Question: Please Help. Thanks Question 4 (6 marks) Riverrocks (whose WACC is 12%) is considering an acquisition of Raft Adventures (whose WACC is 15%). RiverRocks' purchase

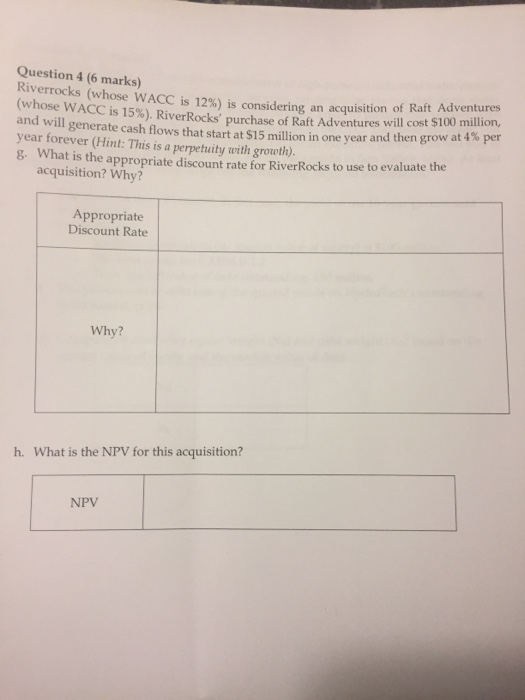

Question 4 (6 marks) Riverrocks (whose WACC is 12%) is considering an acquisition of Raft Adventures (whose WACC is 15%). RiverRocks' purchase of Raft Adventures will cost S100 million, and will generate cash flows that start at $15 million in one year and then grow at 4% per year forever (Hint: This is a perpetuity with growth) 8 What is the appropriate discount rate for RiverRocks to use to evaluate the acquisition? Why? Appropriate Discount Rate Why? h. What is the NPV for this acquisition? NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts