Question: Please help! This question is looking for LIFO in the first part and using the conventional method in the second part (also note they change

Please help! This question is looking for LIFO in the first part and using the conventional method in the second part (also note they change the numbers).

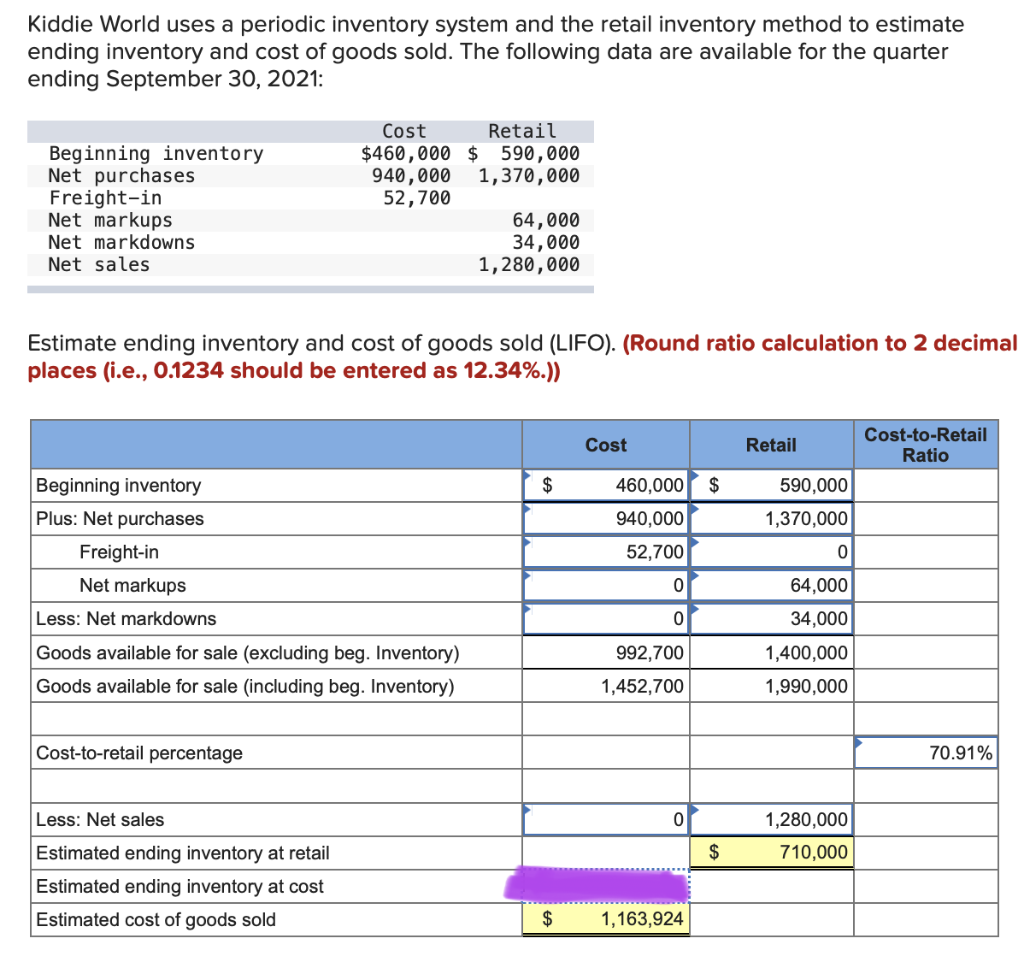

On the LIFO part I have almost all of it except "estimated ending inventory at cost" and I've tried it so many different ways.

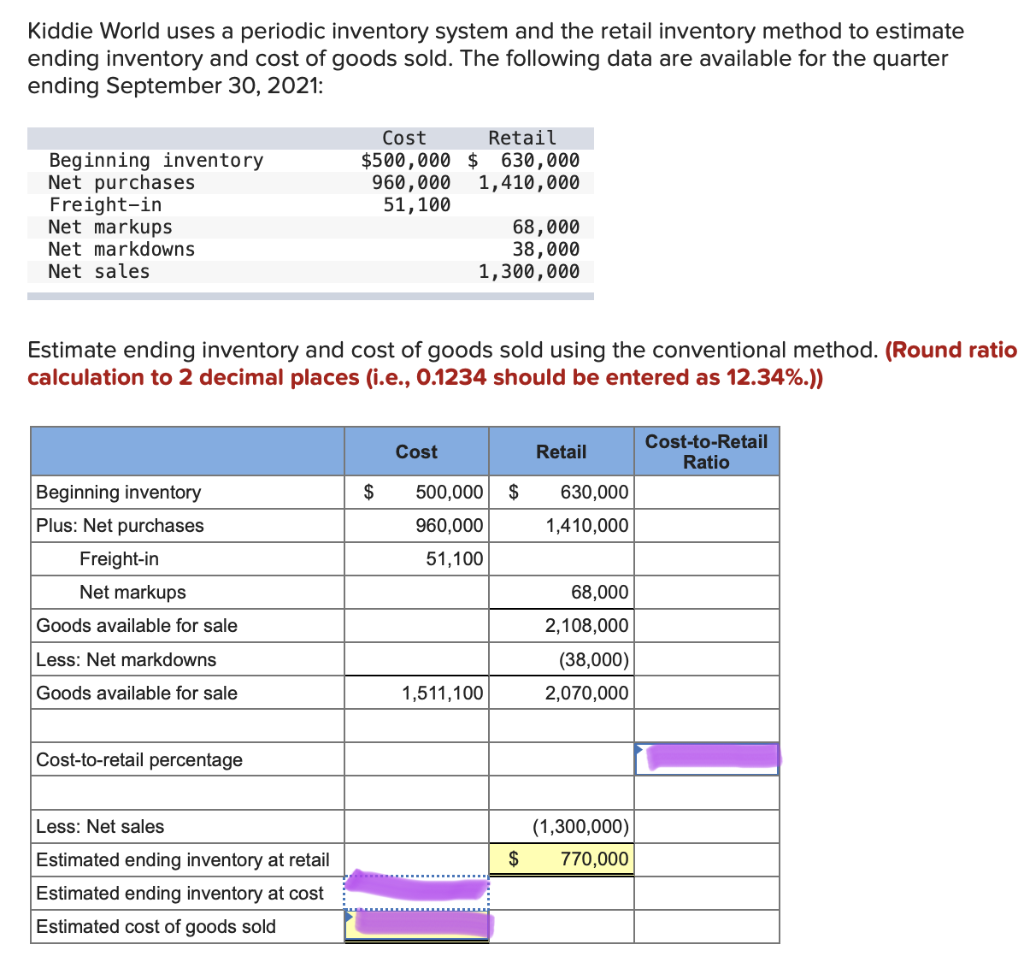

On the conventional part I'm not sure what im doing wrong but I can't figure out any of it. It's looking for cost-to-retail percentage, estimated ending inventory at cost, and estimated cost of goods sold.

Please show me how you find all parts, i've tried everything I can think of!

Kiddie World uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the quarter ending September 30, 2021: Cost Retail $460,000 $ 590,000 1,370,000 Beginning inventory Net purchases Freight-in Net markups 940,000 52,700 64,000 Net markdowns 34,000 1,280,000 Net sales Estimate ending inventory and cost of goods sold (LIFO). (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.)) Cost Retail Cost-to-Retail Ratio Beginning inventory $ Plus: Net purchases Freight-in Net markups Less: Net markdowns Goods available for sale (excluding beg. Inventory) Goods available for sale (including beg. Inventory) Cost-to-retail percentage Less: Net sales Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 460,000 $ 940,000 52,700 0 0 992,700 1,452,700 0 $ 1,163,924 $ 590,000 1,370,000 0 64,000 34,000 1,400,000 1,990,000 1,280,000 710,000 70.91% Kiddie World uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the quarter ending September 30, 2021: Beginning inventory Cost $500,000 960,000 Retail $ 630,000 1,410,000 Net purchases Freight-in Net markups 51,100 Net markdowns 68,000 38,000 1,300,000 Net sales Estimate ending inventory and cost of goods sold using the conventional method. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.)) Cost Retail Cost-to-Retail Ratio $ 500,000 $ Beginning inventory Plus: Net purchases 960,000 Freight-in 51,100 Net markups Goods available for sale Less: Net markdowns Goods available for sale 1,511,100 Cost-to-retail percentage Less: Net sales Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold $ 630,000 1,410,000 68,000 2,108,000 (38,000) 2,070,000 (1,300,000) 770,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts