Question: please help! thank you;) How does the expectations hypothesis differ from the segmentation hypothesis as a theory of the term structure of interest rates? (7

please help! thank you;)

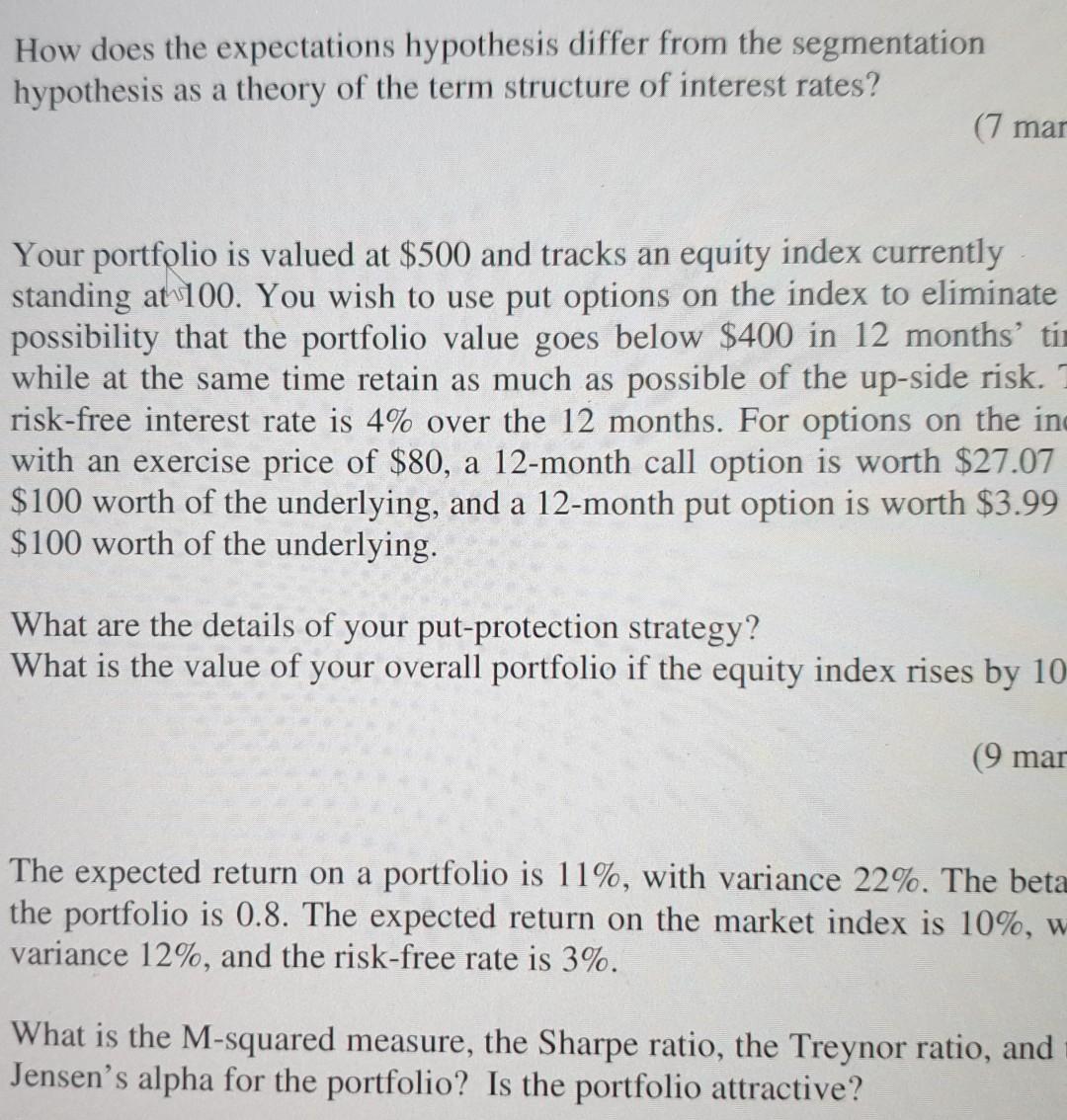

How does the expectations hypothesis differ from the segmentation hypothesis as a theory of the term structure of interest rates? (7 mar Your portfolio is valued at $500 and tracks an equity index currently standing at 100. You wish to use put options on the index to eliminate possibility that the portfolio value goes below $400 in 12 months' ti while at the same time retain as much as possible of the up-side risk. risk-free interest rate is 4% over the 12 months. For options on the in with an exercise price of $80, a 12-month call option is worth $27.07 $100 worth of the underlying, and a 12-month put option is worth $3.99 $100 worth of the underlying. What are the details of your put-protection strategy? What is the value of your overall portfolio if the equity index rises by 10 (9 mar The expected return on a portfolio is 11%, with variance 22%. The beta the portfolio is 0.8. The expected return on the market index is 10%, w variance 12%, and the risk-free rate is 3%. What is the M-squared measure, the Sharpe ratio, the Treynor ratio, and Jensen's alpha for the portfolio? Is the portfolio attractive? How does the expectations hypothesis differ from the segmentation hypothesis as a theory of the term structure of interest rates? (7 mar Your portfolio is valued at $500 and tracks an equity index currently standing at 100. You wish to use put options on the index to eliminate possibility that the portfolio value goes below $400 in 12 months' ti while at the same time retain as much as possible of the up-side risk. risk-free interest rate is 4% over the 12 months. For options on the in with an exercise price of $80, a 12-month call option is worth $27.07 $100 worth of the underlying, and a 12-month put option is worth $3.99 $100 worth of the underlying. What are the details of your put-protection strategy? What is the value of your overall portfolio if the equity index rises by 10 (9 mar The expected return on a portfolio is 11%, with variance 22%. The beta the portfolio is 0.8. The expected return on the market index is 10%, w variance 12%, and the risk-free rate is 3%. What is the M-squared measure, the Sharpe ratio, the Treynor ratio, and Jensen's alpha for the portfolio? Is the portfolio attractive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts