Please help to answer c and d:

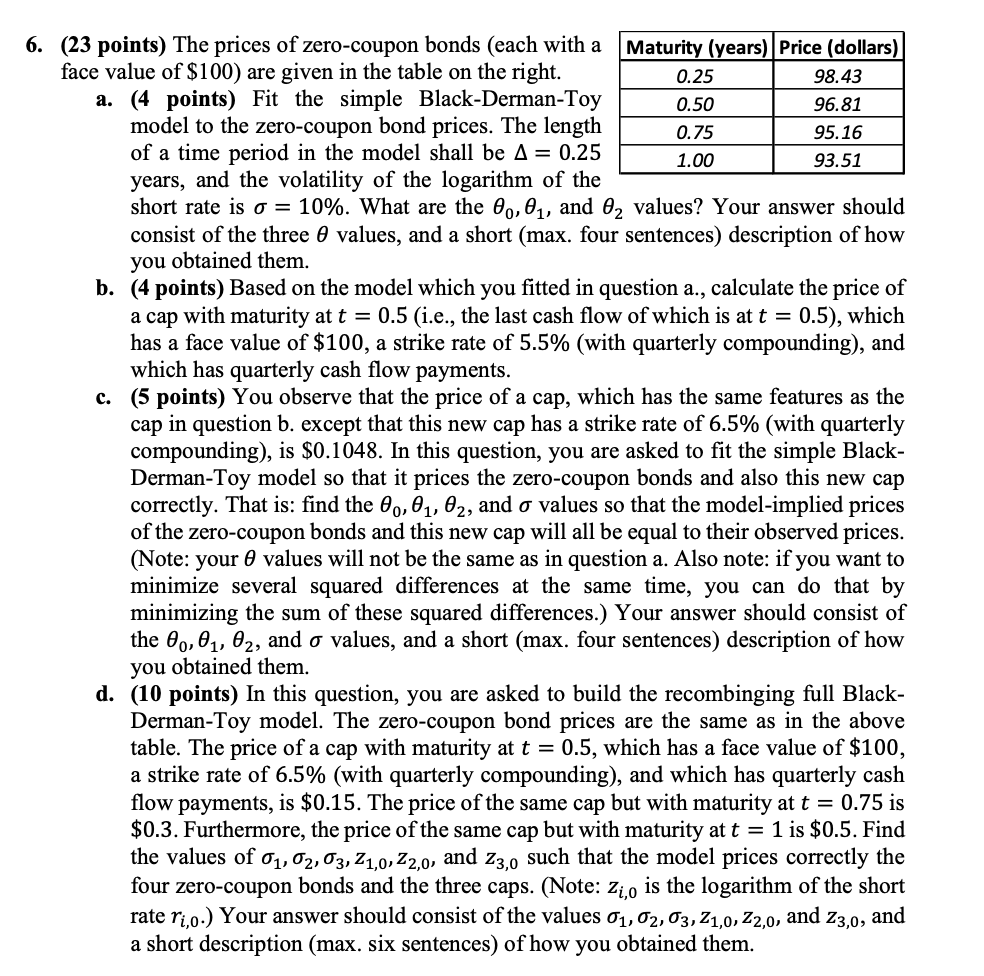

6. (23 points) The prices of zero-coupon bonds (each with a Maturity (years) Price (dollars) face value of $100) are given in the table on the right. a. (4 points) Fit the simple Black-Derman-Toy model to the zero-coupon bond prices. The length of a time period in the model shall be A = 0.25 years, and the volatility of the logarithm of the short rate is or = 10%. What are the 60,01, and .92 values? Your answer should consist of the three I9 values, and a short (max. four sentences) description of how you obtained them. b. (4 points) Based on the model which you tted in question a., calculate the price of a cap with maturity at t = 0.5 (i.e., the last cash ow of which is at t = 0.5), which has a face value of $100, a strike rate of 5.5% (with quarterly compounding), and which has quarterly cash ow payments. 1:. (5 points) You observe that the price of a cap, which has the same features as the cap in question b. except that this new cap has a strike rate of 6.5% (with quarterly compounding), is $01048. In this question, you are asked to t the simple Black- Derman-Toy model so that it prices the zero-coupon bonds and also this new cap correctly. That is: nd the 60, 01, 02, and or values so that the model-implied prices of the zero-coupon bonds and this new cap will all be equal to their observed prices. (Note: your 6 values will not be the same as in question a. Also note: if you want to minimize several squared differences at the same time, you can do that by minimizing the sum of these squared differences.) Your answer should consist of the Ho, 61, 02, and a values, and a short (max. four sentences) description of how you obtained them. d. (10 points) In this question, you are asked to build the recombinging full Black- Derman-Toy model. The zero-coupon bond prices are the same as in the above table. The price of a cap with maturity at t = 0.5, which has a face value of $100, a strike rate of 6.5% (with quarterly compounding), and which has quarterly cash ow payments, is $0.15. The price of the same cap but with maturity at t = 0.75 is $0.3. Furthermore, the price of the same cap but with maturity at t = 1 is $0.5. Find the values of 01, 02,03,zllo,zzl, and 23,0 such that the model prices correctly the four zero-coupon bonds and the three caps. (Note: 21.0 is the logarithm of the short rate rm.) Your answer should consist of the values 01, 02, 03, 21,0, 22,0, and 23,0, and a short description (max. six sentences) of how you obtained them