Question: please help thank you View Policies Current Attempt in Progress O $25053. O $66780 O $22260. O $33390. -/1 Save for Later E !!! On

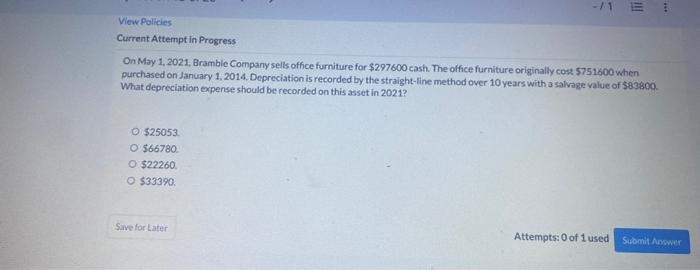

View Policies Current Attempt in Progress O $25053. O $66780 O $22260. O $33390. -/1 Save for Later E !!! On May 1, 2021, Bramble Company sells office furniture for $297600 cash. The office furniture originally cost $751600 when purchased on January 1, 2014. Depreciation is recorded by the straight-line method over 10 years with a salvage value of $83800. What depreciation expense should be recorded on this asset in 2021? **** Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts