Question: Please help. Thanks. SuperAnalysts has just used the CAPM model to compute an re of 16% for Merck, Inc. It found re by, among other

Please help. Thanks.

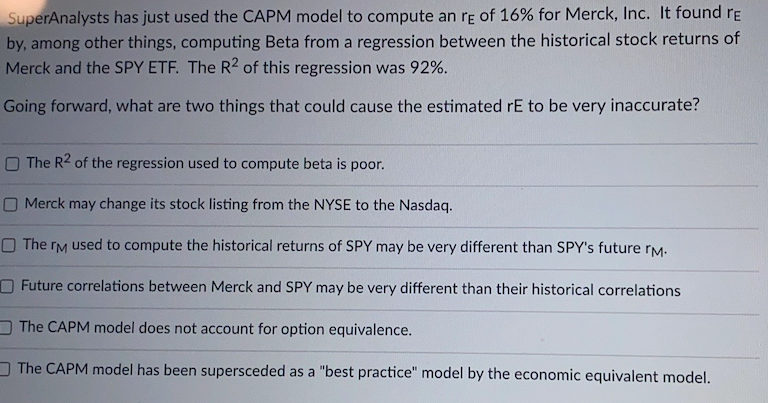

SuperAnalysts has just used the CAPM model to compute an re of 16% for Merck, Inc. It found re by, among other things, computing Beta from a regression between the historical stock returns of Merck and the SPY ETF. The R2 of this regression was 92%. Going forward, what are two things that could cause the estimated rE to be very inaccurate? The R2 of the regression used to compute beta is poor. Merck may change its stock listing from the NYSE to the Nasdaq. The rm used to compute the historical returns of SPY may be very different than SPY's future rm. Future correlations between Merck and SPY may be very different than their historical correlations The CAPM model does not account for option equivalence. The CAPM model has been supersceded as a "best practice" model by the economic equivalent model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts