pay its dues by having done all the appropriate groundwork. The differences between Stages 3 and 4 should not be underestimated. In Stage 3, manufacturing considerations feed into business strategy, but the function itself is still seen as reactive (in that its role is a derived one), not as a source of potential competitive advantage. Stage 4 implies a deep shift in manufacturing's role, in its self-image, and in the view of it held by managers in other functions. It is, at last, regarded as an equal partner and is therefore expected to play a major role in strengthening a company's market posi- tion. Equally important, it helps the rest of the organization see the world in a new way. Stage 3. companies will, for example, treat automation as essentially a cost-cutting and labor-saving activ. ity. A Stage 4 manufacturing operation will bring automation into focus as a means of boosting process precision and product quality. There is an expectation in Stage 4 that all levels of management will possess a high degree of technical competence and will be aware of how their actions may affect manufacturing activities. Further, they are expected to have a general understanding of the way products, markets, and processes interact and to manage actively these interactions across functions. Traditional ap proaches to improving performance-providing flexibility through excess capacity, for example, or raising delivery dependability through holding finished-goods inventory, or reducing costs through improvements in labor productivity-no longer are considered as the only way to proceed. Tighter integration of product design and process capa- bilities can also lead to increased flexibility, as well as to faster deliveries (through shorter pro- duction cycle times) and to lower costs (through improved product quality and reliability). Most American top managers, in our expe- rience, regard the transition from Stage 1 to Stage 2, and then on to Stage 3, as a desirable course to pursue. Yet few view achieving Stage 4 capa- bilities as an obvious goal or strengthen their companies' manufacturing functions with the clear intent of moving there. In fact, most companies that reach Stage 3 do not perceive a move to Stage 4 as either essential or natural. Their managers, believing that Stage 3 provides 90% of the benefits attain- able, resist spending the extra effort to advance further. Many prefer to play it safe by remaining in Stage 3 for a sustained period before deciding how and whether to move on. A sizable number doubt the value of Stage 4-some because they think it extremely risky in organizational terms; others because they feel threatened by the kind of initiatives manufacturing might take when unleashed. One company, in fact, ruled out a move: to Stage 4 as being potentially destabilizing to its R&D group, which historically had played the key role in establishing the company's competitive advantage. Although the benefits of operating in Stage 4 will vary from company to company and will often be invisible to managers until they are just on the edge of Stage 4 operations, four variables can serve as a sort of litmus test for a company's real attitude toward the competitive role its man- ufacturing organization can-and should-play and thus indicate its placement in Stage 3 or Stage 4. THE AMOUNT OF ONGOING IN-HOUSE INNOVA- TION. Stage 4 organizations continually invest. in process improvements, not only because they benefit existing products but also because they will benefit future products. This is not to say. these companies are uninterested in big-step im- provements, but that they place great importance on the cumulative value of continual enhance- ments in process technology. THE EXTENT TO WHICH A COMPANY DEVELOPS ITS OWN MANUFACTURING EQUIPMENT. The typical Stage 3 operation continues to rely on outside. suppliers for equipment development. A Stage 4 company wants to know more than its suppliers about everything that is critical to its business. It may continue to buy much of its equipment, but it will also produce enough internally to ensure that it is close to the state-of-the-art in equipment technology. Our experience with Stage 4 German and Japanese manufacturers is that they follow this practice much more than most of their American counterparts. Yet even in Germany, where leading companies develop their own equipment, sup- pliers such as those making machine tools remain strong and innovative. Reducing their market does not cripple their competitive viability. In- stead, the increased competition and the greater technical sophistication among equipment users have made the interactions between manufactur- ers and suppliers more innovative for both. THE ATTENTION PAID TO MANUFACTURING INFRA- STRUCTURE. Stage 4 managers take care to integrate measurement systems, manufacturing planning and control procedures, and work force policies in their structural decisions on capacity, vertical integration, and the like. They do not necessarily give infrastructure and structural ele- ments equal weight, but they look on both as important, and complementary, sources of com- petitive strength. THE LINK BETWEEN PRODUCT DESIGN AND MAN- UFACTURING PROCESS DESIGN. Stage 3 compa- nies focus on improving the hand-offs from product design to manufacturing; in Stage 4 the emphasis is on the parallel and interactive development of both products and processes. If managers choose not to attempt the tran- sition to Stage 4, that choice should be made intentionally, not by default or through a failure to understand the kind of benefits that new stage could offer. Rather, it should reflect a reasoned judgement that the risks were too great or the rewards insufficient. Getting ere from Here Two examples of organizations that, in the early 1980s, chose to attempt the transition to Stage 4 are General Electric's dishwasher operation (at the business unit level) and IBM (at the corporate level). Taking a closer look at these two experi ences may help bring into focus the benefits of and the obstacles to, a successfully managed transition. General Electric Dishwasher Dishwashers are one of several major consumer appliances that GE has produced for decades. In the late 1970s GE's dishwasher strategic business unit (SBU) did a careful self-analysis and con- cluded that it had dated and aging resources: a 20-year-old product design, a 10- to 20-year-old manufacturing process, and an aging work force (average seniority of 15 to 16 years) represented by a strong, traditional union. Its manufacturing operations were primarily located, together with five other major appliance plants, at GE's Appli- ance Park in Lousiville, Kentucky. A single labor relations group dealt with all of the site's 14,000 hourly workers, whose relations with manage- ment were neutral at best. Nevertheless, it was a very successful busi- ness, holding the leading position in the US. dishwasher market and turning out about one- third of the units sold. In late 1977, as part of its normal planning for product redesign, the SBU proposed to corporate management that it invest $18 million in the incremental improvement of the product and its manufacturing process. With dishwasher manufacturing more or less at Stage 2 (it was essentially following "GE Appliance Park manufacturing practice"), those involved saw the request as a proposed foray into Stage 3, and expected the unit to return to Stage 2 once the improvements in products and processes began to age. GE's senior managers normally would have approved such an investment and allowed the SBU to carry on with its traditional approach. In this case, however, they asked a number of tough questions about the long-term prospects for the business and encouraged SBU managers to think about pursuing a more innovative and aggressive course. The idea of making a fundamental change in the SBU's strategy gained rapid support from some key middle managers, who saw major op- portunities if GE could break out of its traditional thinking. They began laying the groundwork for a solid move to Stage 3. Over the next several months, as this refor- mulated proposal to upgrade product design and manufacturing processes began to take shape, the nature of the dishwasher business suggested pos- sible benefits from moving on through Stage 3 to Stage 4: GE product designers had developed a top-of- the-line product with a plastic tub and plastic door liner. Although currently more expensive than the standard steel model, it offered signif- icantly improved operating performance and used proprietary GE materials. More disciplined product design could increase component standardization because little of the product was visible after installation. Since only 55% of U.S. households owned dish- washers, there was considerable growth poten- tial in the primary market as well as a sizable replacement market. In combination with GE's strong competitive position, these factors led management to con- clude that if the "right" product were introduced at the "right" price and with the "right" quality, GE could greatly expand both industry demandi and its own market share, particularly in the private label business. Accordingly, SBU managers decided not just to fix current problems but to do it right. They jettisoned their modest proposal for incremental product and process improvement and developed much bolder proposals requiring an investment of more than $38 million. This revised plan rested on a major commit- ment to improve the factory's working environ- ment through better communication with the work force as well as to encourage its involvement in redesigning the manufacturing process. Laying the groundwork for this new relationship took almost two years, but the time was well spent. Once established, this relationship markedly en- hanced the contribution manufacturing could make to the overall business of the SBU. The new plan also called for a complete redesign of the product around a central core. consisting of a single-piece plastic tub and a single- piece plastic door. To ensure that the product. would meet quality standards, management es- tablished stringent specifications for GE and for its vendors and demanded that both internal and external suppliers reduce their incidence of defects to one-twentieth of the levels formerly allowed. To meet the new specifications and the new cost targets, managers now had to carry out process and product development in tandem, not separate. them as they had done in the past. The revised proposal addressed, as well, the design of the production process. Automation was essential-not just to reduce costs but also to improve quality. Thus, modifications in product design had to reflect the capabilities and con- straints of the new process. In addition, that process had to accommodate more worker control and shorter manufacturing cycle times, along with other nontraditional approaches to improve flex- ibility, quality, delivery dependability, and the integration of product testing with manufactur- ing. By late 1980, there was general agreement on the major building blocks of this new strategy. Each of the functions-product design, marketing. and manufacturing-was to move aggressively toward defining its contribution in Stage 4 terms. To manufacturing management also fell the task of helping to develop performance measures that, if tracked over subsequent years, would indicate how well the function was carrying out its re- sponsibilities. As Exhibit 4 shows, by the end of 1983 there was pronounced improvement in such important areas as service call rates, unit costs, materials handling, inventory turns, reject rates, and pro- ductivity with a promise of still further improve- ments in 1984. Nor was this all. Other benefits included a 70% reduction in the number of parts, the elimination of 20 pounds of weight in the finished product (and thus reduced freight costs), and much more positive worker attitudes. Perhaps most important of all was the large jump in market share that GE won in the 12 months following the new product's introduction. Indeed, during the summer of 1983, Consumer Reports rated it as offering the best value among U.S. dishwash- ers. Although these results were impressive, SBU managers also gained a much better understand- ing of the effort needed to secure fully a Stage 4 position for manufacturing. Their experience underlined the need to treat product and process design in a more iterative and interactive fashion 402 EXHIBIT 4 General Electric Dishwasher SBU redesign Performance measure 1980- 1984 Goal 1981 1983 100 70 Service call rate (index)" 55 100 88 Unit cost (index) 27 + 27 Number of times tub or door 1+ 3 is handled Inventory turns 13 28 10% 2.5% Reject rates (mechanical electrical test) 100 Output per employee (index) 133 142 "Lower is better. and the importance of involving the work force in solving problems. Of late, a rebounding economy with in- creased consumer demand has turned up pressure on the SBU to revert to its traditional view that output is paramount, no matter the compromises. Hence, even though the SBU's manufacturing function is now in Stage 4, it must doggedly fight to stay there and to help the rest of the organi- zation complete the transition rather than allow itself to drift back toward Stage 3. IBM Corporation In the early 1980s, IBM viewed its worldwide activities as comprising 13 major businesses in- cluding, for example, typewriters and large com- puter systems. Like its competitors in each of these product markets, IBM faced rapidly chang- ing environments and so had to be especially careful in designing and coordinating strategies. Hence, in each, the manufacturing organization was expected to play a role equal to that of the other major functions in developing and executing overall business strategy. Unlike its competitors, most of whom still assigned Stage 2 or Stage 3 roles to manufacturing, IBM recognized that pro- 90 1+3 25 3% duction-responsible for 49% of IBM's assets, 110,000 of its employees, and 40% of its final product costs-had much to contribute to the competitive advantage of each business. IBM's worldwide strategy for moving the manufacturing operations of each business into Stage 4 required those businesses to address seven areas of concern in a manner consistent with a Stage 4 approach to production. These areas were Low COST. IBM firmly believed that to be suc cessful it must be the low-cost producer in each of its businesses, success being defined as having the best product quality, growing as fast or faster than the market, and being profitable. Reaching this low-cost position required stabilizing the manufacturing environment (reducing uncer- tainty wherever possible) and linking manufac turing more effectively to marketing and distribution. To this end, marketing had "own- ership of finished-goods inventory, and factory production rates were to be smoothed out by the adoption of a 90-day shipping horizon. In addition, IBM decided to design products around certain standard modules and, although it produced dif- ferent configurations of these standard modules to customer order, it would not manufacture cus- tomized modules. INVENTORIES. IBM's goal was to reduce inven- tories significantly, first by measuring stock care- fully and frequently and then by reducing "order churn" (the fluctuation in mix and volume that occurs before an order actually gets into the final production schedule). Lower in-process invento- ries, derived in part from the adoption of a just- in-time philosophy and from the standardization of components, helped IBM cut its inventory costs by hundreds of millions of dollars within 18 months while supporting ever-increasing sales. QUALITY. IBM estimated that 30% of its prod- ucts' manufacturing cost-the total cost of quality prevention, detection, and appraisal-arose di- rectly from not doing it right the first time. Significant improvements in the quality and man- ufacturability of design, the pursuit of zero defects, and the systematic stress testing of products during design and manufacturing all contributed to the lowering of these costs. AUTOMATION. Automation in a Stage 4 orienta- tion is of value in that it leads to higher product quality, encourages interaction between product design and process design, and cuts overhead. This, in turn, means managing the evolution of the manufacturing process according to a long- term plan, just as with product evolution. ORGANIZATION. To provide the product design and marketing functions with a better linkage with manufacturing, IBM defined an additional level of line manufacturing management, a "pro- duction management center," which was respon- sible for all plants manufacturing a product line. For example, the three large system plants (lo- cated in France, Japan, and the United States) were all under a single production management center that served as the primary linkage with marketing for that product line, as well as with R&D's efforts to design new products. Such cen- ters were intended not only to create effective functional interfaces but also to be responsible for planning manufacturing processes, defining plant charters, measuring plant performance, and ensuring that the processes and systems employed by different facilities were uniformly excellent. MANUFACTURING SYSTEMS. The purpose here was to develop integrated systems that provided information, linked directly to strategic business variables, for both general and functional man- agers. Such systems had to be compatible with each other yet flexible enough for each business to be able to select the modules it needed. As part of this systems effort, IBM rethought its entire manufacturing measurement system with the in- tent of reducing its historical focus on direct labor and giving more emphasis to materials, overhead, energy, and indirect labor. IBM believed that its manufacturing systems, like its product lines, should be made up of standard modules based on a common architecture. Each business could then assemble its own customized configuration yet still communicate effectively with other IBM busi- nesses. AFFORDABILITY. By making external competi- tiveness, not internal rules of thumb, the basis for evaluating manufacturing performance, IBM no longer evaluated manufacturing against its own history but rather against its competitors. As part of this concern with affordability, IBM also sought to reduce its overhead, which exceeded 25% of total manufacturing costs. Out of these seven areas of concern emerged a set of three management principles fully in harmony with the move to a Stage 4 appreciation of the competitive contribution that manufactur- ing can make. The first-emphasizing activities that facilitate, encourage, and reward effective interaction between manufacturing and both mar- keting and engineering-requires people able to regard each other as equals and to make signifi- cant contributions to areas other than their own. Information, influence, and support should-and must-flow in both directions. The second principle recognizes that product and process technologies must interact. Process evolution (including automation) and product ev- olution must proceed in tandem. Indeed, IBM uses the terms "process windows" and "product win- dows" to describe these parallel paths and the opportunities they offer to exploit state-of-the-art processes in meeting customer needs and com- petitive realities. The third principle is a focus of attention and resources on only those factors-manufactur- ing, quality, and overhead reduction, for exam- ple that are essential to the long-term success of the business. Getting Things Moving in Your Company Our experience suggests that building manufac- turing excellence requires that managers do more than simply understand the nature of the current role that manufacturing plays in their organiza- tions and develop a plan for enhancing its com- petitive contribution. They must also communicate their vision to their organizations and prepare the ground for the changes that have to be made. In virtually all the Stage 4 companies we have seen, at least one senior manager has been a key catalyst for the transition. Such leaders spring from all functional backgrounds and are concerned not to elevate manufacturing at the expense of other functions but to see their com- panies "firing on all cylinders." Seeking ways to integrate all functions into an effective whole, they must be strong enough, persuasive enough, and tough enough to push beyond conventional management thinking and to force their organi- zations to grapple with the deeper challenges prevailing in the increasingly competitive world of industry. Today, there is considerable pessimism in some quarters about the long-term prospects for U.S. manufacturing. We are neither pessimistic nor optimistic; the answer "lies not in our stars but in ourselves." We have seen many organiza- tions focus their efforts on achieving Stage 4 and make incredible improvements in short periods of time. Unfortunately, we have also seen many of them subsequently lose that commitment. After making tremendous strides, they begin to get comfortable and fall behind again. Manufacturing can contribute significantly to the competitive success of any business. But it takes managers with determination, vision, and the ability to sustain focused effort over a long period of time and often in the face of stiff organizational resistance. The industrial race is no longer decided (if it ever was) by a fast and furious last-minute cavalry charge. It is a long, patient, persistent process of working together to clear the land, cultivate the fields, and continually extend the frontiers of an organization's capabil- ities

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock