Question: questions go together, please answer both RiverRocks, whose WACC is 12.7%, is considering an acquisition of Raft Adventures (whose WACC is 15.5% ). The purchase

questions go together, please answer both

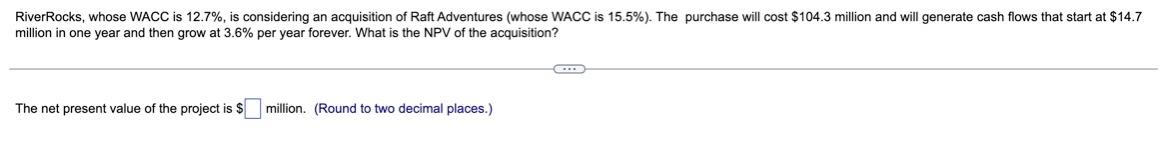

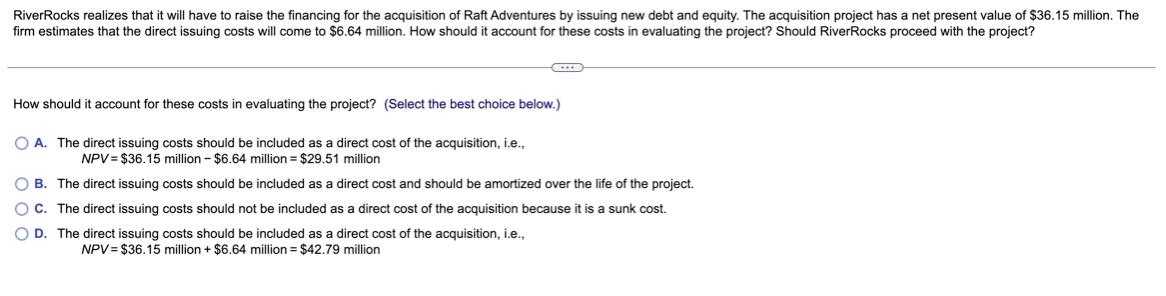

RiverRocks, whose WACC is 12.7%, is considering an acquisition of Raft Adventures (whose WACC is 15.5% ). The purchase will cost $104.3 million and will generate cash flows that start at $14.7 million in one year and then grow at 3.6% per year forever. What is the NPV of the acquisition? The net present value of the project is $ million. (Round to two decimal places.) RiverRocks realizes that it will have to raise the financing for the acquisition of Raft Adventures by issuing new debt and equity. The acquisition project has a net present value of $36.15 million. The firm estimates that the direct issuing costs will come to $6.64 million. How should it account for these costs in evaluating the project? Should RiverRocks proceed with the project? How should it account for these costs in evaluating the project? (Select the best choice below.) A. The direct issuing costs should be included as a direct cost of the acquisition, i.e., NPV=$36.15million$6.64million=$29.51million B. The direct issuing costs should be included as a direct cost and should be amortized over the life of the project. C. The direct issuing costs should not be included as a direct cost of the acquisition because it is a sunk cost. D. The direct issuing costs should be included as a direct cost of the acquisition, i.e., NPV=$36.15 million +$6.64 million =$42.79 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts