Question: Can you help with this my assignments. Answer just this Q5-2 with formula please and thank you. View Policies Current Attempt in Progress North

Can you help with this my assignments.

\

\

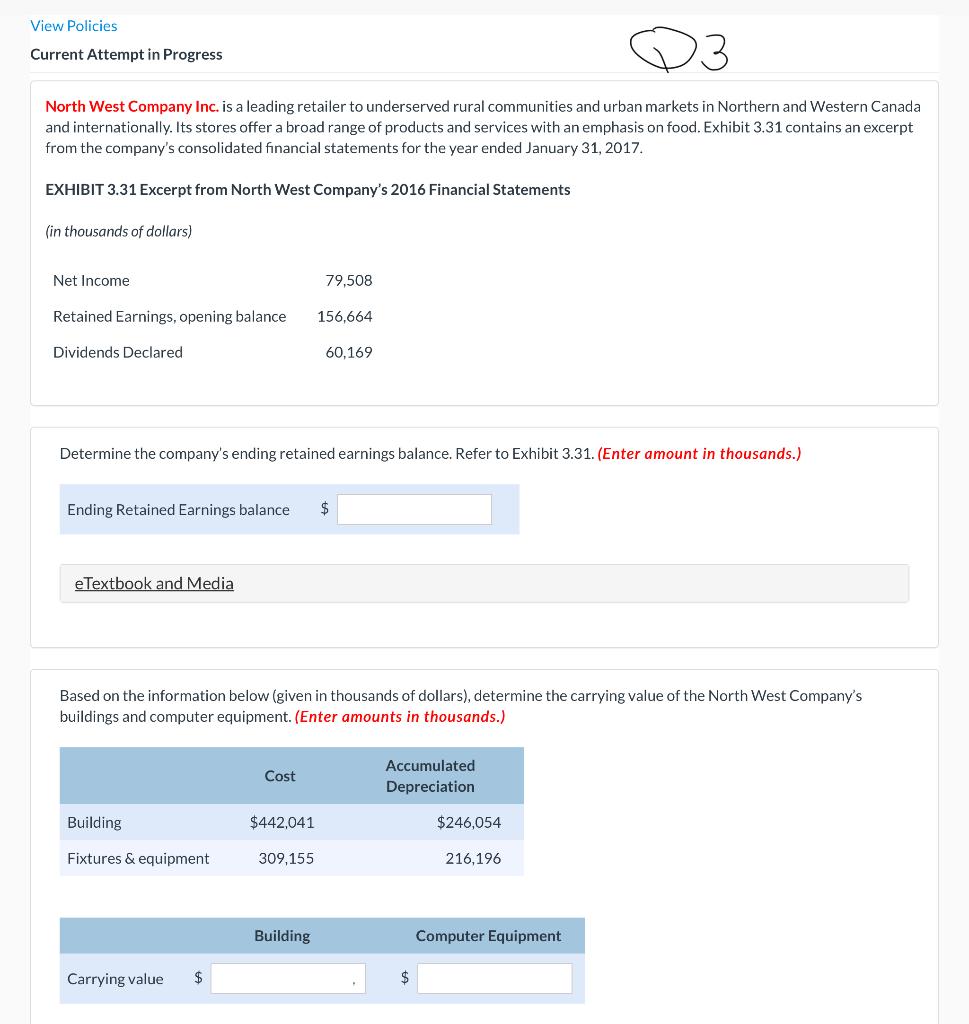

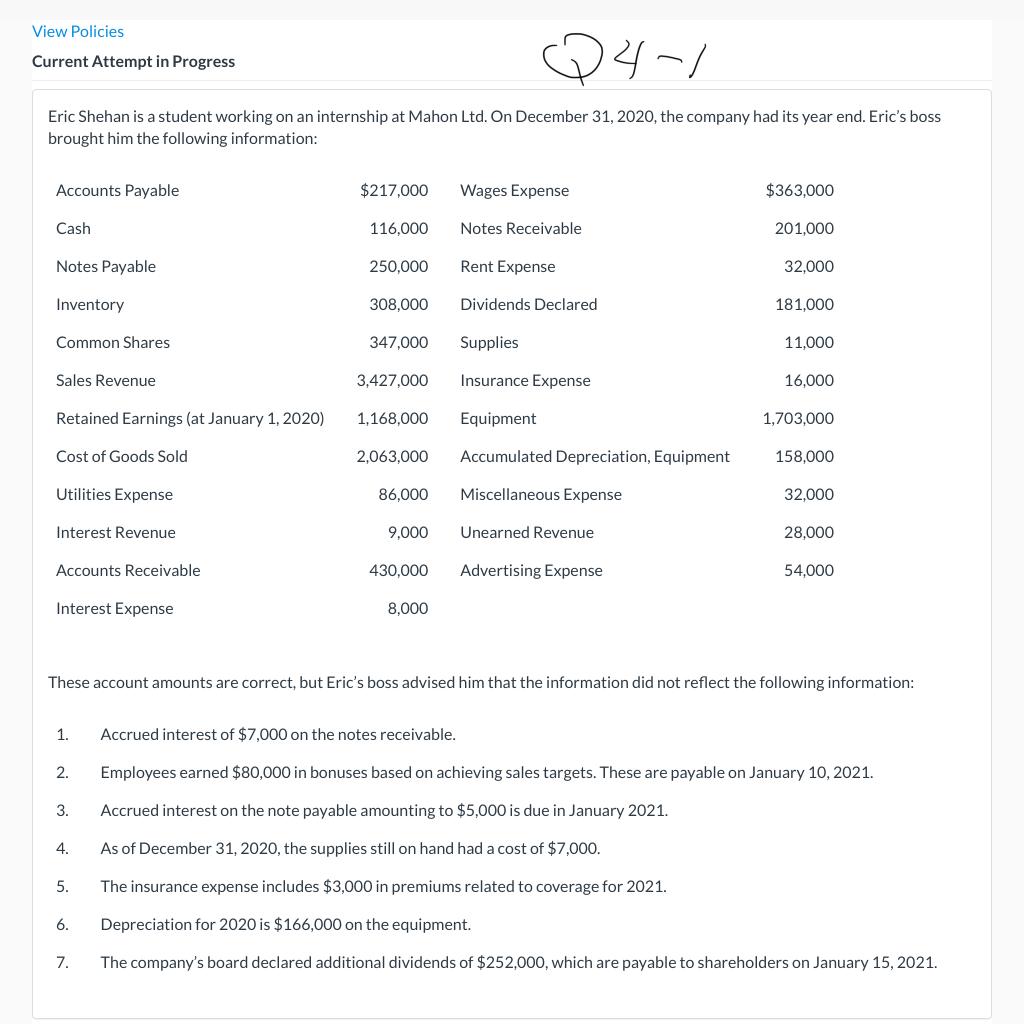

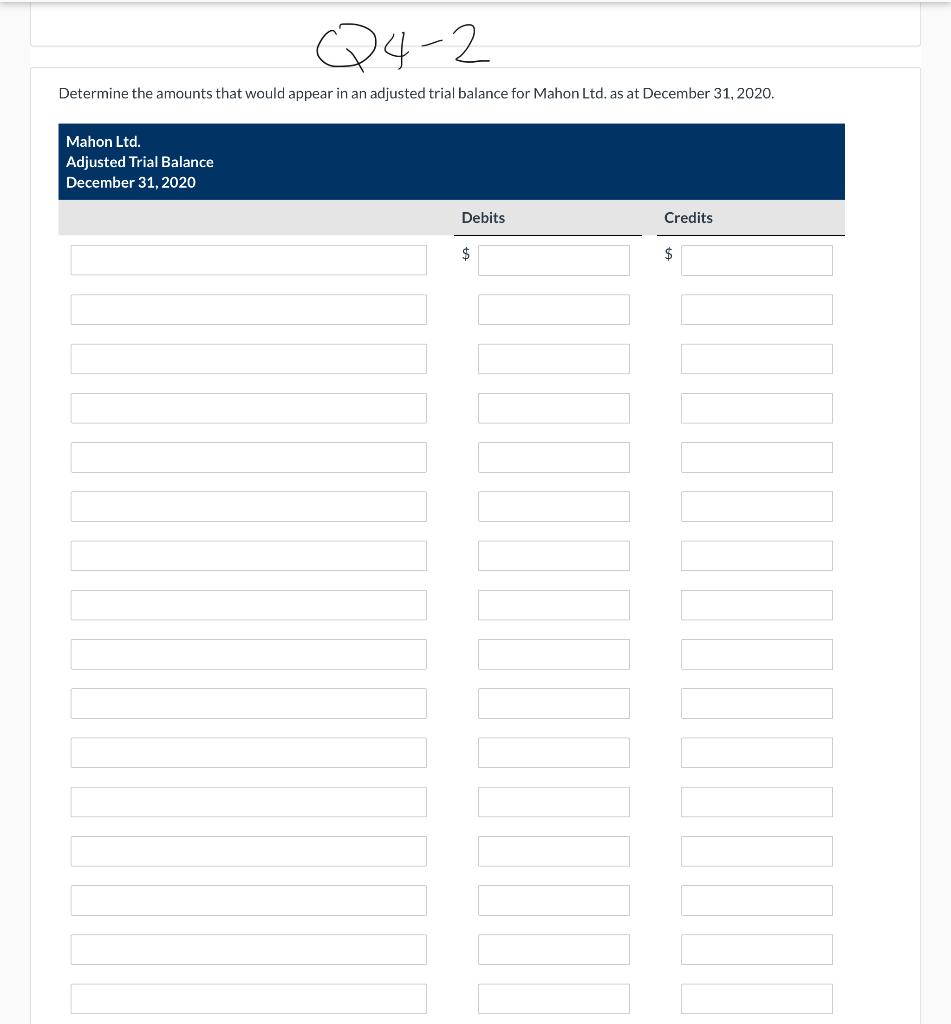

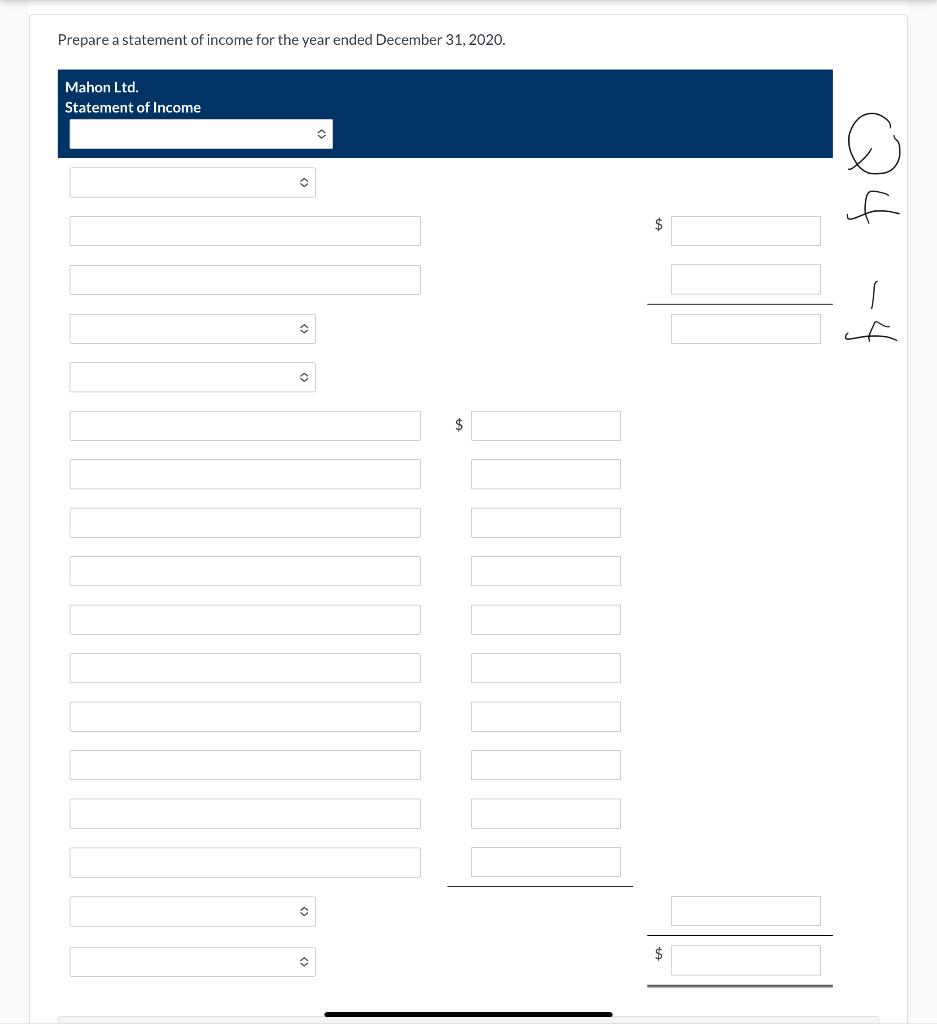

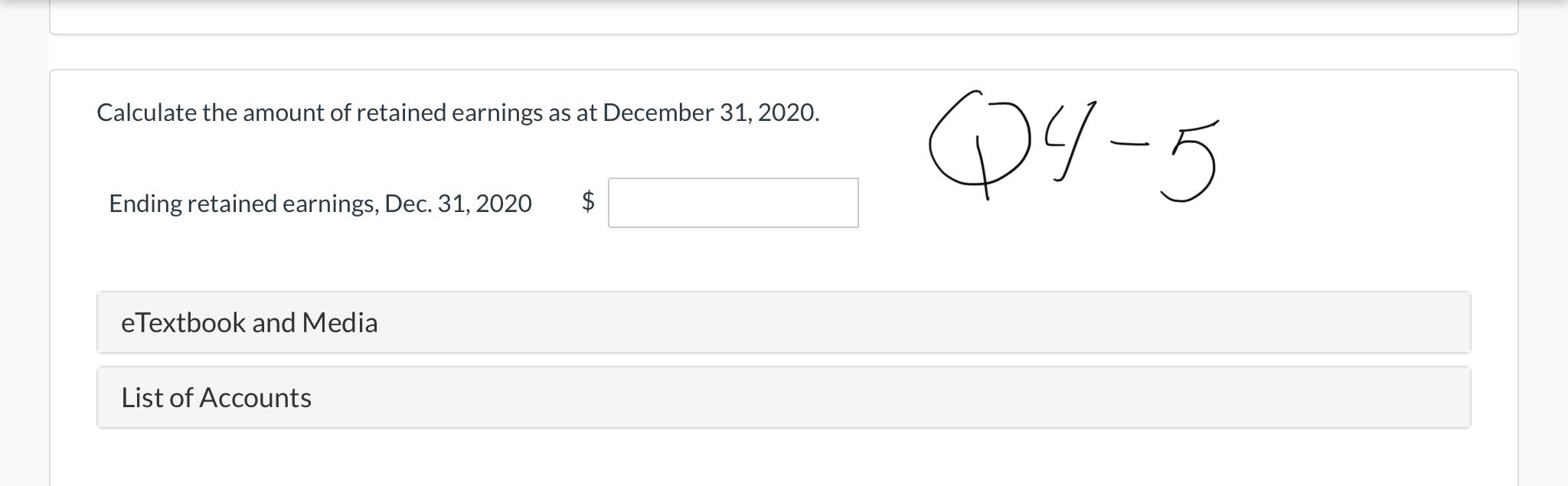

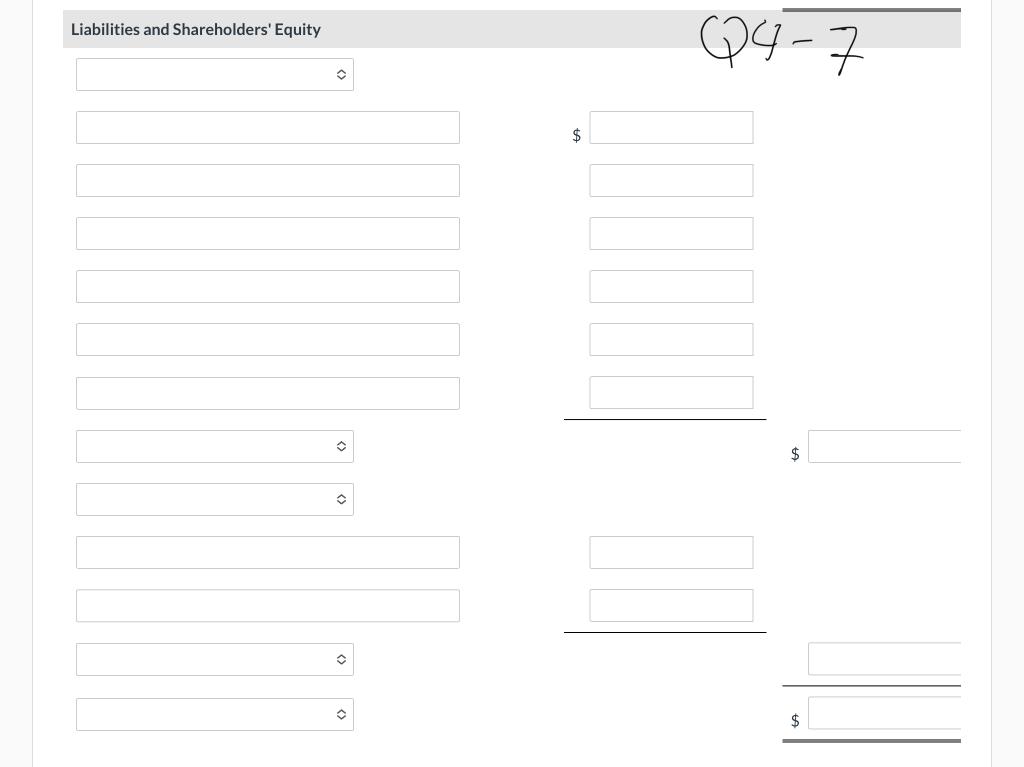

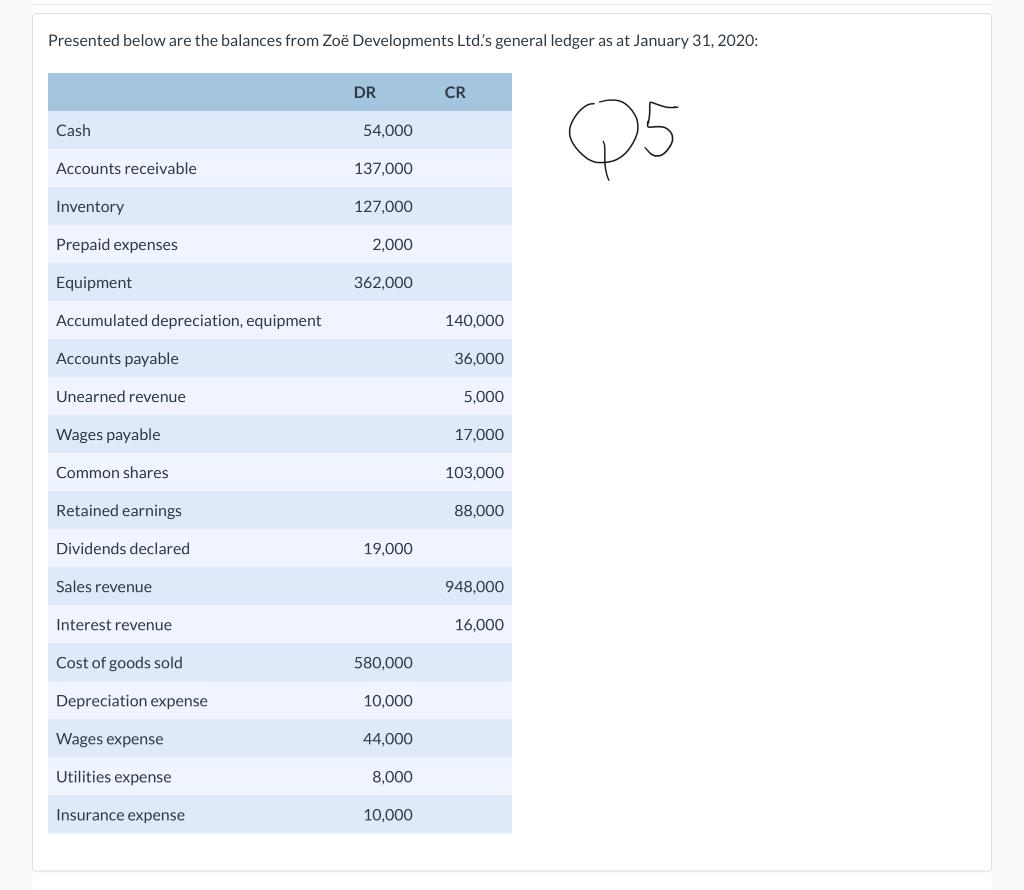

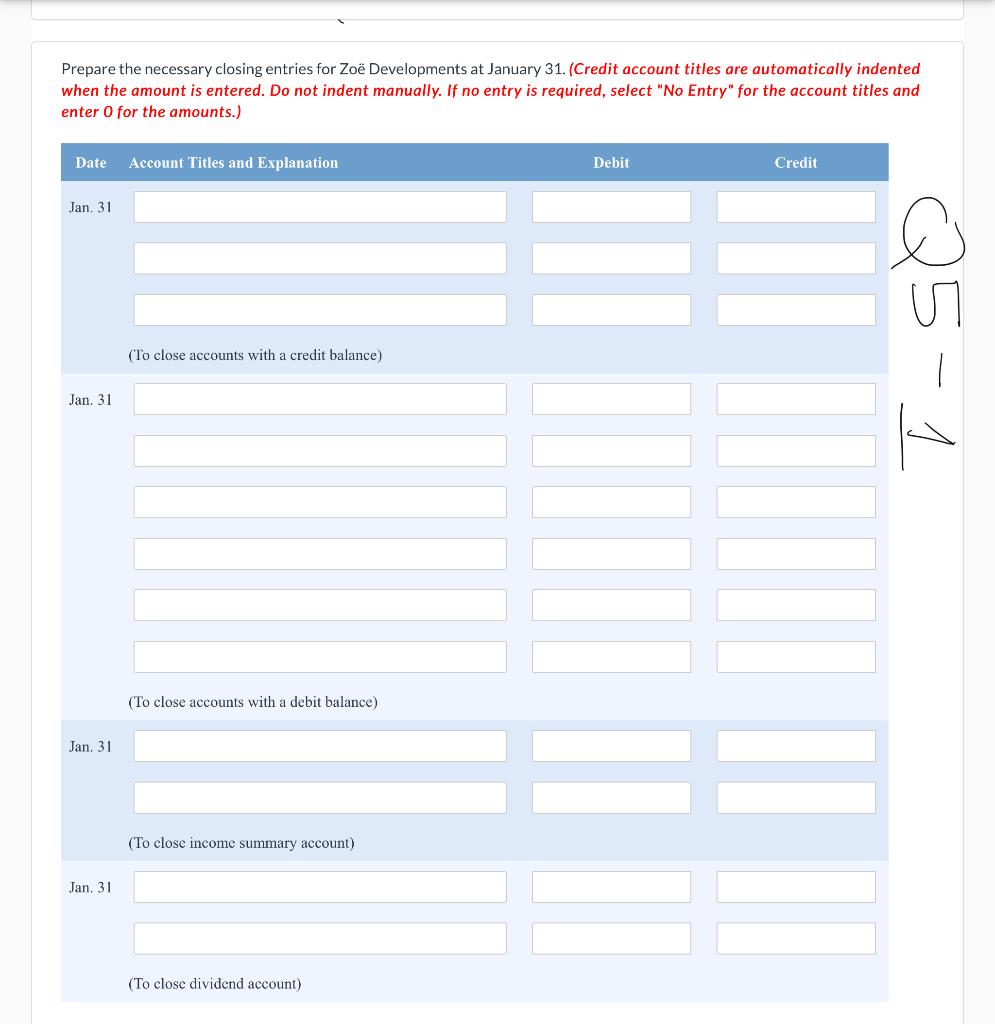

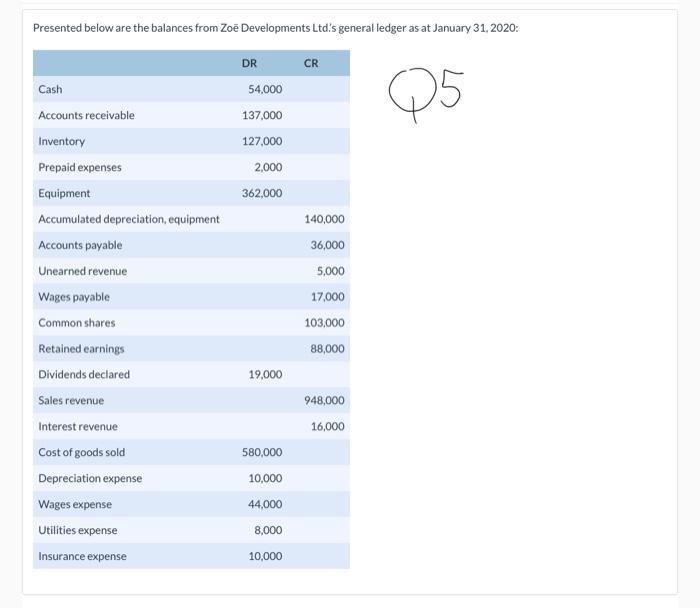

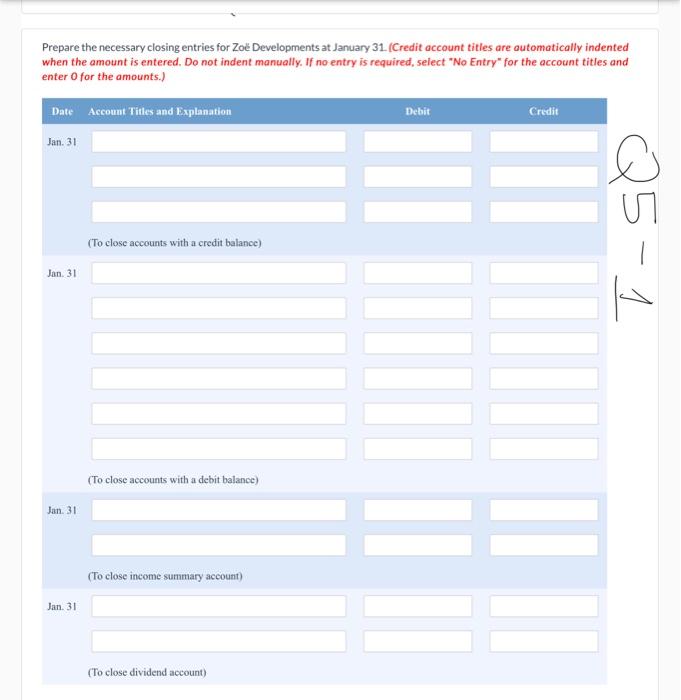

View Policies Current Attempt in Progress North West Company Inc. is a leading retailer to underserved rural communities and urban markets in Northern and Western Canada and internationally. Its stores offer a broad range of products and services with an emphasis on food. Exhibit 3.31 contains an excerpt from the company's consolidated financial statements for the year ended January 31, 2017 EXHIBIT 3.31 Excerpt from North West Company's 2016 Financial Statements (in thousands of dollars) Net Income 79,508 Retained Earnings, opening balance 156,664 Dividends Declared 60,169 Determine the company's ending retained earnings balance. Refer to Exhibit 3.31. (Enter amount in thousands.) Ending Retained Earnings balance $ e Textbook and Media Based on the information below (given in thousands of dollars), determine the carrying value of the North West Company's buildings and computer equipment. (Enter amounts in thousands.) Cost Accumulated Depreciation Building $442,041 $246,054 Fixtures & equipment 309,155 216,196 Building Computer Equipment Carrying value $ $ View Policies Current Attempt in Progress 4-/ Eric Shehan is a student working on an internship at Mahon Ltd. On December 31, 2020, the company had its year end. Eric's boss brought him the following information: Accounts Payable $217,000 Wages Expense $363,000 Cash 116,000 Notes Receivable 201,000 Notes Payable 250.000 Rent Expense 32,000 Inventory 308,000 Dividends Declared 181,000 Common Shares 347,000 Supplies 11,000 Sales Revenue 3,427,000 Insurance Expense 16,000 Retained Earnings (at January 1, 2020) 1,168,000 Equipment 1,703,000 Cost of Goods Sold 2,063,000 Accumulated Depreciation, Equipment 158,000 Utilities Expense 86,000 Miscellaneous Expense 32,000 Interest Revenue 9,000 Unearned Revenue 28,000 Accounts Receivable 430.000 Advertising Expense 54.000 Interest Expense 8,000 These account amounts are correct, but Eric's boss advised him that the information did not reflect the following information: 1. Accrued interest of $7,000 on the notes receivable. 2. Employees earned $80,000 in bonuses based on achieving sales targets. These are payable on January 10, 2021. 3. Accrued interest on the note payable amounting to $5,000 is due in January 2021. 4. As of December 31, 2020, the supplies still on hand had a cost of $7,000. 5. The insurance expense includes $3,000 in premiums related to coverage for 2021. 6. Depreciation for 2020 is $166,000 on the equipment. 7. The company's board declared additional dividends of $252,000, which are payable to shareholders on January 15, 2021. Q4-2 Determine the amounts that would appear in an adjusted trial balance for Mahon Ltd. as at December 31, 2020. Mahon Ltd. Adjusted Trial Balance December 31, 2020 Debits Credits $ $ Q43 te Prepare a statement of income for the year ended December 31, 2020. Mahon Ltd. Statement of Income $ Q4 -4 $ $ Calculate the amount of retained earnings as at December 31, 2020. 04-5 Ending retained earnings, Dec. 31, 2020 $ e Textbook and Media List of Accounts Liabilities and Shareholders' Equity 04-7 $ $ $ Presented below are the balances from Zo Developments Ltd's general ledger as at January 31, 2020: DR CR Cash 54.000 Q5 Accounts receivable 137,000 Inventory 127,000 Prepaid expenses 2.000 Equipment 362,000 Accumulated depreciation, equipment 140,000 Accounts payable 36,000 Unearned revenue 5,000 Wages payable 17,000 Common shares 103,000 Retained earnings 88,000 Dividends declared 19,000 Sales revenue 948,000 Interest revenue 16,000 Cost of goods sold 580,000 Depreciation expense 10,000 Wages expense 44,000 Utilities expense 8,000 Insurance expense 10,000 Prepare the necessary closing entries for Zo Developments at January 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 31 (To close accounts with a credit balance) Q5-1 Jan. 31 (To close accounts with a debit balance) Jan. 31 (To close income summary account) Jan. 31 (To close dividend account) Determine the ending Retained Earnings account balance. 05-2 Ending balance of Retained Earnings $ Presented below are the balances from Zoe Developments Ltd's general ledger as at January 31, 2020: CR 25 DR 54.000 137,000 127.000 2,000 362,000 Cash Accounts receivable Inventory Prepaid expenses Equipment Accumulated depreciation, equipment Accounts payable Unearned revenue Wages payable Common shares Retained earnings Dividends declared Sales revenue Interest revenue Cost of goods sold Depreciation expense Wages expense Utilities expense Insurance expense 140,000 36,000 5,000 17.000 103,000 88,000 19,000 948,000 16,000 580,000 10,000 44,000 8,000 10,000 Prepare the necessary closing entries for Zo Developments at January 31 (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry* for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 31 (To close accounts with a credit balance) Q5-1 Jan. 31 (To close accounts with a debit balance) Jan. 31 II (To close income summary account) Jan. 31 (To close dividend account) Determine the ending Retained Earnings account balance. 65-2 Ending balance of Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts