Question: Please help!!! This is what I got.. Could you help explain the formula or anything possible? Question 3 25 pts Question 3: Based on the

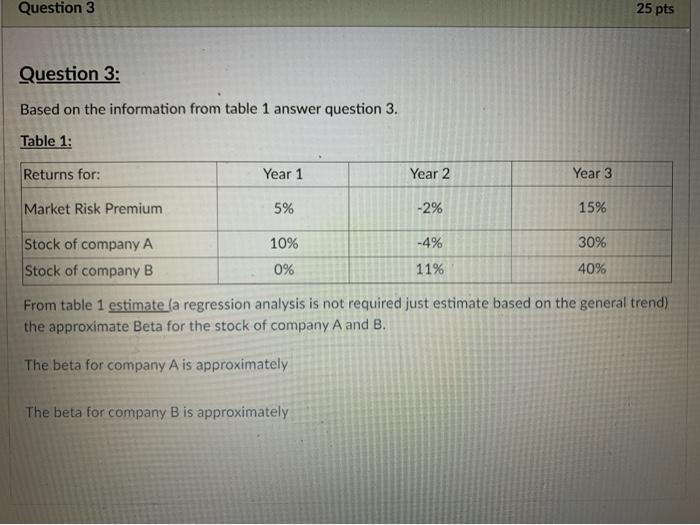

Question 3 25 pts Question 3: Based on the information from table 1 answer question 3. Table 1: Returns for: Year 1 Year 2 Year 3 Market Risk Premium 5% -2% 15% 10% -4% 30% Stock of company A Stock of company B 0% 11% 40% From table 1 estimate (a regression analysis is not required just estimate based on the general trend) the approximate Beta for the stock of company A and B. The beta for company A is approximately The beta for company B is approximately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts