Question: Please help! Thanks Melvin is single, age 58. He earned the following income this year: Salary Qualified dividend income earned on stock he owns Interest

Please help! Thanks

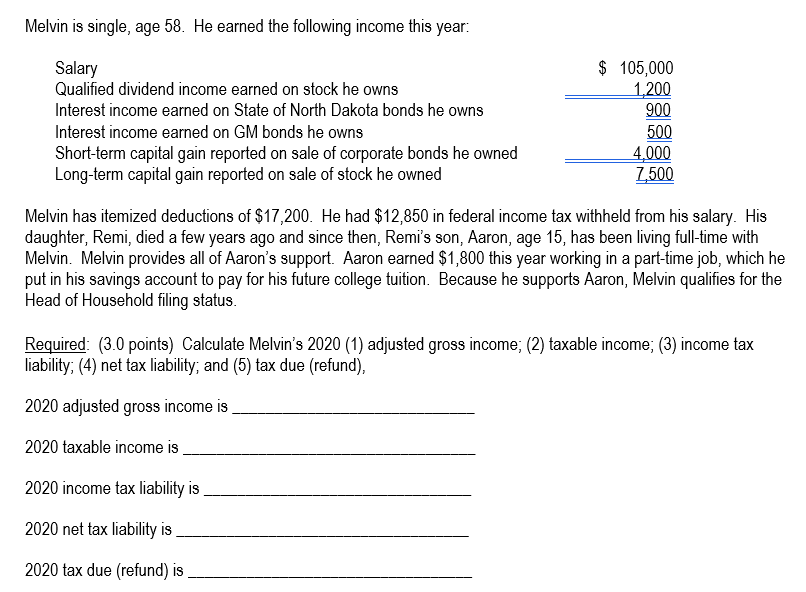

Melvin is single, age 58. He earned the following income this year: Salary Qualified dividend income earned on stock he owns Interest income earned on State of North Dakota bonds he owns Interest income earned on GM bonds he owns Short-term capital gain reported on sale of corporate bonds he owned Long-term capital gain reported on sale of stock he owned $ 105,000 1,200 900 500 4,000 7,500 Melvin has itemized deductions of $17,200. He had $12,850 in federal income tax withheld from his salary. His daughter, Remi, died a few years ago and since then, Remi's son, Aaron, age 15, has been living full-time with Melvin. Melvin provides all of Aaron's support. Aaron earned $1,800 this year working in a part-time job, which he put in his savings account to pay for his future college tuition. Because he supports Aaron, Melvin qualifies for the Head of Household filing status. Required: (3.0 points) Calculate Melvin's 2020 (1) adjusted gross income; (2) taxable income; (3) income tax liability; (4) net tax liability, and (5) tax due (refund), 2020 adjusted gross income is 2020 taxable income is 2020 income tax liability is 2020 net tax liability is 2020 tax due (refund) is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts