Question: - You as a developer will start to construct an apartment property costing $90 million. You will make the first $50M payment on January 1,2023

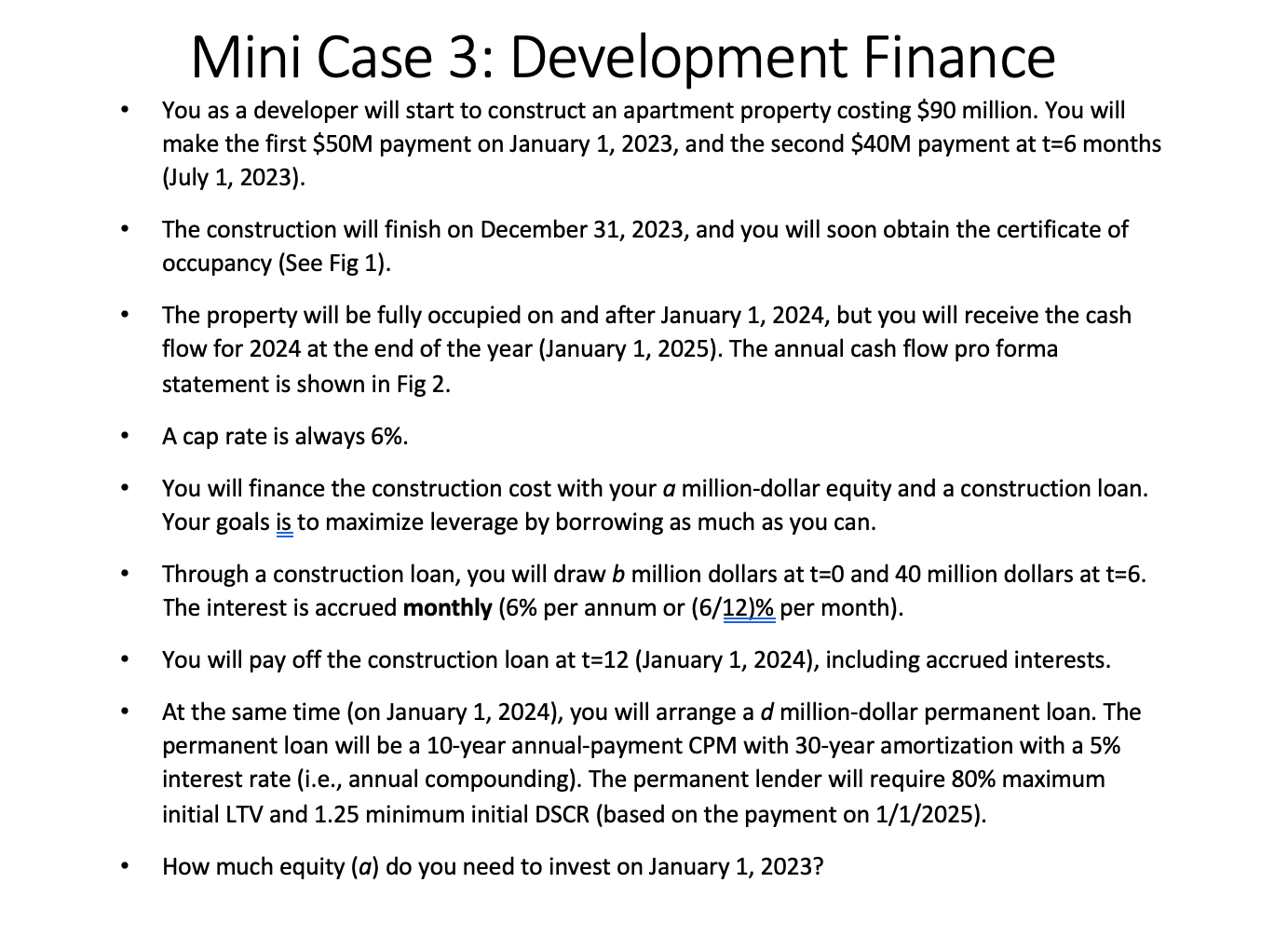

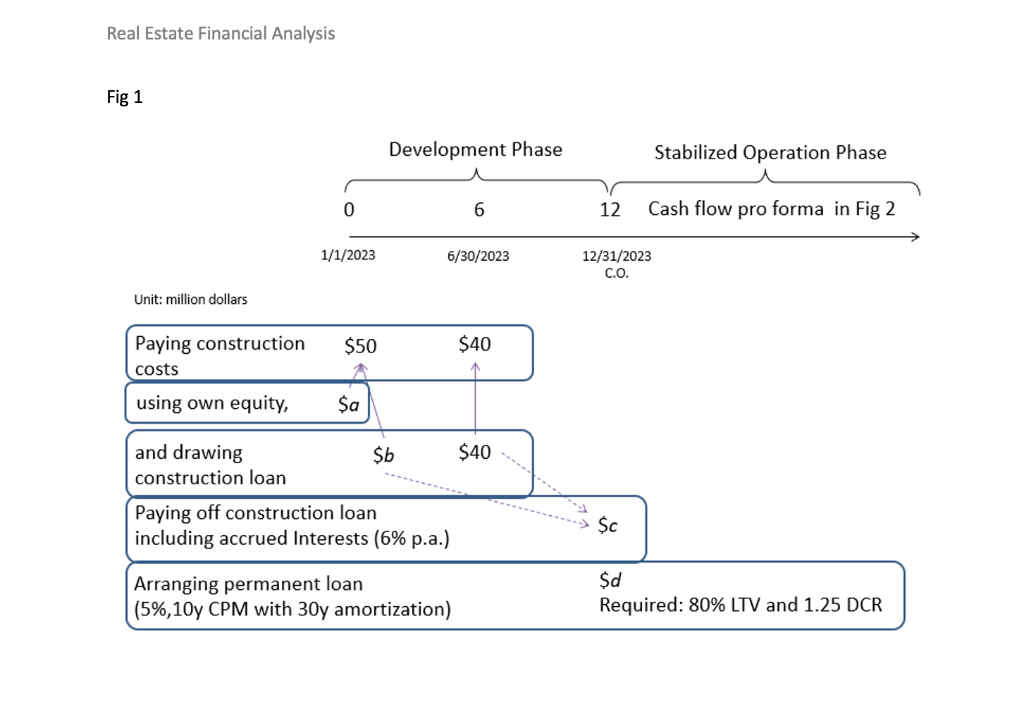

- You as a developer will start to construct an apartment property costing $90 million. You will make the first $50M payment on January 1,2023 , and the second $40M payment at t=6 months (July 1, 2023). - The construction will finish on December 31, 2023, and you will soon obtain the certificate of occupancy (See Fig 1). - The property will be fully occupied on and after January 1,2024 , but you will receive the cash flow for 2024 at the end of the year (January 1, 2025). The annual cash flow pro forma statement is shown in Fig 2. - A cap rate is always 6%. - You will finance the construction cost with your a million-dollar equity and a construction loan. Your goals is to maximize leverage by borrowing as much as you can. - Through a construction loan, you will draw b million dollars at t=0 and 40 million dollars at t=6. The interest is accrued monthly ( 6% per annum or (6/12)% per month). - You will pay off the construction loan at t=12 (January 1, 2024), including accrued interests. - At the same time (on January 1, 2024), you will arrange a d million-dollar permanent loan. The permanent loan will be a 10 -year annual-payment CPM with 30-year amortization with a 5% interest rate (i.e., annual compounding). The permanent lender will require 80% maximum initial LTV and 1.25 minimum initial DSCR (based on the payment on 1/1/2025). - How much equity (a) do you need to invest on January 1, 2023? Raal Fetato Finanrial Analucic Real Estate Financial Analysis - You as a developer will start to construct an apartment property costing $90 million. You will make the first $50M payment on January 1,2023 , and the second $40M payment at t=6 months (July 1, 2023). - The construction will finish on December 31, 2023, and you will soon obtain the certificate of occupancy (See Fig 1). - The property will be fully occupied on and after January 1,2024 , but you will receive the cash flow for 2024 at the end of the year (January 1, 2025). The annual cash flow pro forma statement is shown in Fig 2. - A cap rate is always 6%. - You will finance the construction cost with your a million-dollar equity and a construction loan. Your goals is to maximize leverage by borrowing as much as you can. - Through a construction loan, you will draw b million dollars at t=0 and 40 million dollars at t=6. The interest is accrued monthly ( 6% per annum or (6/12)% per month). - You will pay off the construction loan at t=12 (January 1, 2024), including accrued interests. - At the same time (on January 1, 2024), you will arrange a d million-dollar permanent loan. The permanent loan will be a 10 -year annual-payment CPM with 30-year amortization with a 5% interest rate (i.e., annual compounding). The permanent lender will require 80% maximum initial LTV and 1.25 minimum initial DSCR (based on the payment on 1/1/2025). - How much equity (a) do you need to invest on January 1, 2023? Raal Fetato Finanrial Analucic Real Estate Financial Analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts