Question: please help! thank you :) Save = Homework: Chapter 9 Homework Question 5, P 9-32 (book/static) HW Score: 503, 5 et 6 ports Part 106

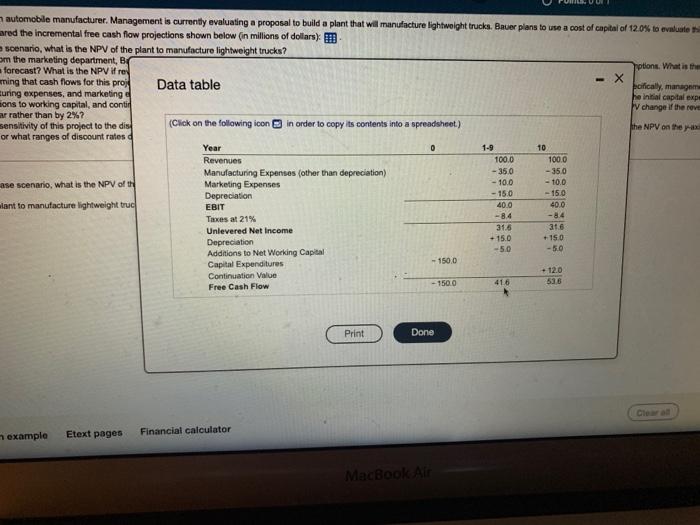

Save = Homework: Chapter 9 Homework Question 5, P 9-32 (book/static) HW Score: 503, 5 et 6 ports Part 106 O Points: 0 Bacon Industries is in womeble manufacturer Management is currently evaluating proposal to build a plant that will manufacture lightweight truck Bauer plans to use a cost of capital of 2.0 reseth, has prepared the incrementare how projections shown below in milions of dollars a. For this base-cases, what is the NPV of the plant to manufacture lightweight trucks 6. Based on input from the marketing department, Bauer in uncertain about ever forecast in particularment would like to earn the way of the NPV to ne umption What PV are 10% higher than forecast? What is the NPV 10% lower than tocht can sing an ows for this procwe contant rent would like to explore the entity of analysis to pobie routine and operating perso revenues, mandaring experts and marketing expert we given in the for year and grow by per year wrywatne 2 Margarepare to meet the new depressions to working and control systed in the water heater Hover 4. to warto the document of the to computer NPV to feel sunt whether on the same and Pepe www grow by per year by 237 Com o For wholescentes termes NPV For this he can whatever . Ver Et page * 1 0 % 7 6 u 1 7 4 3 O P 1 U Y E R T Q W lab H 10 automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 120% to evaluate ared the incremental free cash flow projections shown below (in millions of dollars): 2 scenario, what is the NPV of the plant to manufacture lightweight trucks? om the marketing department, BC forecast? What is the NPV try riptions What is the ming that cash flows for this proj Data table - X poifically, manager Euring expenses, and marketing he initial capital expe ions to working capital, and contin V change of the reve ar rather than by 2%? sensitivity of this project to the dis (Click on the following icon in order to copy its contents into a spreadsheet.) the NPV on the or what ranges of discount rates d Year 0 1-9 Revenues 100.0 100.0 Manufacturing Expenses (other than depreciation) -350 -350 case scenario, what is the NPV of the Marketing Expenses -100 - 10.0 Depreciation - 150 - 15.0 want to manufacture lightweight truc EBIT 40.0 40.0 Taxes at 21% -8.4 -8.4 Unlevered Net Income 31.5 31.6 - 150 Depreciation Additions to Net Working Capital -50 -50 Capital Expenditures - 1500 Continuation Value + 12.0 - 1500 Free Cash Flow 416 536 - 15.0 Print Done example Etext pages Financial calculator MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts