Question: Please help! Thank you! Mini Case 3: Development Finance - You as a developer will start to construct an apartment property costing $90 million. You

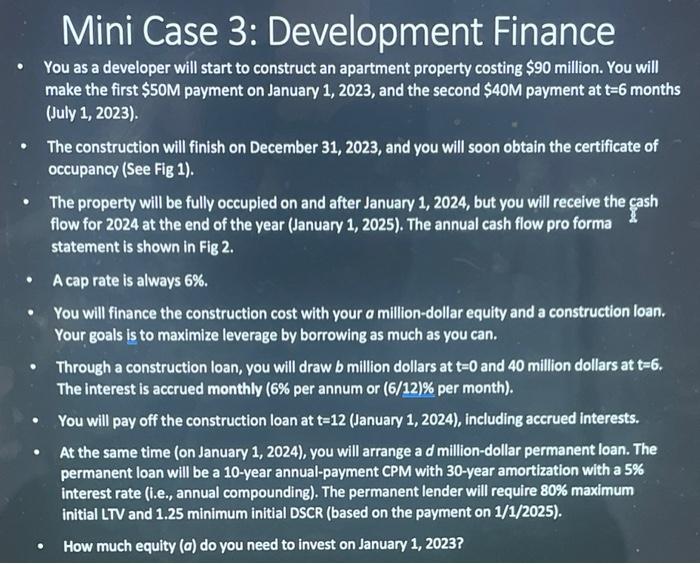

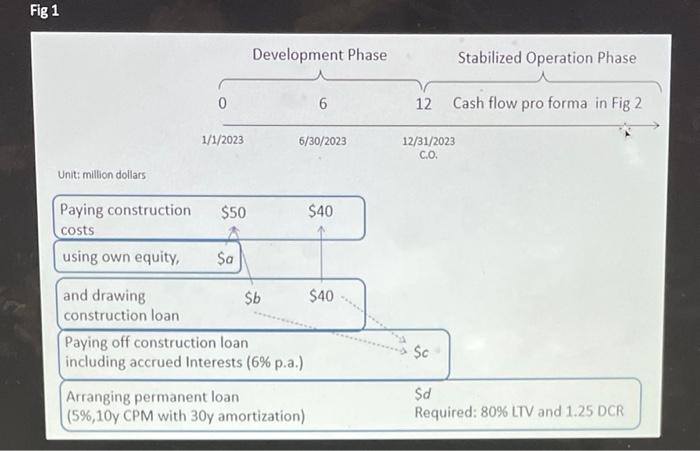

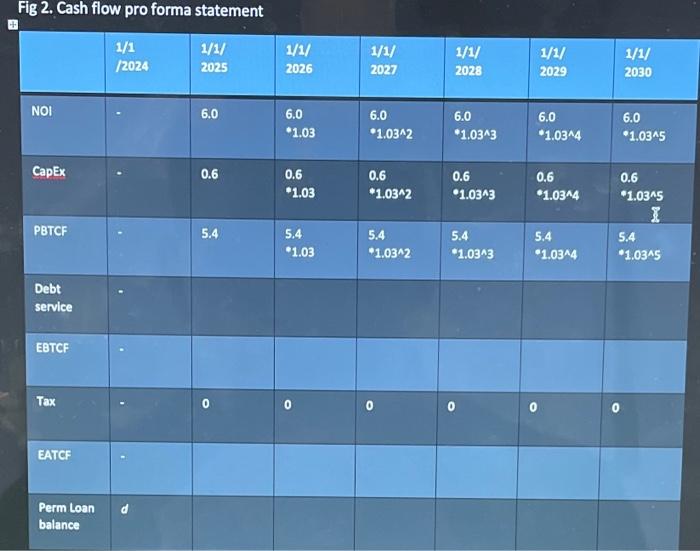

Mini Case 3: Development Finance - You as a developer will start to construct an apartment property costing $90 million. You will make the first $50M payment on January 1,2023 , and the second $40M payment at t=6 months (July 1, 2023). - The construction will finish on December 31, 2023, and you will soon obtain the certificate of occupancy (See Fig 1). - The property will be fully occupied on and after January 1, 2024, but you will receive the cash flow for 2024 at the end of the year (January 1, 2025). The annual cash flow pro forma statement is shown in Fig 2. - A cap rate is always 6%. - You will finance the construction cost with your a million-dollar equity and a construction loan. Your goals is to maximize leverage by borrowing as much as you can. - Through a construction loan, you will draw b million dollars at t=0 and 40 million dollars at t=6. The interest is accrued monthly ( 6% per annum or (6/12)% per month). - You will pay off the construction loan at t=12 (January 1,2024 ), including accrued interests. - At the same time (on January 1, 2024), you will arrange a d million-dollar permanent loan. The permanent loan will be a 10-year annual-payment CPM with 30-year amortization with a 5\% interest rate (i.e., annual compounding). The permanent lender will require 80% maximum initial LTV and 1.25 minimum initial DSCR (based on the payment on 1/1/2025). - How much equity (a) do you need to invest on January 1,2023 ? Unit: million dollars Fig 2. Cash flow pro forma statement Mini Case 3: Development Finance - You as a developer will start to construct an apartment property costing $90 million. You will make the first $50M payment on January 1,2023 , and the second $40M payment at t=6 months (July 1, 2023). - The construction will finish on December 31, 2023, and you will soon obtain the certificate of occupancy (See Fig 1). - The property will be fully occupied on and after January 1, 2024, but you will receive the cash flow for 2024 at the end of the year (January 1, 2025). The annual cash flow pro forma statement is shown in Fig 2. - A cap rate is always 6%. - You will finance the construction cost with your a million-dollar equity and a construction loan. Your goals is to maximize leverage by borrowing as much as you can. - Through a construction loan, you will draw b million dollars at t=0 and 40 million dollars at t=6. The interest is accrued monthly ( 6% per annum or (6/12)% per month). - You will pay off the construction loan at t=12 (January 1,2024 ), including accrued interests. - At the same time (on January 1, 2024), you will arrange a d million-dollar permanent loan. The permanent loan will be a 10-year annual-payment CPM with 30-year amortization with a 5\% interest rate (i.e., annual compounding). The permanent lender will require 80% maximum initial LTV and 1.25 minimum initial DSCR (based on the payment on 1/1/2025). - How much equity (a) do you need to invest on January 1,2023 ? Unit: million dollars Fig 2. Cash flow pro forma statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts