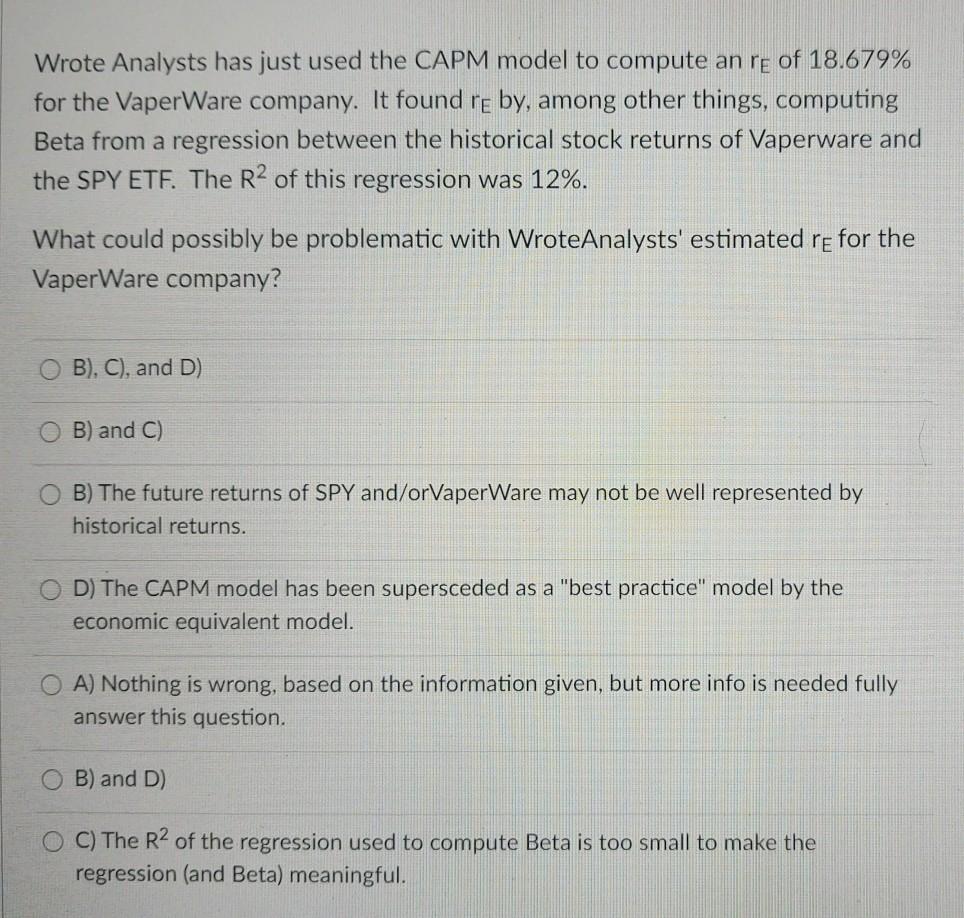

Question: Wrote Analysts has just used the CAPM model to compute an re of 18.679% for the Vaper Ware company. It found re by, among other

Wrote Analysts has just used the CAPM model to compute an re of 18.679% for the Vaper Ware company. It found re by, among other things, computing Beta from a regression between the historical stock returns of Vaperware and the SPY ETE. The R2 of this regression was 12%. What could possibly be problematic with WroteAnalysts' estimated re for the VaperWare company? B), C), and D) B) and C) B) The future returns of SPY and/orVaperWare may not be well represented by historical returns. D) The CAPM model has been supersceded as a "best practice" model by the economic equivalent model. A) Nothing is wrong, based on the information given, but more info is needed fully answer this question. B) and D) OC) The R2 of the regression used to compute Beta is too small to make the regression (and Beta) meaningful

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts