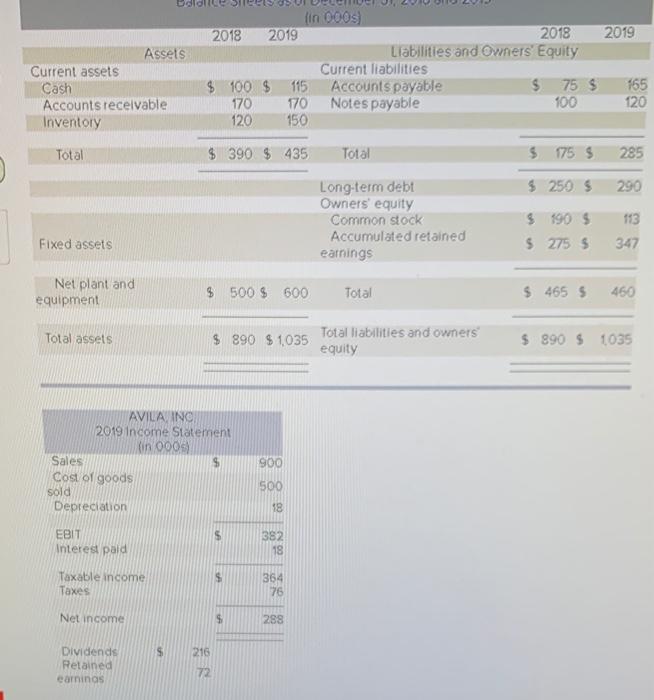

Question: please help thanks so much in advance Assets Current assets Cash Accounts receivable Inventory in 000) 2018 2019 2018 2019 Llabilities and Owners' Equity Current

please help thanks so much in advance

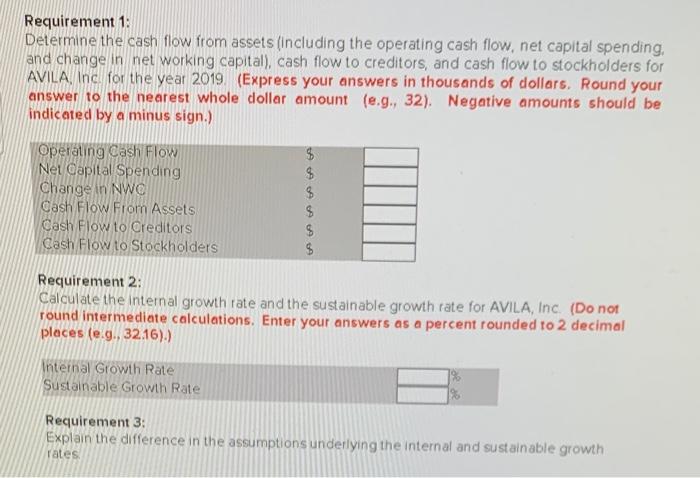

please help thanks so much in advance Assets Current assets Cash Accounts receivable Inventory in 000) 2018 2019 2018 2019 Llabilities and Owners' Equity Current liabilities $ 100 $ 115 Accounts payable $ 75 $ 165 170 770 Notes payable 100 120 120 150 Total $ 390 $ 435 Total $175 $ 285 $ 250 S 290 Long-term debt Owners' equity Common stock Accumulated retained earnings $ 190 $ $ 275 $ 113 347 Fixed assets Net plant and equipment $ 500 $ 600 Total $ 465 5 460 Total assets $ 890 $ 1.035 Total liabilities and owners equity $ 890 $ 1035 AVILA INC 2019 income Statement in 000 Sales Cost of goods sold Depreciation 900 500 18 5 EBIT Interest paid 382 18 Taxable income Taxes 364 76 Net income 288 S 216 Dividends Retained earnings 72 Requirement 1: Determine the cash flow from assets (including the operating cash flow, net capital spending, and change in net working capital), cash flow to creditors, and cash flow to stockholders for AVILA Inc for the year 2019 (Express your answers in thousands of dollars. Round your answer to the nearest whole dollar amount (e.g., 32). Negative amounts should be indicated by a minus sign.) Operating Cash Flow Net Capital Spending Change in NWC Cash Flow From Assets Cash Flow to Creditors Cash Flow to Stockholders $ $ $ $ $ Requirement 2: Calculate the internal growth rate and the sustainable growth rate for AVILA, Inc. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places (e.g., 32.16).) Internal Growth Rate Sustainable Growth Rate Requirement 3: Explain the difference in the assumptions underlying the internal and sustainable growth rates

Step by Step Solution

There are 3 Steps involved in it

To solve the problem lets go through each requirement step by step Requirement 1 Cash Flows Operating Cash Flow OCF textOCF textEBIT textDepreciation ... View full answer

Get step-by-step solutions from verified subject matter experts