Question: Please help! Thanks!! 7 Listed below are several transactions that typically produce either an increase or a decrease in cash. Indicate by letter whether the

Please help! Thanks!!

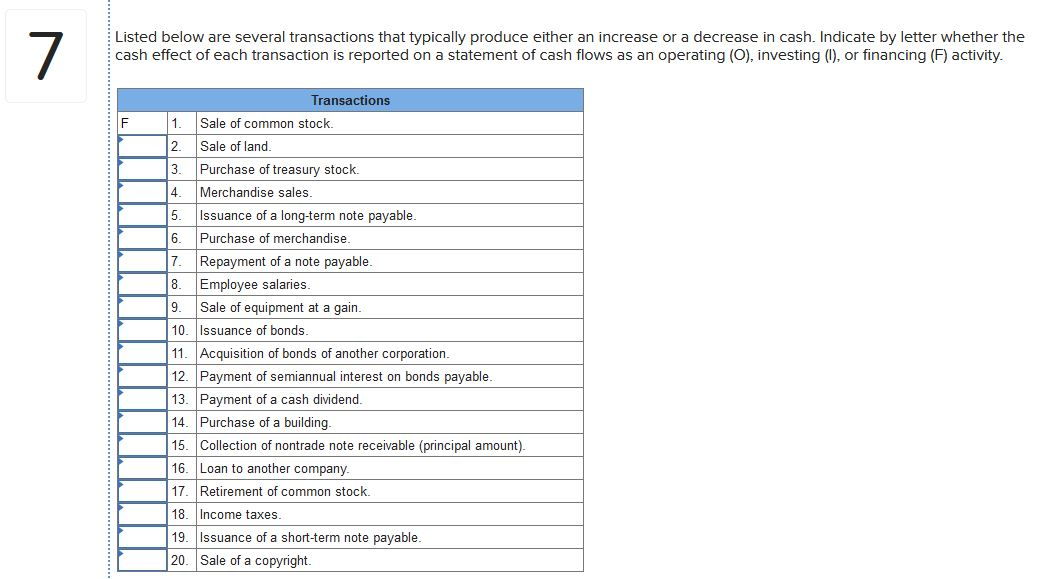

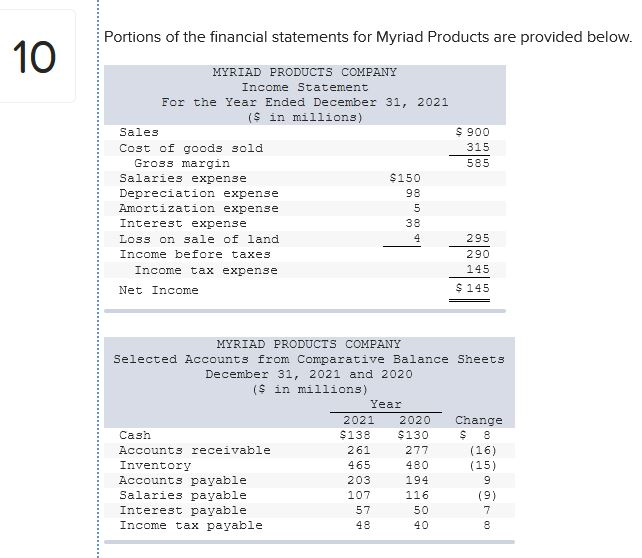

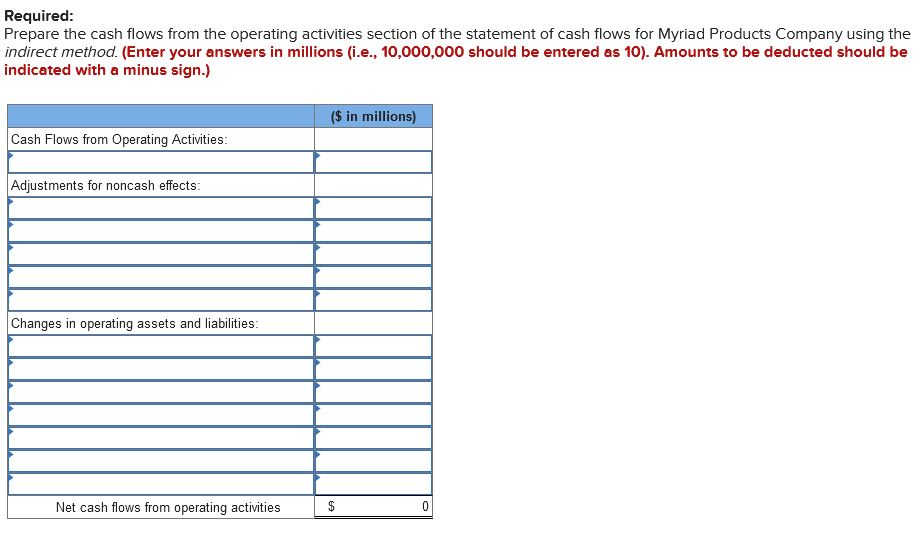

7 Listed below are several transactions that typically produce either an increase or a decrease in cash. Indicate by letter whether the cash effect of each transaction is reported on a statement of cash flows as an operating (O), investing (), or financing (F) activity. F 1 Transactions Sale of common stock. 2 Sale of land. 3. Purchase of treasury stock. 4. Merchandise sales 5. Issuance of a long-term note payable. 6. Purchase of merchandise 7. Repayment of a note payable. 8. Employee salaries. 9. Sale of equipment at a gain. 10. Issuance of bonds. 11. Acquisition of bonds of another corporation 12. Payment of semiannual interest on bonds payable 13. Payment of a cash dividend. 14. Purchase of a building. 15. Collection of nontrade note receivable (principal amount) 16. Loan to another company. 17. Retirement of common stock. 18. Income taxes. 19. Issuance of a short-term note payable. 20. Sale of a copyright. Portions of the financial statements for Myriad Products are provided below. 10 MYRIAD PRODUCTS COMPANY Income Statement For the Year Ended December 31, 2021 ($ in millions) Sales S 900 Cost of goods sold 315 Gross margin 585 Salaries expense $150 Depreciation expense 98 Amortization expense 5 Interest expense 38 Loss on sale of land 4 295 Income before taxes 290 Income tax expense 145 Net Income $ 145 MYRIAD PRODUCTS COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2021 and 2020 ($ in millions) Year 2021 2020 Change Cash $138 $130 $ 8 Accounts receivable 261 277 (16) Inventory 465 480 (15) Accounts payable 203 194 9 Salaries payable 107 116 (9) Interest payable 57 50 7 Income tax payable 48 40 8 Required: Prepare the cash flows from the operating activities section of the statement of cash flows for Myriad Products Company using the indirect method. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Amounts to be deducted should be indicated with a minus sign.) ($ in millions) Cash Flows from Operating Activities: Adjustments for noncash effects: Changes in operating assets and liabilities: Net cash flows from operating activities $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts