Question: Please help, thanks! Gleason Construction enters into a long term fixed price contract to build an office building for $28,000,000. In the first year of

Please help, thanks!

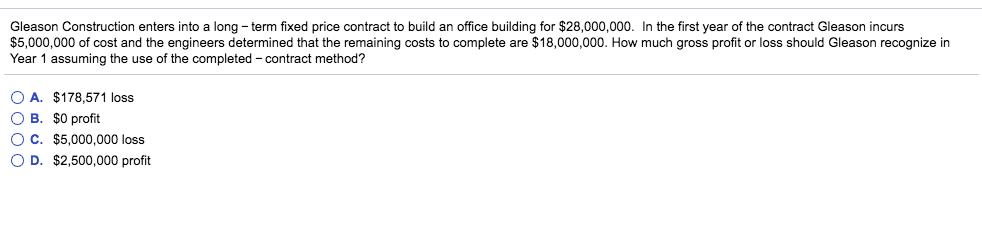

Gleason Construction enters into a long term fixed price contract to build an office building for $28,000,000. In the first year of the contract Gleason incurs $5,000,000 of cost and the engineers determined that the remaining costs to complete are $18,000,000. How much gross profit or loss should Gleason recognize irn Year 1 assuming the use of the completed -contract method? O A. $178,571 loss OB, SO profit O C. $5,000,000 loss O D. $2,500,000 profit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock