Question: please help super lost DROP DOWN OPTIONS part a part b PLEASE HELP THANK YOU HERES DATA Cross-sectional ratio analysis Use the financial staloments for

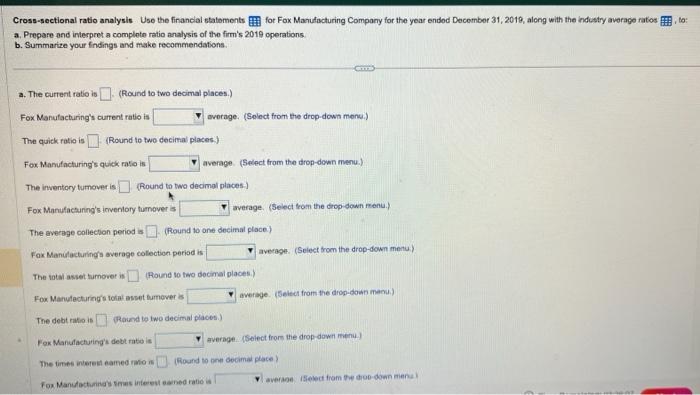

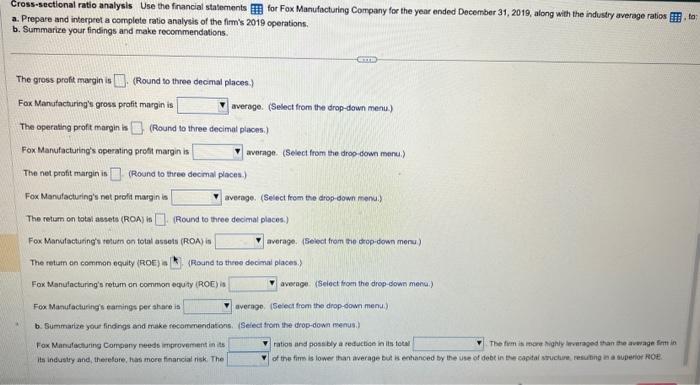

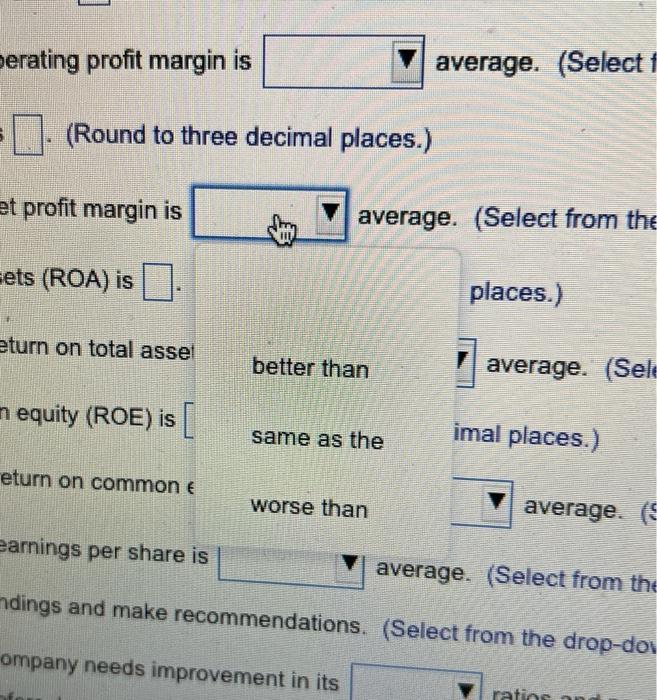

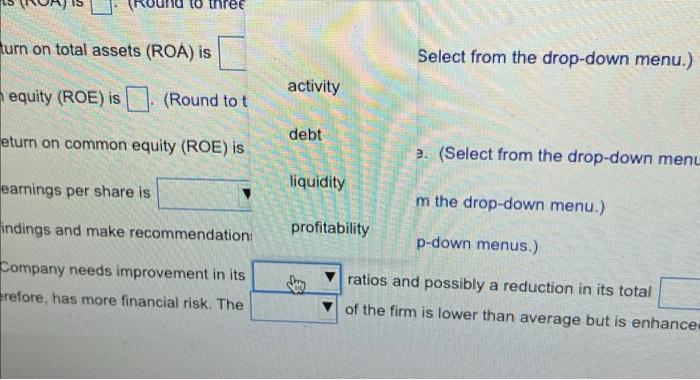

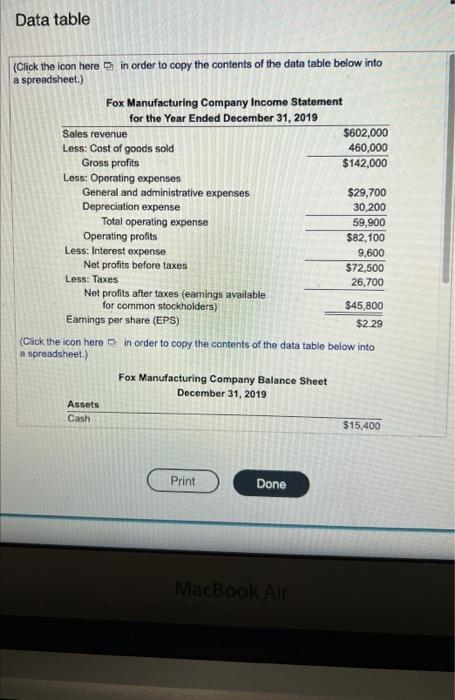

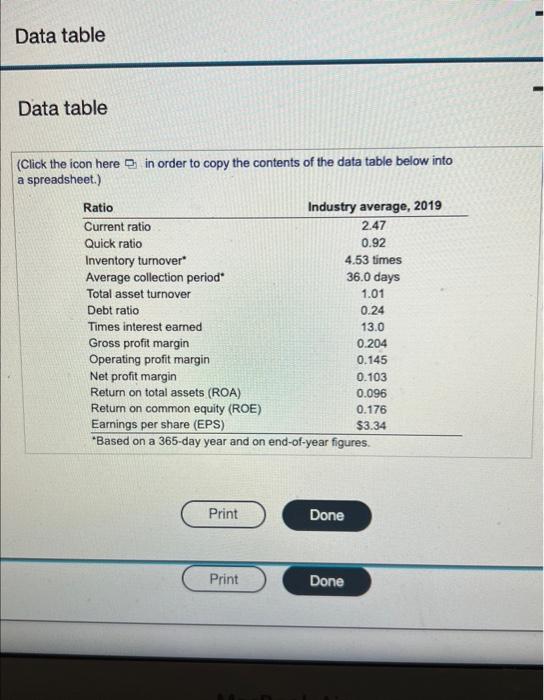

Cross-sectional ratio analysis Use the financial staloments for Fox Manufucturing Company for the year endod Decomber 31 , 2019, along with the industy average ratos to: a. Prepare and interpret a comploto ratio analysis of the firm's 2019 operations. b. Summarize your findings and make recommendations. a. The current ratio is (Round to two decimal places.) Fox Manufacturing's current ratio is avorage. (Solect from the drop-down mene.) The quick ratio is (Round to two decirnal places) Fox Manufacturing's quick ratio is average. (Select from the drop-down menu.) The inventory tumover is (Riound to two decimal places) Fox Manufaciung's invenlory tumover is average. (Select trom the dop-down menu.) The everage collection period is (Round to one decimal place.) Fax Maniflacturingis average collection period is avergot. (Select trom the drop-down menu) The total asset thmorer is (Round to two docimal places.) Fox Manulecturng's tofia asset fumever is averige. (5elect from the drop-dont macu.) The debt ratio is (Raund to two decimal placos.) Fok Manufacturing's debt rato is average: pselect from the drop-down menu.) The inese interest eamed rimo is (fiound to one oecma plate ) deveraon isewd from the thoo-down aiend i Cross-sectional ratio analysis Use the frnancial stalements for Fox Manufocturing Company for the year ended December 31,2019 , along with the industry average ratios a. Prepare and interpeet a complete ratio analysis of the firm's 2019 operations. b. Summarize your findings and make recommendations. The gross prefit margin is (Round to three decmal places.) Fox Manutacturing's gross profit margin is averoge. (Select from the drop-down menu) The operating profit margin is (Round to three decimal placess.) Fox Manufacturing's operating prost margin is average. (Select from the drog-down menu.) The net profit margin is (Round to three decimal places.) Fox Manufacturing's net peola marg in is aveeage. (Select from the drop-down menu.) The retum on total assets (ROA) is (Round to three decimal places.) Fox Manutacturing's retum on totat assols (ROA) is average. (Sieket frem the drop-down meny) The retum on common equity (ROE) a k; (Round to thee decimal places.) Fox Manufacturing's retum on common equty (ROC) is aveage. (Seioct froen the drop-down menu.) Fox Manufacturings eamings per ahare is averape, (Select from the drop-down mend.) b. Summarize youe findings and make recommendatons. (Select trom the drop-down renus.) Fox Manutacturing Compeny needs improvement in its ratios and poss bly a cetuctice in lts toce The frem is mare Mighiy lererased than the avwage Simt in Its industry and, theielore, hats more financial risk. The of the fims is lower than average bul is entanced by the use of debe in Ew captai stuchire reaining a a ouperior Rot: (Round to three decimal places.) average. (Select from th t profit margin is ets (ROA) is places.) turn on total asset equity (ROE) is average. (Select Select from the drop-down menu.) activity equity (ROE) is (Round to t iturn on common equity (ROE) is debt 3. (Select from the drop-down men arnings per share is liquidity m the drop-down menu.) ndings and make recommendation: profitability p-down menus.) Company needs improvement in its refore, has more financial risk. The ratios and possibly a reduction in its total of the firm is lower than average but is enhance rage but is enhanced by the use of debt in the capital stru Data table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) (Click the icon here [ in order to copy the contents of the data table below into a spreadsheet.) Data table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Cross-sectional ratio analysis Use the financial staloments for Fox Manufucturing Company for the year endod Decomber 31 , 2019, along with the industy average ratos to: a. Prepare and interpret a comploto ratio analysis of the firm's 2019 operations. b. Summarize your findings and make recommendations. a. The current ratio is (Round to two decimal places.) Fox Manufacturing's current ratio is avorage. (Solect from the drop-down mene.) The quick ratio is (Round to two decirnal places) Fox Manufacturing's quick ratio is average. (Select from the drop-down menu.) The inventory tumover is (Riound to two decimal places) Fox Manufaciung's invenlory tumover is average. (Select trom the dop-down menu.) The everage collection period is (Round to one decimal place.) Fax Maniflacturingis average collection period is avergot. (Select trom the drop-down menu) The total asset thmorer is (Round to two docimal places.) Fox Manulecturng's tofia asset fumever is averige. (5elect from the drop-dont macu.) The debt ratio is (Raund to two decimal placos.) Fok Manufacturing's debt rato is average: pselect from the drop-down menu.) The inese interest eamed rimo is (fiound to one oecma plate ) deveraon isewd from the thoo-down aiend i Cross-sectional ratio analysis Use the frnancial stalements for Fox Manufocturing Company for the year ended December 31,2019 , along with the industry average ratios a. Prepare and interpeet a complete ratio analysis of the firm's 2019 operations. b. Summarize your findings and make recommendations. The gross prefit margin is (Round to three decmal places.) Fox Manutacturing's gross profit margin is averoge. (Select from the drop-down menu) The operating profit margin is (Round to three decimal placess.) Fox Manufacturing's operating prost margin is average. (Select from the drog-down menu.) The net profit margin is (Round to three decimal places.) Fox Manufacturing's net peola marg in is aveeage. (Select from the drop-down menu.) The retum on total assets (ROA) is (Round to three decimal places.) Fox Manutacturing's retum on totat assols (ROA) is average. (Sieket frem the drop-down meny) The retum on common equity (ROE) a k; (Round to thee decimal places.) Fox Manufacturing's retum on common equty (ROC) is aveage. (Seioct froen the drop-down menu.) Fox Manufacturings eamings per ahare is averape, (Select from the drop-down mend.) b. Summarize youe findings and make recommendatons. (Select trom the drop-down renus.) Fox Manutacturing Compeny needs improvement in its ratios and poss bly a cetuctice in lts toce The frem is mare Mighiy lererased than the avwage Simt in Its industry and, theielore, hats more financial risk. The of the fims is lower than average bul is entanced by the use of debe in Ew captai stuchire reaining a a ouperior Rot: (Round to three decimal places.) average. (Select from th t profit margin is ets (ROA) is places.) turn on total asset equity (ROE) is average. (Select Select from the drop-down menu.) activity equity (ROE) is (Round to t iturn on common equity (ROE) is debt 3. (Select from the drop-down men arnings per share is liquidity m the drop-down menu.) ndings and make recommendation: profitability p-down menus.) Company needs improvement in its refore, has more financial risk. The ratios and possibly a reduction in its total of the firm is lower than average but is enhance rage but is enhanced by the use of debt in the capital stru Data table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) (Click the icon here [ in order to copy the contents of the data table below into a spreadsheet.) Data table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts